Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Rehabilitation is a crucial step in recovering from addiction or any other physical or mental health condition. For those who rely on Medicare, the question of how long they can stay in rehab can be a major concern. Understanding the coverage provided by Medicare and the different types of rehab programs available can help individuals make informed decisions about their treatment options.

Medicare can cover up to 90 days of inpatient rehab per benefit period, with an additional 60 days of coverage with a lifetime reserve. However, the length of stay can vary depending on the individual’s condition and progress. It’s important to work with healthcare providers to determine the appropriate length of stay and to explore other resources available for continued care after leaving rehab.

How Long Can You Stay in Rehab With Medicare?

If you or a loved one is struggling with addiction, getting professional help is crucial. However, the cost of rehab can be a significant barrier for many people. If you have Medicare, you may be wondering how long you can stay in rehab and what services are covered. In this article, we’ll explore the answers to these questions and more.

What is Medicare?

Medicare is a federal health insurance program for people who are 65 or older, as well as for some younger individuals with disabilities. It consists of four parts:

– Part A (hospital insurance)

– Part B (medical insurance)

– Part C (Medicare Advantage, which is an alternative to Parts A and B)

– Part D (prescription drug coverage)

If you have Medicare, you may be able to get coverage for substance abuse treatment.

What Rehab Services Does Medicare Cover?

Medicare provides coverage for a variety of rehab services, including:

– Inpatient hospital care: If you need to stay in the hospital for detoxification or other medical reasons, Medicare Part A will cover the cost.

– Inpatient rehab: If you need intensive rehabilitation services, such as physical therapy, occupational therapy, or speech therapy, Medicare Part A will cover the cost of a stay in a rehab facility.

– Outpatient rehab: If you don’t need to stay in a rehab facility but still need rehab services, Medicare Part B will cover the cost of outpatient therapy.

– Medications: If you need medications to help with your recovery, Medicare Part D may cover the cost.

It’s important to note that Medicare only covers services that are deemed medically necessary. Your doctor or treatment provider will need to justify why you need a certain service for Medicare to cover it.

How Long Can You Stay in Rehab With Medicare?

Medicare doesn’t have a set limit on how long you can stay in rehab. However, there are some guidelines you should be aware of.

For inpatient rehab, Medicare will cover up to 90 days of care per benefit period. If you need more care, you may be able to get an additional 60 days of coverage with a lifetime reserve day.

For outpatient rehab, Medicare will cover as many sessions as your doctor deems medically necessary.

It’s important to remember that these guidelines are just that – guidelines. Your doctor or treatment provider will work with Medicare to determine what services and how long they will cover them based on your individual needs.

Benefits of Using Medicare for Rehab

There are several benefits to using Medicare for rehab:

– Cost savings: Medicare can help cover the cost of rehab, which can be a significant financial burden for many families.

– Access to care: Medicare is widely accepted, so you’ll be able to find treatment providers who accept your insurance.

– Comprehensive coverage: Medicare covers a wide range of rehab services, so you can get the care you need without worrying about whether it’s covered.

Drawbacks of Using Medicare for Rehab

While there are many benefits to using Medicare for rehab, there are also some drawbacks to consider:

– Limited coverage: Medicare only covers services that are deemed medically necessary, so some services may not be covered.

– Restrictions on providers: You may be limited in your choice of treatment providers if you use Medicare.

– Paperwork: You may need to fill out paperwork and wait for approval before you can receive certain services.

Rehab Vs. Medicare Advantage Plans

While Medicare offers coverage for rehab, some individuals may choose to enroll in a Medicare Advantage plan instead. These plans are offered by private insurance companies and provide coverage for all the services covered by Medicare Parts A and B.

One advantage of Medicare Advantage plans is that they may provide additional benefits that aren’t covered by traditional Medicare, such as dental, vision, and hearing coverage. However, these plans may also have higher out-of-pocket costs and restrictions on providers.

Ultimately, the decision of whether to use traditional Medicare or a Medicare Advantage plan for rehab depends on your individual needs and preferences. It’s important to carefully consider your options and speak with a qualified insurance professional before making a decision.

Conclusion

If you or a loved one is struggling with addiction, getting professional help is crucial. If you have Medicare, you may be able to get coverage for rehab services. While Medicare offers comprehensive coverage, it’s important to be aware of the guidelines and restrictions on services. Ultimately, the decision of whether to use Medicare or a Medicare Advantage plan for rehab depends on your individual needs and preferences.

Contents

- Frequently Asked Questions

- How long can you stay in rehab with Medicare?

- What types of rehab programs does Medicare cover?

- What is the process for getting rehab care covered by Medicare?

- Can Medicare cover the cost of outpatient rehab services?

- What happens if an individual exceeds the 100-day limit for rehab care?

- Medicare Benefits for Rehabilitation in a Skilled Nursing Facility

Frequently Asked Questions

How long can you stay in rehab with Medicare?

Medicare will cover up to 100 days of inpatient rehab care per benefit period. However, the length of stay in rehab may depend on several factors, including the type of rehab program and the individual’s needs and progress.

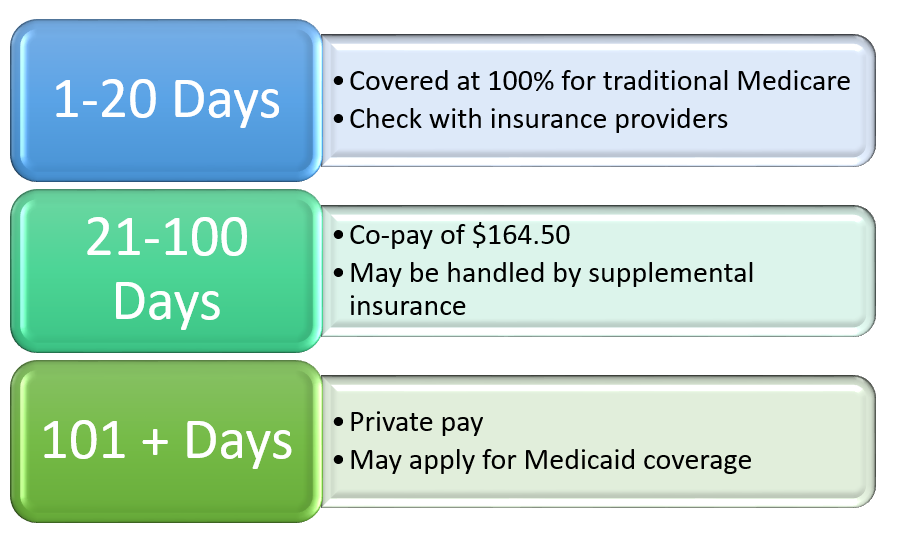

During the first 20 days of inpatient rehab care, Medicare will cover the full cost of care. From day 21 to day 100, there may be a daily coinsurance payment required. It’s important to note that Medicare will only cover rehab care that is deemed medically necessary by a healthcare provider.

What types of rehab programs does Medicare cover?

Medicare covers a range of rehab programs, including inpatient rehab facilities, skilled nursing facilities, and home health services. Each type of program has different requirements for coverage, so it’s important to consult with a healthcare provider to determine the best option for an individual’s needs.

Inpatient rehab facilities provide intensive rehabilitation services for individuals who require 24-hour care. Skilled nursing facilities offer short-term rehab care for individuals who require assistance with daily activities and medical supervision. Home health services provide rehab services for individuals who are able to live at home but require assistance with daily activities.

What is the process for getting rehab care covered by Medicare?

To get rehab care covered by Medicare, an individual must first have a qualifying hospital stay. After the hospital stay, a healthcare provider will determine if the individual requires rehab care and what type of care is necessary. The healthcare provider will then work with the individual to develop a plan of care that is covered by Medicare.

It’s important to note that not all rehab programs are covered by Medicare, and some may require prior authorization. It’s recommended to consult with a healthcare provider or Medicare representative to determine coverage and eligibility.

Can Medicare cover the cost of outpatient rehab services?

Yes, Medicare can cover the cost of outpatient rehab services, such as physical therapy and occupational therapy. Medicare Part B covers these services, and there may be out-of-pocket costs, such as deductibles and coinsurance.

To be eligible for coverage, the individual must receive services from a Medicare-approved provider. The healthcare provider must also determine that the services are medically necessary and create a plan of care that outlines the services to be provided.

What happens if an individual exceeds the 100-day limit for rehab care?

If an individual exceeds the 100-day limit for rehab care, they may be responsible for the full cost of care. However, there are some exceptions to this rule, such as if the individual is able to start a new benefit period or if they require continued care due to a new illness or injury.

It’s important to note that the 100-day limit is per benefit period, which begins the day an individual is admitted to a hospital or skilled nursing facility and ends when they have not received inpatient care for 60 consecutive days.

Medicare Benefits for Rehabilitation in a Skilled Nursing Facility

In conclusion, the length of time you can stay in rehab with Medicare ultimately depends on your individual needs and treatment plan. Medicare provides coverage for up to 100 days of inpatient care, but this does not guarantee that you will receive the full 100 days. Your healthcare provider will determine the appropriate length of stay based on your progress and medical needs.

It’s important to note that Medicare only covers certain types of rehab facilities, such as those that are certified by Medicare and provide medically necessary services. Additionally, not all services may be covered by Medicare, so it’s important to understand your benefits and any potential out-of-pocket costs.

Overall, seeking treatment for addiction or other medical conditions is an important step towards recovery and Medicare can provide valuable support. By working with your healthcare provider and understanding your Medicare benefits, you can ensure that you receive the care you need for as long as necessary.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts