Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program for people who are 65 or older, as well as those with certain disabilities. This program helps cover the cost of medical services, including hospital visits, doctor’s visits, and prescription drugs. However, there are still costs that individuals must pay out of pocket, including premiums and deductibles.

Understanding the difference between Medicare premiums and deductibles is crucial for anyone enrolled in the program. While both involve paying money for coverage, they serve different purposes and can have a significant impact on an individual’s overall healthcare costs. In this article, we will explore the differences between Medicare premiums and deductibles and how they affect your healthcare coverage.

Difference Between Medicare Premium and Deductible

Medicare is a health insurance program that provides coverage for millions of Americans over the age of 65. It is divided into different parts, each with its own premium and deductible. Understanding the difference between these two terms is essential to making an informed decision about which Medicare plan is right for you.

What is a Medicare Premium?

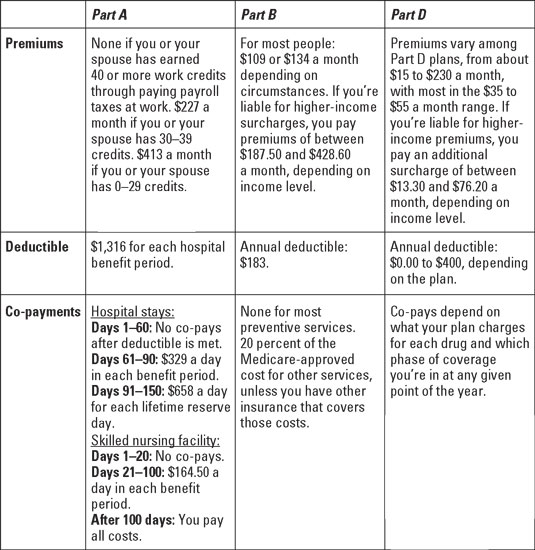

A Medicare premium is a monthly fee that you pay to be enrolled in Medicare. It is similar to the premium you pay for private health insurance. The amount of your premium is based on several factors, including your income, the type of Medicare plan you have, and whether you are enrolled in any other health insurance plans.

For most people, the standard Part B premium is $148.50 per month in 2021. However, if your income is above a certain threshold, you may have to pay more. You can find out how much you will pay by contacting the Social Security Administration or visiting their website.

What is a Medicare Deductible?

A Medicare deductible is the amount you must pay out of pocket before your Medicare coverage begins. It is similar to the deductible you pay for private health insurance. The amount of your deductible depends on the type of Medicare plan you have.

For example, the Part A deductible is $1,484 in 2021. This means that if you are admitted to the hospital, you will have to pay the first $1,484 of your medical expenses before Medicare coverage begins. The Part B deductible is $203 in 2021. This means that you will have to pay the first $203 of your doctor’s visits and other outpatient services before Medicare coverage begins.

Benefits of Paying Medicare Premiums and Deductibles

Paying Medicare premiums and deductibles can provide several benefits. For one, it ensures that you have access to necessary medical care when you need it. It also helps to keep healthcare costs down for everyone by spreading the cost of medical care across a larger pool of people.

Additionally, some Medicare plans offer benefits beyond what is covered by traditional Medicare. For example, Medicare Advantage plans may offer additional benefits such as dental, vision, and prescription drug coverage. However, these plans may have higher premiums and deductibles than traditional Medicare.

Medicare Premiums vs Deductibles: Which is More Important?

Both Medicare premiums and deductibles are important to consider when choosing a Medicare plan. Premiums are an ongoing expense, while deductibles are a one-time expense. If you have frequent medical needs, you may want to choose a plan with a higher premium but lower deductible to minimize your out-of-pocket costs.

On the other hand, if you are generally healthy and do not require frequent medical care, you may want to choose a plan with a lower premium but higher deductible to save money on your monthly expenses.

Conclusion

In conclusion, understanding the difference between Medicare premiums and deductibles is essential to making an informed decision about your healthcare coverage. Be sure to consider your medical needs and budget when choosing a Medicare plan, and don’t hesitate to seek guidance from a qualified healthcare professional if you have any questions.

Frequently Asked Questions

What is Medicare Premium?

Medicare Premium is the amount that you pay for your Medicare insurance. It is a monthly payment that you make to the government to receive healthcare coverage. The amount of your premium will depend on the type of Medicare plan you choose, your income, and other factors.

It is important to note that Medicare Part A is generally free for most people who have paid into the system through their taxes, while Medicare Part B has a monthly premium. However, some people may also pay a higher premium for Medicare Part A and/or Part B based on their income.

What is Medicare Deductible?

Medicare Deductible is the amount that you pay out of pocket for healthcare services before Medicare starts to pay. Each year, Medicare sets a deductible amount for each part of the program. For example, in 2021, the deductible for Medicare Part A is $1,484, and the deductible for Medicare Part B is $203.

It is important to note that once you have met your deductible, you will still be responsible for paying a portion of the cost of your healthcare services. This is called coinsurance or copayment, depending on the type of service you receive.

What is the difference between Medicare Premium and Deductible?

The main difference between Medicare Premium and Deductible is what they cover. Medicare Premium is the amount that you pay each month for your Medicare insurance, while Medicare Deductible is the amount that you have to pay out of pocket before Medicare starts to pay for your healthcare services.

Another difference is that Medicare Premium is a fixed amount that you pay each month, while Medicare Deductible can vary from year to year. Additionally, while you must pay your Medicare Premium to maintain your coverage, you do not have to pay your Medicare Deductible if you do not receive any healthcare services during the year.

How do I know if I have to pay a Medicare Premium or Deductible?

If you are eligible for Medicare, you will automatically be enrolled in Medicare Part A, which is generally free. However, you will have to pay a monthly premium for Medicare Part B (and Part D if you choose to enroll in a prescription drug plan). The amount of your premium will depend on your income.

To find out your Medicare Deductible, you can check your Medicare Summary Notice or contact Medicare directly. You can also ask your healthcare provider or pharmacy about the cost of specific services or medications to determine if you have to pay a coinsurance or copayment.

Can I get help paying for my Medicare Premium and Deductible?

Yes, there are programs available to help you pay for your Medicare Premium and Deductible if you meet certain income and asset requirements. The most common program is called Extra Help, which is designed to help with the costs of prescription drugs. There are also state programs that may provide additional assistance with Medicare costs.

To find out if you are eligible for these programs, you can contact your local Social Security office or your State Health Insurance Assistance Program (SHIP).

⚠️ 2023 Medicare Part B Premium and Deductible UPDATE!

In conclusion, understanding the difference between Medicare premium and deductible is crucial for beneficiaries to make informed decisions about their healthcare coverage. While premiums are the monthly fees paid to Medicare to receive coverage, deductibles are the amount beneficiaries must pay out of pocket before Medicare begins to cover their healthcare costs.

It’s important to note that not all Medicare plans have the same premiums and deductibles. It’s essential to review and compare the different plans available to find the one that best fits your medical needs and budget.

In summary, taking the time to understand the difference between Medicare premium and deductible can save beneficiaries money and ensure they receive the healthcare coverage they need. By doing your research and comparing plans, you can make an informed decision that will benefit you in the long run.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts