Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing retirement age or have you already reached it? If so, you may be wondering what your healthcare options are. One option to consider is a PPO (Preferred Provider Organization) Medicare plan.

A PPO Medicare plan is a type of Medicare Advantage plan that offers a network of healthcare providers to choose from. With a PPO plan, you have the freedom to see any provider within the network, but you may pay higher out-of-pocket costs if you choose to see a provider outside of the network. Keep reading to learn more about PPO Medicare plans and how they can benefit you.

A PPO Medicare plan is a type of Medicare Advantage plan that allows you to receive healthcare services from a network of providers. With a PPO plan, you have the flexibility to see doctors and specialists outside of the network for a higher cost. Additionally, you do not need a referral to see a specialist. PPO plans often include prescription drug coverage and other benefits not covered by Original Medicare.

Understanding PPO Medicare Plans

If you’re looking for a Medicare plan that offers flexibility and choice, a PPO Medicare plan may be a good option for you. PPO stands for Preferred Provider Organization, and these plans allow you to see doctors and providers outside of the plan’s network, though there may be additional costs associated with doing so. In this article, we’ll take a closer look at what PPO Medicare plans are and how they work.

What is a PPO Medicare Plan?

A PPO Medicare plan is a type of Medicare Advantage plan that combines your Medicare Part A (hospital insurance) and Part B (medical insurance) benefits into one plan. These plans are offered by private insurance companies and are approved by Medicare. PPO Medicare plans work by creating a network of healthcare providers that have agreed to provide services to plan members at a discounted rate. In exchange for this discount, plan members agree to use providers within the plan’s network.

When you enroll in a PPO Medicare plan, you’ll be given a list of providers in the plan’s network. You can choose to see any provider on this list without a referral from your primary care physician. You can also choose to see providers outside of the plan’s network, but you’ll typically pay more for these services. It’s important to note that the out-of-pocket costs for seeing providers outside of the plan’s network may be significantly higher than those for in-network providers.

How Does a PPO Medicare Plan Work?

When you enroll in a PPO Medicare plan, you’ll continue to pay your Medicare Part B premium in addition to any premium that the plan charges. You’ll also be responsible for any deductibles, copayments, or coinsurance that the plan requires. These costs may vary depending on the plan and the services you receive.

If you choose to see an in-network provider, you’ll typically pay less for your healthcare services. Providers in the plan’s network have agreed to provide services at a discounted rate, so you’ll pay less out of pocket. If you choose to see an out-of-network provider, you’ll typically pay more for your services. The plan will still cover some of the cost, but you’ll be responsible for paying the difference.

Benefits of a PPO Medicare Plan

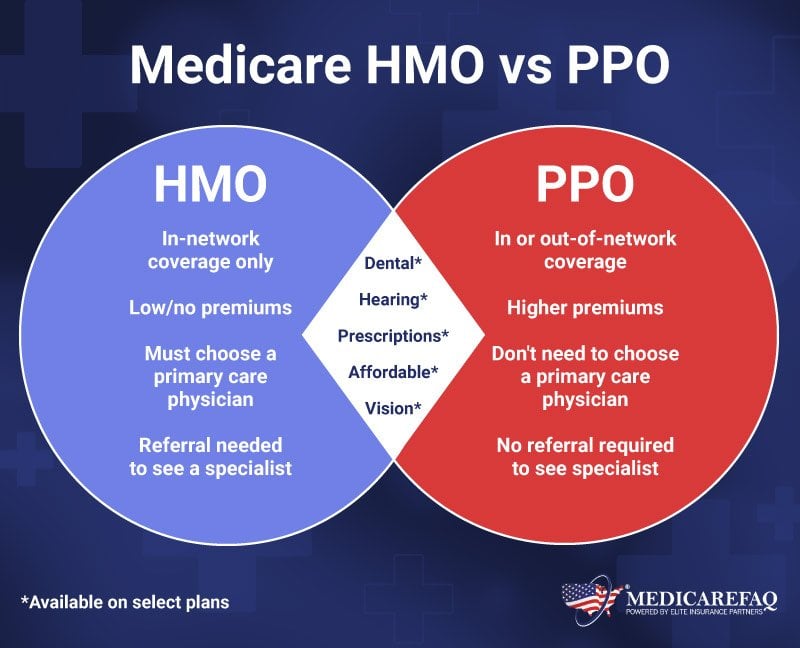

One of the main benefits of a PPO Medicare plan is the flexibility it offers. Unlike an HMO plan, which typically requires you to choose a primary care physician and only see providers within the plan’s network, a PPO plan allows you to see any provider on the plan’s list without a referral. This can be especially beneficial if you live in a rural area or if you have a specialist that you prefer to see.

Another benefit of a PPO Medicare plan is that you can choose to see providers outside of the plan’s network if you need to. While you’ll typically pay more for these services, the option is there if you need it. This can be especially beneficial if you’re traveling or if you need to see a specialist that isn’t available in the plan’s network.

Drawbacks of a PPO Medicare Plan

One of the main drawbacks of a PPO Medicare plan is the cost. While these plans may offer more flexibility and choice than other Medicare Advantage plans, they also tend to be more expensive. You’ll not only pay your Medicare Part B premium, but you’ll also be responsible for any premium that the plan charges. Additionally, you may be responsible for deductibles, copayments, or coinsurance that the plan requires.

Another drawback of a PPO Medicare plan is that the out-of-pocket costs for seeing providers outside of the plan’s network can be significantly higher than those for in-network providers. If you choose to see an out-of-network provider, you may be responsible for paying a large portion of the cost of your services.

Choosing a PPO Medicare Plan

If you’re considering a PPO Medicare plan, it’s important to do your research and compare plans carefully. Look at the premiums, deductibles, copayments, and coinsurance for each plan to determine which one is the best fit for your needs and budget. Additionally, make sure to check the plan’s network to ensure that your preferred providers are included.

PPO Medicare Plan vs. Other Medicare Plans

One of the main differences between a PPO Medicare plan and other Medicare Advantage plans, such as HMOs and PFFS plans, is the level of flexibility and choice that they offer. While HMO plans require you to choose a primary care physician and only see providers within the plan’s network, PPO plans allow you to see any provider on the plan’s list without a referral. PFFS plans, on the other hand, allow you to see any provider that accepts the plan’s payment terms.

Another difference between PPO Medicare plans and other Medicare Advantage plans is the cost. PPO plans tend to be more expensive than HMO plans, but they may offer more flexibility and choice. PFFS plans may have similar costs to PPO plans, but they may not have as extensive a network of providers.

Conclusion

PPO Medicare plans can be a good option for those who are looking for flexibility and choice in their healthcare. These plans allow you to see providers outside of the plan’s network, but you may pay more for these services. If you’re considering a PPO Medicare plan, it’s important to do your research and compare plans carefully to determine which one is the best fit for your needs and budget.

Frequently Asked Questions

What is a PPO Medicare Plan?

A PPO (Preferred Provider Organization) Medicare Plan is a type of Medicare Advantage Plan offered by private insurance companies approved by Medicare. It provides you with a network of doctors, hospitals, and other healthcare providers that are contracted with the plan. The PPO plan allows you to see providers outside of the network, but at a higher cost.

When you enroll in a PPO Medicare Plan, you will have to pay a monthly premium in addition to your Medicare Part B premium. The plan will also have a yearly deductible, copayments, and coinsurance. You will receive all of the benefits of Original Medicare, including hospital and medical coverage, and may also offer additional benefits such as prescription drug coverage, dental and vision services, and wellness programs.

What are the advantages of a PPO Medicare Plan?

One of the advantages of a PPO Medicare Plan is that you have the flexibility to see any healthcare provider of your choice, even if they are outside the plan’s network. This can be beneficial if you have a doctor or hospital that you prefer to use that is not in the network. You will still be covered, but at a higher cost.

Another advantage is that PPO plans often offer additional benefits such as prescription drug coverage, dental and vision services, and wellness programs. These benefits can help you save money on healthcare costs and improve your overall health and well-being. Finally, PPO plans usually have lower out-of-pocket costs than traditional Medicare, which can help you save money in the long run.

What are the disadvantages of a PPO Medicare Plan?

One of the disadvantages of a PPO Medicare Plan is that you will have to pay a monthly premium in addition to your Medicare Part B premium. The plan will also have a yearly deductible, copayments, and coinsurance, which can add up quickly if you require a lot of medical services.

Another disadvantage is that if you see a healthcare provider outside of the plan’s network, you will have to pay a higher cost for their services. This can be a significant expense if you require frequent medical care. Finally, PPO plans may have more restrictions than traditional Medicare, such as requiring prior authorization for certain medical services or medications.

How do I enroll in a PPO Medicare Plan?

To enroll in a PPO Medicare Plan, you must first be eligible for Medicare Part A and Part B. You can then enroll during the Medicare Annual Enrollment Period, which runs from October 15th to December 7th each year. You can also enroll during the Medicare Advantage Open Enrollment Period, which runs from January 1st to March 31st each year.

To enroll, you can contact a private insurance company that offers PPO Medicare Plans and request information about their plans. You can also use the Medicare Plan Finder tool on the Medicare website to compare plans and enroll online.

Can I switch from a PPO Medicare Plan to Original Medicare?

Yes, you can switch from a PPO Medicare Plan to Original Medicare during the Medicare Annual Enrollment Period, which runs from October 15th to December 7th each year. You can also switch during the Medicare Advantage Open Enrollment Period, which runs from January 1st to March 31st each year.

To switch, you can contact the private insurance company that offers your PPO Medicare Plan and request to disenroll. You can then enroll in Original Medicare and select a Medicare Part D plan for prescription drug coverage, or enroll in a Medicare Supplement Plan to help cover the costs of Original Medicare.

Medicare PPO Plans – Explained!

In conclusion, a PPO Medicare plan is a popular choice for those who want a bit more flexibility in their healthcare options. With a PPO plan, you have the freedom to visit any doctor or hospital that accepts Medicare, without needing a referral. This can be especially beneficial for those who travel frequently or have specific medical needs.

While PPO plans may have higher premiums and out-of-pocket costs than other Medicare plans, they offer a wider range of benefits and more control over your healthcare choices. Additionally, PPO plans often include prescription drug coverage and other supplemental benefits to help you get the care you need.

Overall, if you are looking for a Medicare plan that offers greater flexibility and choice, a PPO plan may be the right choice for you. Be sure to carefully consider your options and compare plans to find the one that best meets your healthcare needs and budget.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts