Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Advantage and Kaiser Permanente are two types of health insurance plans available for seniors in the United States. While both offer comprehensive coverage for medical and prescription drugs, there are some key differences between the two that are important to understand before making a decision. In this article, we will explore the similarities and differences between Medicare Advantage and Kaiser Permanente, as well as the pros and cons of each plan.

Contents

- Difference between Medicare Advantage and Kaiser Permanente

- Frequently Asked Questions

- What is the difference between Medicare Advantage and Kaiser Permanente?

- Which one is better: Medicare Advantage or Kaiser Permanente?

- Can I switch from Medicare Advantage to Kaiser Permanente?

- Does Kaiser Permanente offer Medicare Advantage plans?

- The Benefit of Being a Kaiser Permanente Medicare Advantage Member

Difference between Medicare Advantage and Kaiser Permanente

When it comes to healthcare coverage, there are numerous options available, but two of the most popular are Medicare Advantage and Kaiser Permanente. Both of these options offer unique benefits and drawbacks, and understanding the differences between them can help you make an informed decision about which one is right for you.

What is Medicare Advantage?

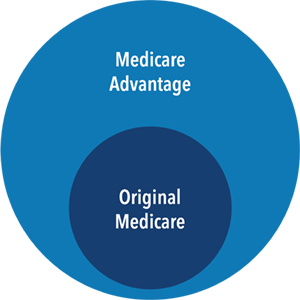

Medicare Advantage is a type of health insurance plan that is offered by private insurance companies, but it is regulated by the federal government. It is designed to provide Medicare beneficiaries with an alternative to traditional Medicare coverage.

One of the biggest benefits of Medicare Advantage is that it often includes additional benefits that are not covered by traditional Medicare, such as dental, vision, and hearing care. Additionally, many Medicare Advantage plans also include prescription drug coverage, which can be a significant cost savings for those who require regular medication.

On the downside, Medicare Advantage plans often have more restrictive provider networks than traditional Medicare plans, meaning that you may not be able to see the doctor of your choice. Additionally, you may be required to pay higher out-of-pocket costs for certain services.

What is Kaiser Permanente?

Kaiser Permanente is a healthcare organization that provides both health insurance and medical care. It is a not-for-profit organization that operates in several states across the country.

One of the biggest benefits of Kaiser Permanente is that it offers comprehensive care, including primary care, specialty care, and hospital services. Additionally, Kaiser Permanente is known for its focus on preventative care, which can help you stay healthy and avoid costly medical procedures down the line.

On the downside, Kaiser Permanente is only available in certain areas, so it may not be an option for everyone. Additionally, because it is a not-for-profit organization, it does not offer the same level of customization as some other healthcare options.

Benefits of Medicare Advantage

There are several benefits to choosing a Medicare Advantage plan over traditional Medicare. Some of these benefits include:

- Additional benefits, such as dental, vision, and hearing care

- Prescription drug coverage

- Lower out-of-pocket costs for some services

However, it is important to note that not all Medicare Advantage plans are created equal, and the benefits offered can vary significantly from plan to plan.

Benefits of Kaiser Permanente

Kaiser Permanente also offers a number of benefits for those who choose to enroll in its healthcare plans. Some of these benefits include:

- Comprehensive care, including primary care, specialty care, and hospital services

- Focus on preventative care

- Integrated healthcare system

However, like Medicare Advantage, Kaiser Permanente may not be available in all areas, and it may not offer the same level of customization as some other healthcare options.

Medicare Advantage vs. Kaiser Permanente

When it comes to choosing between Medicare Advantage and Kaiser Permanente, there are several factors to consider. Some of the key differences between the two options include:

| Factor | Medicare Advantage | Kaiser Permanente |

|---|---|---|

| Provider network | May be more restricted | Comprehensive, integrated system |

| Benefits | May include additional benefits not covered by traditional Medicare | Focus on preventative care |

| Availability | Available to all Medicare beneficiaries | Only available in certain areas |

Ultimately, the best choice for you will depend on your individual healthcare needs and preferences. It is important to carefully review your options and compare the benefits and drawbacks of each before making a decision.

Frequently Asked Questions

What is the difference between Medicare Advantage and Kaiser Permanente?

Medicare Advantage and Kaiser Permanente are both healthcare options for individuals who are eligible for Medicare. Medicare Advantage is a type of Medicare plan offered by private insurance companies, while Kaiser Permanente is a healthcare system that provides managed care services.

With Medicare Advantage, individuals have the option to choose a plan that is tailored to their specific healthcare needs. These plans often offer additional benefits such as vision, dental, and prescription drug coverage. On the other hand, Kaiser Permanente offers a comprehensive healthcare system that includes primary care, specialty care, and hospital services all under one organization.

While Medicare Advantage plans are offered by various insurance companies, Kaiser Permanente is a self-contained healthcare system that has its own network of healthcare providers. Individuals who choose Kaiser Permanente typically receive all of their healthcare services through the organization, whereas those who choose Medicare Advantage may need to see healthcare providers outside of their plan’s network.

Which one is better: Medicare Advantage or Kaiser Permanente?

The answer to this question ultimately depends on an individual’s specific healthcare needs and preferences. Medicare Advantage plans offer a wide range of options, allowing individuals to choose a plan that best suits their healthcare needs and budget. However, these plans may have limitations when it comes to choosing healthcare providers and accessing certain services.

Kaiser Permanente, on the other hand, offers a comprehensive healthcare system that includes primary care, specialty care, and hospital services all under one organization. This can be beneficial for individuals who prefer to receive all of their healthcare services through one provider and have access to a wide range of services.

Ultimately, the decision between Medicare Advantage and Kaiser Permanente comes down to an individual’s specific healthcare needs and preferences. It is important to carefully evaluate the benefits and limitations of each option before making a decision.

Can I switch from Medicare Advantage to Kaiser Permanente?

Yes, it is possible to switch from Medicare Advantage to Kaiser Permanente. However, it is important to note that there may be certain restrictions and requirements when it comes to switching plans.

Individuals who wish to switch from Medicare Advantage to Kaiser Permanente should first review their current plan and compare it to the services offered by Kaiser Permanente. It is also important to consider any costs associated with switching plans, such as premiums, deductibles, and copayments.

Once an individual has decided to switch to Kaiser Permanente, they should contact the organization to begin the enrollment process. It is important to carefully review all of the terms and conditions of the new plan before enrolling to ensure that it meets all of an individual’s healthcare needs.

Does Kaiser Permanente offer Medicare Advantage plans?

Yes, Kaiser Permanente offers Medicare Advantage plans. These plans are designed to provide comprehensive healthcare services to individuals who are eligible for Medicare. Kaiser Permanente’s Medicare Advantage plans offer a range of benefits, including prescription drug coverage, vision and dental care, and wellness programs.

One of the benefits of choosing a Kaiser Permanente Medicare Advantage plan is that individuals have access to a comprehensive healthcare system that includes primary care, specialty care, and hospital services all under one organization. This can be beneficial for individuals who prefer to receive all of their healthcare services through one provider and have access to a wide range of services.

The Benefit of Being a Kaiser Permanente Medicare Advantage Member

In conclusion, understanding the differences between Medicare Advantage and Kaiser Permanente can help you make an informed decision about your healthcare coverage. While both options offer comprehensive care, Medicare Advantage plans are available to anyone who qualifies for Medicare, while Kaiser Permanente is only available in certain regions of the country.

Additionally, Medicare Advantage plans often come with lower out-of-pocket costs and more flexibility in choosing healthcare providers, while Kaiser Permanente plans typically have a more integrated approach to healthcare with a focus on preventive care.

Ultimately, the decision between Medicare Advantage and Kaiser Permanente will depend on your individual healthcare needs and preferences. Be sure to carefully consider all of your options and consult with a healthcare professional before making a final decision.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts