Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

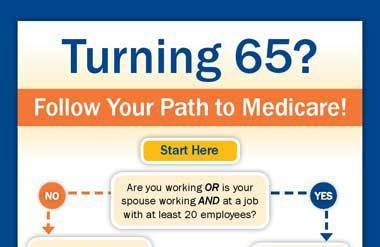

Turning 65 is a significant milestone for most people. Among the many things you need to consider is enrolling in Medicare. Medicare is a federal health insurance program that covers certain medical expenses for people aged 65 and above.

Applying for Medicare can be a daunting task, especially if you are not familiar with the process. However, with a little guidance, you can navigate the process with ease. In this article, we will guide you through the steps you need to take to apply for Medicare when you turn 65.

How Do You Apply for Medicare When You Turn 65?

Becoming eligible for Medicare is a significant milestone for any American. However, the process of applying for Medicare can be overwhelming and confusing, especially for those who have never dealt with healthcare insurance before. In this article, we will guide you through the steps to apply for Medicare when you turn 65.

Step 1: Know Your Enrollment Period

The first step to applying for Medicare is to know your enrollment period. You can sign up for Medicare during the Initial Enrollment Period (IEP), which lasts for seven months. This period includes the three months before you turn 65, the month you turn 65, and the three months after you turn 65. If you miss this window, you can still sign up during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. However, you may face late enrollment penalties if you miss your IEP.

To enroll in Medicare, you can visit the Social Security Administration (SSA) website or call their toll-free number to request an application. You can also visit your local Social Security office to apply in person.

Step 2: Decide on Your Medicare Coverage

The next step is to decide on your Medicare coverage. Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). Part A is usually free for most people, while Part B requires a monthly premium. You can also choose to enroll in a Medicare Advantage plan (Part C) or a prescription drug plan (Part D). These plans are offered by private insurance companies and may have different costs and benefits than Original Medicare.

To help you decide on your Medicare coverage, you can use the Medicare Plan Finder tool on the Medicare website. This tool allows you to compare different plans based on your location, health status, and prescription drug needs.

Step 3: Gather Your Information

Before you apply for Medicare, you will need to gather some information. This includes your Social Security number, birth date, and information about your current healthcare coverage (if any). You will also need to provide information about your income and assets if you are applying for a Medicare Savings Program or Extra Help with prescription drug costs.

Step 4: Fill Out Your Application

Once you have gathered your information, you can fill out your Medicare application. You can do this online, over the phone, or in person at a Social Security office. Make sure to review your application carefully before submitting it to ensure that all of your information is accurate.

Step 5: Wait for Your Medicare Card

After you submit your application, you will receive a confirmation letter from the Social Security Administration. This letter will confirm that your application has been received and is being processed. You should receive your Medicare card in the mail within a few weeks.

Benefits of Medicare

One of the main benefits of Medicare is that it provides access to affordable healthcare for older Americans. Medicare covers a wide range of healthcare services, including hospital stays, doctor visits, and prescription drugs. It also offers preventive services, such as annual wellness visits and cancer screenings.

In addition, Medicare provides financial protection for those with chronic health conditions or disabilities. Medicare Advantage plans may offer additional benefits, such as dental and vision coverage, transportation services, and fitness programs.

Medicare vs. Private Insurance

While Medicare provides comprehensive coverage for older Americans, some may choose to supplement their coverage with private insurance. Private insurance plans may offer additional benefits and more personalized coverage options. However, they may also have higher costs and more restrictions than Medicare.

It is important to carefully compare Medicare and private insurance options before making a decision. You should consider your healthcare needs, budget, and personal preferences when choosing a healthcare plan.

Conclusion

Applying for Medicare can be overwhelming, but it is an important step in ensuring access to affordable healthcare as you age. By knowing your enrollment period, deciding on your coverage, gathering your information, filling out your application, and waiting for your Medicare card, you can successfully enroll in Medicare at age 65. Remember to consider the benefits and drawbacks of Medicare and private insurance before making a final decision.

Contents

Frequently Asked Questions

What is Medicare?

Medicare is a federal health insurance program for people who are 65 or older, as well as some younger people with disabilities. It is divided into different parts, each covering different health care services.

To apply for Medicare, you must be a U.S. citizen or permanent legal resident who has lived in the U.S. for at least five years. You can apply for Medicare during the seven-month period that begins three months before your 65th birthday month and ends three months after your birthday month.

How do I apply for Medicare?

You can apply for Medicare in three ways: online, by phone, or in person. To apply online, go to the Social Security Administration’s website and follow the instructions. To apply by phone, call the Social Security Administration at 1-800-772-1213. To apply in person, go to your local Social Security office.

When you apply for Medicare, you will need to provide certain information, such as your birthdate, Social Security number, and information about any other health insurance coverage you may have. You may also need to provide proof of citizenship or residency.

What is Medicare Part A?

Medicare Part A is the part of Medicare that covers hospital stays, skilled nursing facility care, hospice care, and some home health care. Most people do not have to pay a premium for Part A if they or their spouse paid Medicare taxes while working.

If you are automatically enrolled in Medicare when you turn 65, you will be enrolled in Part A. If you need to apply for Medicare, you can do so through the Social Security Administration.

What is Medicare Part B?

Medicare Part B is the part of Medicare that covers doctor visits, outpatient care, and some preventive services. There is a monthly premium for Part B, which varies depending on your income.

If you are automatically enrolled in Medicare when you turn 65, you will be enrolled in Part B unless you opt out. If you need to apply for Medicare, you can do so through the Social Security Administration.

What is Medicare Part D?

Medicare Part D is the part of Medicare that covers prescription drugs. There are many different Part D plans to choose from, and the cost and coverage can vary depending on the plan you choose.

To enroll in a Part D plan, you must have Medicare Part A or Part B. You can enroll in a Part D plan when you first become eligible for Medicare or during the annual enrollment period, which occurs from October 15 to December 7 each year.

Turning 65 – What you need to know about enrolling in Medicare

In conclusion, applying for Medicare when you turn 65 can seem like a daunting task, but it doesn’t have to be. By following a few simple steps, you can ensure that you are enrolled in the right Medicare plan for your needs.

First, take the time to research the different parts of Medicare and what they cover. This will help you determine which plan is best for you.

Next, make sure you understand when you need to enroll. For most people, this is during the seven-month period that begins three months before their 65th birthday.

Finally, don’t hesitate to reach out for help if you need it. Medicare counselors, insurance agents, and even family members can all provide valuable guidance and support as you navigate the enrollment process. With a little bit of effort, you can confidently apply for Medicare and rest easy knowing that you have the coverage you need.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts