Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage for millions of Americans over 65 years old and those with disabilities. While the program provides valuable benefits, some individuals still struggle to afford the out-of-pocket costs associated with Medicare. Fortunately, there are four Medicare savings programs available to help those in need.

In this article, we will explore what the four Medicare savings programs are, who is eligible for them, and how they can help beneficiaries save money on healthcare expenses. So, if you or someone you know is struggling to afford Medicare, keep reading to learn more about these valuable programs.

Contents

- Understanding Medicare Savings Programs

- Qualified Medicare Beneficiary (QMB) Program

- Specified Low-Income Medicare Beneficiary (SLMB) Program

- Qualified Individual (QI) Program

- Qualified Disabled and Working Individuals (QDWI) Program

- Benefits of Medicare Savings Programs

- Comparison: QMB vs. SLMB vs. QI vs. QDWI

- How to Apply for Medicare Savings Programs

- Conclusion

- Frequently Asked Questions

Understanding Medicare Savings Programs

If you are a senior citizen or an individual with limited income and resources, you may be eligible for one or more of the four Medicare Savings Programs. These programs are designed to provide financial assistance to those who struggle to pay for their medical expenses. In this article, we will explore each of the four Medicare Savings Programs and what benefits they offer.

Qualified Medicare Beneficiary (QMB) Program

The Qualified Medicare Beneficiary (QMB) program is intended to help low-income individuals cover the costs of their Medicare Part A and Part B premiums, deductibles, coinsurance, and copayments. To qualify for the QMB program, you must meet the following criteria:

– Have a monthly income at or below 100% of the Federal Poverty Level (FPL)

– Have limited resources below the specified amount

– Be enrolled in Medicare Part A and Part B

If you are eligible for the QMB program, you will not be responsible for any out-of-pocket costs associated with Medicare Part A and Part B, including deductibles, coinsurance, and copayments. Additionally, you will be automatically enrolled in the Extra Help program, which helps cover the costs of prescription drugs.

Specified Low-Income Medicare Beneficiary (SLMB) Program

The Specified Low-Income Medicare Beneficiary (SLMB) program is designed to help pay for Medicare Part B premiums. To be eligible for the SLMB program, you must meet the following criteria:

– Have a monthly income at or below 120% of the FPL

– Have limited resources below the specified amount

– Be enrolled in Medicare Part A and Part B

If you are eligible for the SLMB program, your state will pay your Medicare Part B premium directly to Medicare. You will not be responsible for paying any premiums or deductibles associated with Medicare Part B.

Qualified Individual (QI) Program

The Qualified Individual (QI) program is similar to the SLMB program in that it helps pay for Medicare Part B premiums. However, the QI program has more limited funding and is available on a first-come, first-served basis. To be eligible for the QI program, you must meet the following criteria:

– Have a monthly income at or below 135% of the FPL

– Have limited resources below the specified amount

– Be enrolled in Medicare Part A and Part B

If you are eligible for the QI program, your state will pay your Medicare Part B premium directly to Medicare. You will not be responsible for paying any premiums or deductibles associated with Medicare Part B.

Qualified Disabled and Working Individuals (QDWI) Program

The Qualified Disabled and Working Individuals (QDWI) program is designed to help individuals with disabilities who are under 65 and working pay for their Medicare premiums. To be eligible for the QDWI program, you must meet the following criteria:

– Have a monthly income at or below 200% of the FPL

– Have limited resources below the specified amount

– Be a disabled worker who lost their premium-free Medicare Part A due to returning to work

If you are eligible for the QDWI program, your state will pay your Medicare Part A premium directly to Medicare. You will not be responsible for paying any premiums or deductibles associated with Medicare Part A.

Benefits of Medicare Savings Programs

The main benefit of the Medicare Savings Programs is that they help low-income individuals pay for their medical expenses. Without these programs, many people would not be able to afford the costs associated with Medicare. Additionally, by enrolling in one of these programs, you may be automatically enrolled in other programs, such as Extra Help for prescription drug costs.

Comparison: QMB vs. SLMB vs. QI vs. QDWI

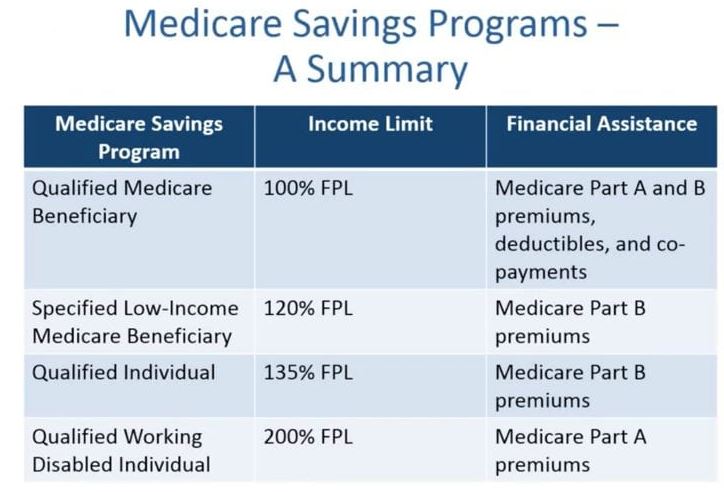

While the QMB, SLMB, QI, and QDWI programs all offer financial assistance to low-income individuals, there are some differences between them. The QMB program is the most comprehensive, as it covers all out-of-pocket costs associated with Medicare Part A and Part B. The SLMB and QI programs only cover Medicare Part B premiums, but have different income requirements. The QDWI program is specifically for disabled individuals under 65 who are working and lost their premium-free Medicare Part A.

Here’s a quick comparison:

| Program | Income Requirements | Benefits |

|---|---|---|

| QMB | At or below 100% of FPL | Covers all out-of-pocket costs associated with Medicare Part A and Part B |

| SLMB | At or below 120% of FPL | Covers Medicare Part B premiums |

| QI | At or below 135% of FPL | Covers Medicare Part B premiums |

| QDWI | At or below 200% of FPL | Covers Medicare Part A premiums |

How to Apply for Medicare Savings Programs

To apply for any of the Medicare Savings Programs, you must contact your state’s Medicaid office. You can find contact information for your state’s Medicaid office on the Medicaid website. When you apply, you will need to provide information about your income, resources, and Medicare coverage.

Conclusion

The Medicare Savings Programs are a valuable resource for low-income individuals who struggle to pay for their medical expenses. By enrolling in one of these programs, you can receive financial assistance to cover the costs associated with Medicare. If you think you may be eligible for one of these programs, contact your state’s Medicaid office to learn more and apply.

Frequently Asked Questions

What Are the 4 Medicare Savings Programs?

The 4 Medicare Savings Programs are state-run programs that help people with limited income and resources pay for their Medicare premiums and other costs. The programs are:

1. Qualified Medicare Beneficiary (QMB): Helps pay for Medicare Part A and Part B premiums, deductibles, coinsurance, and copayments.

2. Specified Low-Income Medicare Beneficiary (SLMB): Helps pay for Medicare Part B premiums.

3. Qualifying Individual (QI) Program: Helps pay for Medicare Part B premiums.

4. Qualified Disabled and Working Individuals (QDWI) Program: Helps pay for Medicare Part A premiums for people with disabilities who are working and have limited income.

Who is eligible for Medicare Savings Programs?

To be eligible for Medicare Savings Programs, you must have Medicare Part A and meet certain income and resource limits set by your state. The income and resource limits vary by state, but generally, you must have income below 135% of the federal poverty level and limited resources such as savings and investments.

If you are eligible for Medicaid, you are automatically eligible for the QMB program. Some states also automatically enroll eligible individuals in other Medicare Savings Programs.

How do I apply for Medicare Savings Programs?

To apply for Medicare Savings Programs, you need to contact your state Medicaid agency. You can find their contact information on the Medicaid website or by calling the Medicare hotline at 1-800-MEDICARE.

You will need to provide information about your income and resources, as well as your Medicare enrollment status. Your state Medicaid agency will review your application and let you know if you qualify for any of the Medicare Savings Programs.

Can I be enrolled in more than one Medicare Savings Program?

No, you can only be enrolled in one Medicare Savings Program at a time. However, you may be eligible for other programs that can help you pay for your Medicare costs, such as Extra Help to pay for prescription drug costs.

What are the benefits of enrolling in Medicare Savings Programs?

Enrolling in a Medicare Savings Program can help you save money on your Medicare costs. Depending on the program you qualify for, you may have your Medicare premiums, deductibles, coinsurance, and copayments paid for by the program. This can help make healthcare more affordable and accessible for people with limited income and resources.

Medicaid & Medicare Savings Programs

In conclusion, the 4 Medicare Savings Programs are an excellent way for seniors and low-income individuals to save money on healthcare costs. These programs can provide assistance with premiums, deductibles, and coinsurance, making healthcare more accessible and affordable.

If you or someone you know is struggling to cover healthcare costs, it’s worth looking into these programs to see if you qualify. With the rising cost of healthcare, every little bit of savings can make a big difference.

Overall, the Medicare Savings Programs are an important resource for those in need of financial assistance with healthcare. By taking advantage of these programs, seniors and low-income individuals can receive the care they need without breaking the bank.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts