Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you considering changing your Medicare Part D plan? Maybe you’re not satisfied with your current coverage or you’re looking for a better deal. Whatever the reason, knowing when and how to change your plan can save you money and provide better healthcare options.

Fortunately, Medicare offers an annual enrollment period where you can switch your plan or make changes to your coverage. In this article, we’ll guide you through the process of changing your Medicare Part D plan so you can make the best decision for your health and budget.

You can change Medicare Part D plans during the Annual Enrollment Period (AEP) from October 15 to December 7 every year. You can also change plans outside of AEP during the Special Enrollment Period (SEP) if you experience a qualifying life event, such as moving to a new location or losing your current coverage. It’s important to review your plan each year to ensure it still meets your needs and covers your medications.

When Can You Change Medicare Part D Plans?

If you are enrolled in Medicare Part D, you may be wondering when you can change your plan. There are certain times throughout the year when you can make changes to your coverage, as well as some special circumstances that may allow you to switch plans outside of those times. Here is a breakdown of when you can change Medicare Part D plans:

Annual Enrollment Period

The Annual Enrollment Period (AEP) is the time each year when you can make changes to your Medicare Part D plan. This period runs from October 15th to December 7th. During this time, you can switch from one plan to another or enroll in a plan for the first time. If you are already enrolled in a plan, you can also make changes to your coverage, such as adding or removing prescription drugs.

If you make changes to your Medicare Part D plan during the AEP, your new coverage will begin on January 1st of the following year. It’s important to note that if you don’t make any changes during the AEP, your current plan will automatically renew for the next year.

Special Enrollment Period

In some cases, you may be eligible for a Special Enrollment Period (SEP) that allows you to change your Medicare Part D plan outside of the AEP. You may qualify for an SEP if you experience certain life events, such as moving to a new area that is not in your plan’s service area or losing your current prescription drug coverage.

If you qualify for an SEP, you typically have 60 days from the date of the qualifying event to make changes to your Medicare Part D plan. Your new coverage will begin on the first day of the month following your enrollment.

Medicare Advantage Open Enrollment Period

If you are enrolled in a Medicare Advantage plan that includes prescription drug coverage, you can make changes to your plan during the Medicare Advantage Open Enrollment Period (OEP). This period runs from January 1st to March 31st each year.

During the OEP, you can switch from one Medicare Advantage plan to another or switch back to Original Medicare with or without a Part D plan. If you make changes during the OEP, your new coverage will begin on the first day of the following month.

Benefits of Changing Medicare Part D Plans

There are several benefits to changing your Medicare Part D plan. One of the biggest advantages is the potential to save money on your prescription drug costs. Different plans have different formularies, which is the list of drugs that the plan covers. By switching to a plan with a more comprehensive formulary or lower copays, you may be able to reduce your out-of-pocket expenses.

Another benefit of changing Medicare Part D plans is the ability to find a plan that better meets your needs. If you are taking new medications or your healthcare needs have changed, you may want to switch to a plan that provides better coverage for your specific needs.

Things to Consider When Changing Medicare Part D Plans

Before you make any changes to your Medicare Part D plan, it’s important to carefully consider your options. Here are some things to keep in mind:

- Check the formulary: Make sure the plan you are considering covers all of the medications you take.

- Compare costs: Look at the monthly premiums, deductibles, copays, and coinsurance of each plan to determine which one is the most cost-effective for you.

- Consider your healthcare needs: Look at the plan’s coverage for services such as doctor visits, hospital stays, and preventive care to ensure it meets your needs.

Medicare Part D Plans: Original Medicare vs. Medicare Advantage

When it comes to Medicare Part D plans, you have two options: Original Medicare with a standalone Part D plan or a Medicare Advantage plan that includes prescription drug coverage. Here are some things to consider when deciding between the two:

Original Medicare with a Standalone Part D Plan

- Flexibility: With Original Medicare and a standalone Part D plan, you have more flexibility to choose your healthcare providers and services.

- More options: There are typically more Part D plans available to choose from than Medicare Advantage plans.

- Higher costs: You may have higher out-of-pocket costs with Original Medicare and a standalone Part D plan, especially if you need a lot of prescription drugs.

Medicare Advantage Plan with Prescription Drug Coverage

- Convenience: With a Medicare Advantage plan, you have all of your healthcare coverage in one plan.

- Lower costs: Medicare Advantage plans often have lower out-of-pocket costs than Original Medicare and a standalone Part D plan.

- Less flexibility: You may be limited to using healthcare providers and services within the plan’s network.

Ultimately, the decision between Original Medicare with a standalone Part D plan and a Medicare Advantage plan with prescription drug coverage comes down to your individual healthcare needs and preferences.

Conclusion

If you are enrolled in Medicare Part D, it’s important to understand when you can change your plan and what factors to consider when making a decision. By carefully weighing your options and comparing plans, you can find the coverage that best meets your needs and helps you save money on your prescription drug costs.

Frequently Asked Questions

When Can You Change Medicare Part D Plans?

Medicare Part D is a prescription drug benefit program that covers the cost of prescription drugs for Medicare beneficiaries. As a Medicare beneficiary, you have the option to enroll in a Part D plan during the Annual Enrollment Period (AEP) or during a Special Enrollment Period (SEP).

The AEP runs from October 15 to December 7 of each year. During this time, you can switch from one Part D plan to another or enroll in a new plan if you are not already enrolled. If you are enrolled in a plan and do not want to make any changes, you do not have to do anything, and your coverage will continue.

What is a Special Enrollment Period?

A Special Enrollment Period (SEP) is a time outside of the Annual Enrollment Period when you can enroll in or switch Part D plans. There are several circumstances that may qualify you for an SEP, such as moving to a new location, losing your current coverage, or experiencing a life-changing event, such as getting married or divorced.

If you qualify for an SEP, you generally have 60 days from the date of the qualifying event to enroll in a new plan or switch to a different plan. If you do not enroll in a plan during the SEP, you may have to wait until the next AEP to make changes to your coverage.

Can you change your Part D plan at any time?

Generally, you cannot change your Part D plan at any time. You can only make changes during the Annual Enrollment Period or during a Special Enrollment Period if you qualify. However, there are a few exceptions to this rule.

If you are enrolled in a plan that has a 5-star rating from Medicare, you may be able to switch to another 5-star rated plan at any time during the year. Additionally, if you are enrolled in a plan that is no longer available, you may be able to switch to a different plan outside of the AEP.

What should you consider when choosing a Part D plan?

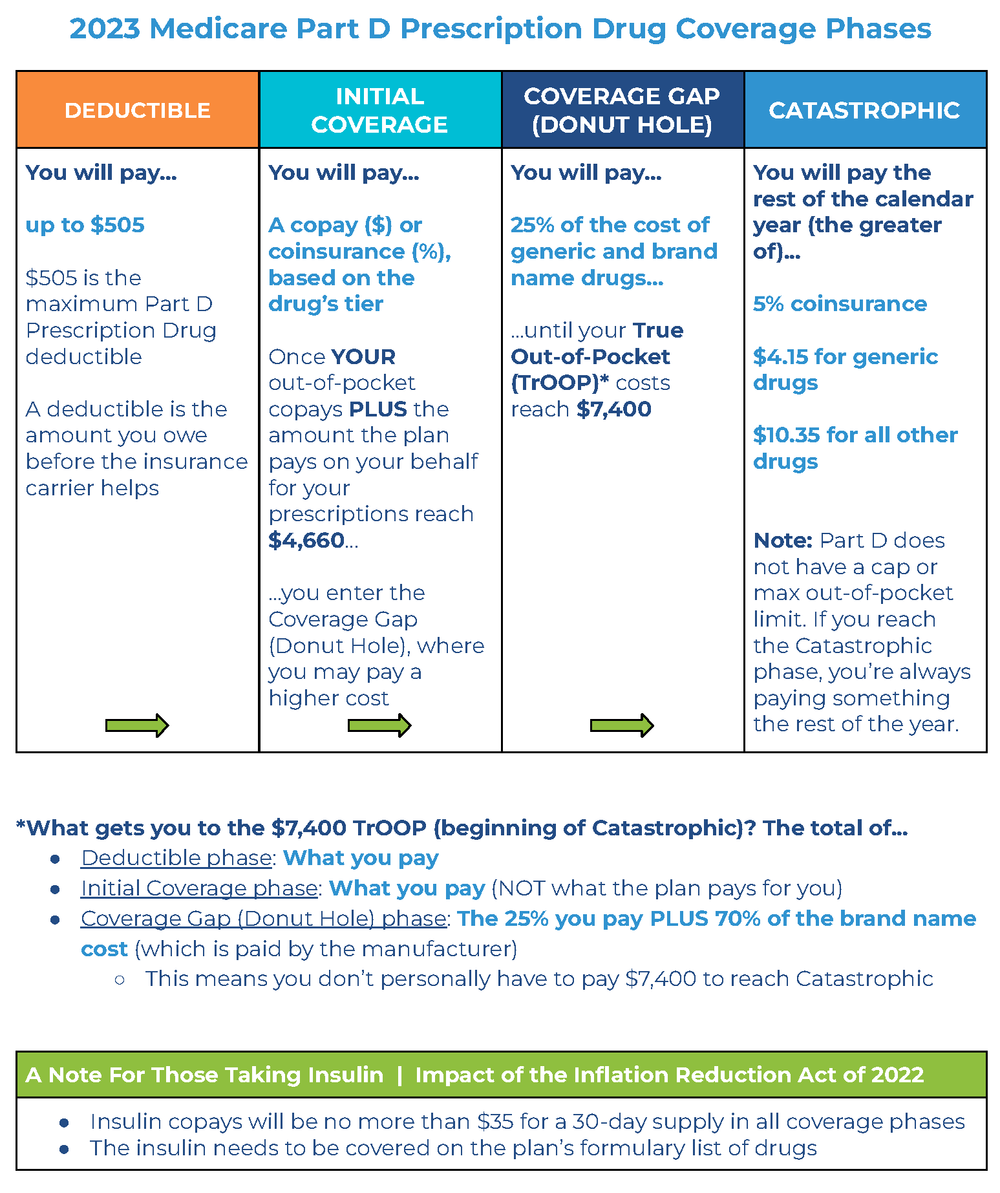

When choosing a Part D plan, there are several factors to consider, such as the cost of the plan, the drugs covered by the plan, the pharmacy network, and the plan’s star rating. You should also consider whether the plan has a coverage gap (also known as the “donut hole”) and how it covers medications during this period.

You may also want to consider whether the plan offers any additional benefits, such as mail-order pharmacy services or a medication therapy management program. It is important to review your options carefully and choose a plan that meets your specific needs and budget.

What happens if you do not enroll in a Part D plan?

If you do not enroll in a Part D plan when you are first eligible, you may face a late enrollment penalty if you decide to enroll later. The penalty is based on the number of months you went without coverage and is added to your monthly premium for as long as you have a Part D plan.

Additionally, if you do not have creditable prescription drug coverage (coverage that is at least as good as Medicare’s standard coverage), you may have to pay a higher premium for Part D coverage when you do enroll. It is important to enroll in a Part D plan when you are first eligible to avoid these penalties and ensure that you have access to affordable prescription drug coverage.

When Can I Change My Medicare Part D Plan?

In conclusion, knowing when to change Medicare Part D plans can make a significant impact on your healthcare costs and coverage. With the Annual Enrollment Period running from October 15th to December 7th, it’s the ideal time to review and compare your current plan with other options available in your area.

If you experience a life-changing event such as moving to a new state, losing your current coverage, or being diagnosed with a new medical condition, you may qualify for a Special Enrollment Period. This allows you to change your plan outside of the Annual Enrollment Period and ensure that you have the coverage you need.

Overall, it’s essential to stay informed about your Medicare Part D plan and any changes that may affect your coverage or costs. By regularly reviewing your plan and exploring your options, you can make informed decisions that suit your healthcare needs and budget.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts