Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Introduction:

Losing a loved one is an emotional experience, and the last thing you want is to worry about the financial aspect of their funeral. That is why many people wonder if Medicare can help with funeral expenses. In this article, we will explore whether or not Medicare covers funeral costs and what other options are available.

Paragraph 1:

Medicare is a government-funded health insurance program that helps cover medical expenses for people aged 65 and over, as well as those with certain disabilities. However, Medicare does not cover funeral expenses, including burial or cremation costs, funeral home services, or any related expenses.

Paragraph 2:

Fortunately, there are other options available to help cover funeral costs. Some states offer burial assistance programs, and veterans may be eligible for burial benefits through the Department of Veterans Affairs. Additionally, some life insurance policies include a funeral expense rider, which can help cover the cost of a funeral. It’s crucial to research your options and plan ahead to ensure that your loved one’s funeral expenses are covered.

Unfortunately, Medicare does not typically cover funeral expenses. However, there are some circumstances in which Medicare may provide limited financial assistance for certain end-of-life expenses. For example, if the deceased was receiving hospice care through Medicare, some funeral expenses may be covered. It’s important to speak with a Medicare representative or your healthcare provider to understand what expenses may be covered in your specific situation.

Does Medicare Help With Funeral Expenses?

Funeral expenses are one of the many costs that families have to deal with after the loss of a loved one. The average cost of a funeral in the United States can range from $7,000 to $12,000, which can be a significant financial burden for many families. Seniors who are enrolled in Medicare may wonder if their plan covers funeral expenses. Here is what you need to know about Medicare and funeral expenses.

Medicare Coverage for Funeral Expenses

Medicare is a federal health insurance program that provides coverage for individuals aged 65 and older, as well as those with certain disabilities. While Medicare does cover many health care services, it does not cover funeral expenses. This means that you cannot use your Medicare benefits to pay for a funeral.

However, there are some Medicare Advantage plans that may offer additional benefits, such as coverage for hospice care and end-of-life services. These plans may also provide a stipend or allowance for funeral expenses. It is important to review the specific benefits of your plan to determine if funeral expenses are covered.

Alternative Options for Covering Funeral Expenses

If you are looking for ways to cover funeral expenses, there are several other options available. One option is to purchase a burial insurance policy. Burial insurance is a type of life insurance policy that is designed to cover funeral expenses. It typically has lower coverage amounts than traditional life insurance policies and can be more affordable.

Another option is to set up a funeral trust. A funeral trust is a legal arrangement that allows you to set aside money specifically for funeral expenses. The funds in the trust can only be used for funeral-related expenses and cannot be accessed for other purposes.

Additionally, some states and local governments offer assistance programs for low-income families who need help covering funeral expenses. These programs may vary by state and may have specific eligibility requirements.

The Benefits of Pre-Planning

While it may be difficult to think about, pre-planning your funeral can help alleviate the financial burden on your loved ones. By pre-planning, you can determine the type of funeral services you want and how much you are willing to spend. This can help ensure that your wishes are met and that your loved ones are not left with unexpected expenses.

Pre-planning also allows you to shop around for the best prices and make informed decisions about the services you choose. This can help you save money and avoid unnecessary expenses.

Funeral Expenses: Cost Comparison

Funeral expenses can vary widely depending on the type of services you choose. Here is a breakdown of some of the most common funeral expenses:

– Funeral service fee: This includes the cost of the funeral director’s services, such as organizing the funeral, preparing the body, and coordinating with other service providers.

– Casket or urn: The cost of a casket or urn can range from a few hundred dollars to several thousand dollars, depending on the materials and design.

– Cemetery plot or mausoleum: The cost of a cemetery plot or mausoleum can also vary widely depending on the location and amenities.

– Headstone or marker: The cost of a headstone or marker can range from a few hundred dollars to several thousand dollars, depending on the materials and design.

– Miscellaneous expenses: Other expenses may include flowers, transportation, and obituary notices.

Frequently Asked Questions

Q: Can I use my Medicare benefits to pay for a funeral?

A: No, Medicare does not cover funeral expenses.

Q: What is burial insurance?

A: Burial insurance is a type of life insurance policy that is designed to cover funeral expenses.

Q: Can I set up a funeral trust?

A: Yes, a funeral trust is a legal arrangement that allows you to set aside money specifically for funeral expenses.

Q: What is the benefit of pre-planning a funeral?

A: Pre-planning a funeral can help alleviate the financial burden on your loved ones and ensure that your wishes are met.

Conclusion

In conclusion, Medicare does not cover funeral expenses. However, there are several alternative options available, such as burial insurance and funeral trusts. Pre-planning your funeral can also help alleviate the financial burden on your loved ones and ensure that your wishes are met. If you have any questions about funeral expenses, be sure to speak with a financial advisor or funeral director.

Contents

Frequently Asked Questions

Medicare is a federal health insurance program for people who are 65 or older, people with certain disabilities, and people with end-stage renal disease. It covers a range of medical services, but does it also help with funeral expenses? Here are some common questions and answers about this topic:

Does Medicare cover funeral expenses?

No, Medicare does not cover funeral expenses. It is designed to cover medical expenses and not end-of-life expenses such as funerals. However, there are other resources available to help with these expenses, such as life insurance policies, veteran’s benefits, and state and local programs.

It’s important to plan ahead for these expenses and explore all available options. Funeral costs can be significant, and not having a plan in place can put a financial burden on loved ones during an already difficult time.

What end-of-life expenses does Medicare cover?

Medicare covers certain end-of-life expenses, such as hospice care and palliative care. Hospice care is for people who are terminally ill and have a life expectancy of six months or less. It provides medical care, pain management, and emotional support to the patient and their family.

Palliative care is for people who have a serious illness and need relief from symptoms such as pain, fatigue, and nausea. It is designed to improve the quality of life for the patient and their family.

Can Medicare help with burial costs?

No, Medicare does not help with burial costs. However, if the deceased was a veteran, they may be eligible for burial benefits through the Department of Veterans Affairs. These benefits can include a burial plot, headstone, and other services.

It’s important to check with the funeral home and other resources to explore all available options for burial costs. Some funeral homes may offer payment plans or other options to help with expenses.

What is a final expense insurance policy?

A final expense insurance policy is a type of life insurance that is designed to cover end-of-life expenses such as funerals. It typically has a lower premium than traditional life insurance policies and is easier to qualify for.

These policies can provide peace of mind for both the policyholder and their loved ones by ensuring that funeral expenses are covered. However, it’s important to carefully review the policy and understand any limitations or exclusions before purchasing.

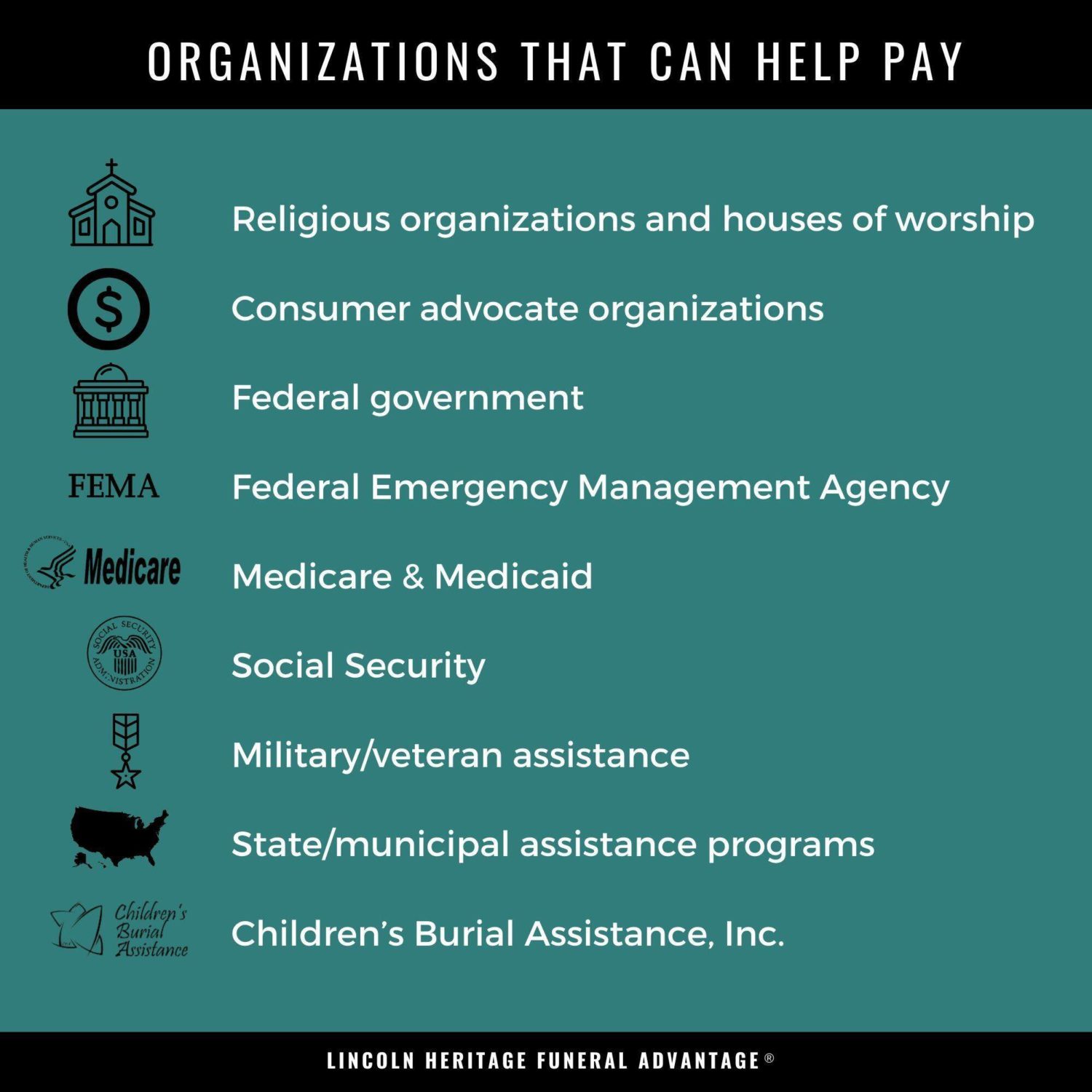

What other resources are available to help with funeral expenses?

There are other resources available to help with funeral expenses, such as state and local programs and non-profit organizations. These programs may have specific eligibility requirements and limitations on the amount of assistance provided.

It’s important to research and explore all available options for assistance with funeral expenses. Funeral homes and other service providers may also offer payment plans or other options to help with expenses.

11 Nonprofit Organizations That Help With Funeral Expenses

In conclusion, Medicare does not cover funeral expenses. It is important to plan ahead and consider purchasing funeral insurance or setting aside funds for these costs. Funeral expenses can add up quickly and can cause a financial burden on loved ones left behind.

While Medicare may not cover funeral expenses, there are other resources available to help with end-of-life planning. Many states offer assistance programs for low-income families, and some funeral homes may offer payment plans or discounts for those facing financial difficulties.

Ultimately, it is important to have open and honest discussions with loved ones about end-of-life planning and funeral arrangements. By planning ahead and exploring all options available, families can ensure that their loved ones receive a proper and dignified farewell without the added stress of financial burden.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts