Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you a Medicare beneficiary looking to switch your Medicare supplement plan? It’s a common question among seniors, and there are various reasons why someone might consider changing their plan. In this article, we’ll explore the different situations where it might be beneficial to switch your Medicare supplement plan, and what you need to know before making a decision.

From changes in your health status to changes in your financial situation, there are several factors that can impact your Medicare supplement plan needs. It’s important to understand your options and evaluate your current plan regularly to ensure that you’re getting the best coverage for your unique needs. So, let’s dive in and discover when changing your Medicare supplement plan might be the right move for you.

When to Change Medicare Supplement Plans?

You can change your Medicare Supplement plan at any time of the year. However, the best time to do it is during the open enrollment period, which starts on the first day of the month you turn 65 and lasts for six months. During this time, you have a guaranteed issue right, which means that insurance companies can’t deny you coverage or charge you a higher premium based on your health status. You can also switch plans outside of the open enrollment period, but you may face medical underwriting and higher premiums.

When to Change Medicare Supplement Plans?

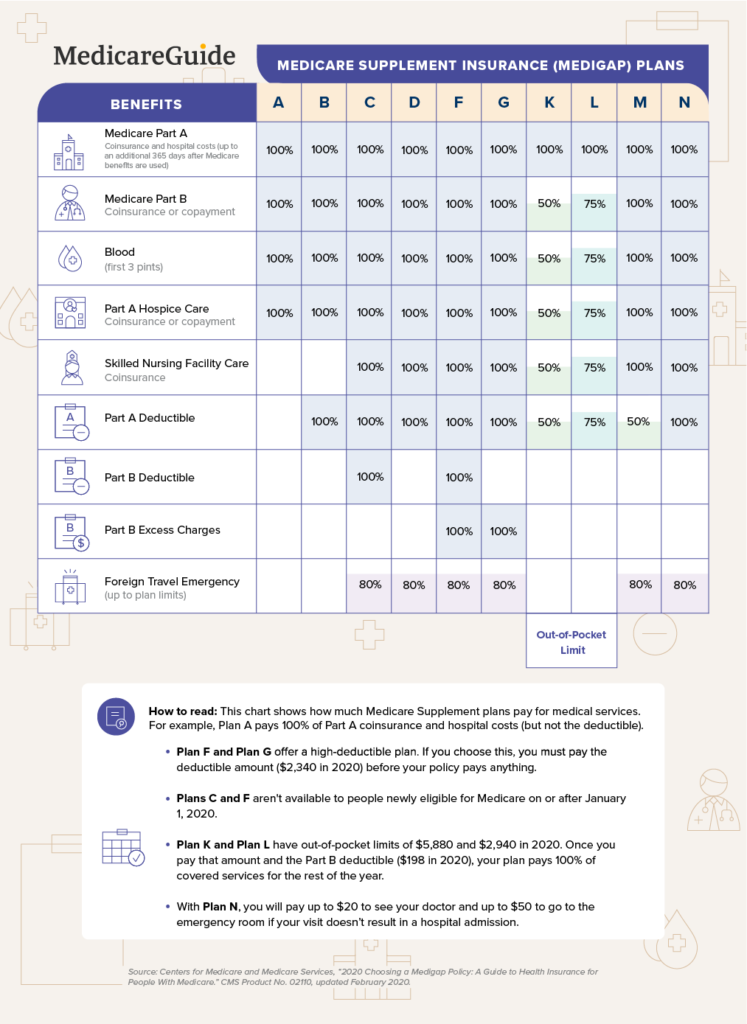

Medicare Supplement Plans, also known as Medigap plans, can be critical for covering out-of-pocket healthcare expenses that aren’t covered by original Medicare. However, people’s healthcare needs change over time, and the plan that was once perfect may no longer be the best fit. In this article, we’ll discuss when and why someone might consider changing their Medicare Supplement Plan.

1. Health has changed

Perhaps the most common reason for changing Medigap plans is because of a change in health. As we age, our medical needs may evolve, and our current plan may no longer be adequate. For example, if you’ve been diagnosed with a chronic illness that requires frequent medical attention, you may want to switch to a plan that offers more comprehensive coverage.

Additionally, if you’ve experienced a significant improvement in your health, you may be paying for coverage that you no longer need. In this case, you may want to downgrade to a plan with lower premiums.

2. Financial situation has changed

Another reason to consider changing your Medigap plan is if your financial situation has changed. For example, if your income has decreased significantly, you may want to switch to a plan with lower premiums.

Conversely, if you’ve come into money and can afford to pay more for comprehensive coverage, you may want to upgrade to a more comprehensive plan.

3. You’re paying for coverage you don’t need

If you’re paying for coverage that you don’t need, you may want to switch to a plan that better fits your needs. For example, if you’re paying for coverage for prescription drugs, but you don’t take any prescription drugs, you may want to switch to a plan that doesn’t include prescription drug coverage.

4. Your plan is being discontinued

Sometimes, insurance companies will discontinue certain Medigap plans. If your plan is being discontinued, you’ll have the option to switch to another plan. If you don’t take action, you may lose your coverage.

5. Your plan is too expensive

If you’re struggling to afford your Medigap plan, you may want to switch to a more affordable plan. However, you’ll want to ensure that the new plan still provides you with the coverage you need.

6. You’ve moved to a new state

If you’ve moved to a new state, you’ll need to check if your Medigap plan is still available in your new location. If not, you’ll need to switch to a plan that’s available in your new state.

7. You’re not happy with the customer service

If you’re unhappy with the customer service you’re receiving from your current insurance company, you may want to switch to a plan with a better reputation for customer service.

8. You’ve found a better deal

If you’ve found a Medigap plan that better fits your needs and is more affordable, you may want to switch to the new plan.

9. You want to change insurance companies

If you’re unhappy with your current insurance company, you may want to switch to a different company. However, you’ll need to ensure that the new company offers a plan that meets your needs.

10. You’re approaching your open enrollment period

Finally, it’s important to remember that you have the option to change your Medigap plan during your open enrollment period. This period lasts for six months and begins on the first day of the month in which you turn 65. During this time, you can switch to any Medigap plan that’s available in your area without being subject to medical underwriting.

In conclusion, there are many reasons why someone might consider changing their Medigap plan. Whether you’re experiencing a change in health or financial situation, or you’re simply not happy with your current plan, it’s important to weigh your options carefully to ensure that you’re getting the best coverage for your needs.

Contents

- Frequently Asked Questions

- When should I consider changing my Medicare Supplement Plan?

- Can I change my Medicare Supplement Plan at any time?

- What should I consider when choosing a new Medicare Supplement Plan?

- What happens if I switch to a new Medicare Supplement Plan?

- Can I switch from a Medicare Advantage Plan to a Medicare Supplement Plan?

- When can I change my Medicare Supplement Plan?

Frequently Asked Questions

When should I consider changing my Medicare Supplement Plan?

There are a few reasons why you may want to consider changing your Medicare Supplement Plan. Firstly, if you find that your current plan is not meeting your healthcare needs or is becoming too expensive, it may be time to consider switching to a different plan. Additionally, if you move to a new state or your current plan is no longer offered in your area, you will need to find a new plan.

Before making any changes, it is important to research and compare different plans to ensure that you are getting the best coverage for your needs and budget. You can do this by using online resources or speaking with a licensed insurance agent.

Can I change my Medicare Supplement Plan at any time?

No, you cannot change your Medicare Supplement Plan at any time. You can only change your plan during certain enrollment periods, such as the Annual Enrollment Period (AEP) or the Open Enrollment Period (OEP). The AEP occurs every year from October 15th to December 7th, while the OEP occurs from January 1st to March 31st.

During these enrollment periods, you can switch to a different Medicare Supplement Plan or enroll in a plan for the first time. It is important to note that there may be restrictions or limitations on changing plans outside of these enrollment periods.

What should I consider when choosing a new Medicare Supplement Plan?

When choosing a new Medicare Supplement Plan, there are several factors to consider. Firstly, you should consider your healthcare needs and how much coverage you require. You should also consider your budget and how much you can afford to pay in premiums and out-of-pocket costs.

Additionally, you should research and compare different plans to ensure that you are getting the best coverage for your needs. This may involve looking at the different benefits and costs associated with each plan, as well as reading reviews and speaking with a licensed insurance agent.

What happens if I switch to a new Medicare Supplement Plan?

If you switch to a new Medicare Supplement Plan, you will need to cancel your current plan and enroll in the new plan during the appropriate enrollment period. Once you have enrolled in the new plan, your coverage will begin on the date specified by the plan.

It is important to note that you may be subject to medical underwriting when enrolling in a new plan outside of your initial enrollment period. This means that the insurance company may review your medical history and health status to determine your eligibility for coverage.

Can I switch from a Medicare Advantage Plan to a Medicare Supplement Plan?

Yes, you can switch from a Medicare Advantage Plan to a Medicare Supplement Plan during certain enrollment periods. However, you will need to disenroll from your Medicare Advantage Plan and enroll in a Medicare Supplement Plan during the appropriate enrollment period.

It is important to note that you may be subject to medical underwriting when enrolling in a Medicare Supplement Plan outside of your initial enrollment period. Additionally, you will need to continue paying your Medicare Part B premium in order to enroll in a Medicare Supplement Plan.

When can I change my Medicare Supplement Plan?

In conclusion, knowing when to change Medicare Supplement plans is crucial for staying on top of your healthcare needs. Whether you’re looking for better coverage or simply want to save money, it’s important to regularly review your plan and assess your options. By doing so, you can ensure that you’re getting the most out of your Medicare benefits and staying protected against unexpected medical costs.

Ultimately, the decision to change your Medicare Supplement plan should be based on your individual needs and circumstances. If you’re experiencing changes in your health status or have recently had a major life event, it may be time to reevaluate your coverage. Additionally, if you’re paying high premiums or experiencing gaps in coverage, switching to a different plan may be the best option for you.

Overall, it’s important to consult with a licensed insurance agent or healthcare provider before making any changes to your Medicare Supplement plan. They can help you navigate the complex world of Medicare and ensure that you’re making an informed decision that meets your unique healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts