Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we all know, healthcare is a fundamental need in life, and there are various ways to finance it. Medicare is a popular and government-funded healthcare program in the United States. However, not many people are aware of the Medicare Hospital Insurance Tax, which plays a critical role in funding the program. In this article, we will explore what the Medicare Hospital Insurance Tax is and how it works.

Medicare Hospital Insurance Tax is a payroll tax levied on employees and employers to fund the Medicare Part A program. The tax funds hospital insurance coverage for eligible individuals who are 65 years or older, individuals with disabilities, and those with end-stage renal disease. Understanding what the Medicare Hospital Insurance Tax is and how it works is vital to help you make informed decisions about your healthcare needs. So, let’s dive in and explore this topic further.

Medicare Hospital Insurance Tax is a payroll tax paid by employees and employers to fund Medicare Part A. Employees pay 1.45% of their wages, and employers contribute a matching 1.45%. Self-employed individuals pay the full 2.9% tax. The tax applies to all wages, salaries, and tips, and there is no income cap. It helps fund hospital insurance, skilled nursing facility care, hospice care, and some home health care services for Medicare beneficiaries.

Contents

- Understanding Medicare Hospital Insurance Tax

- Frequently Asked Questions

- What is Medicare Hospital Insurance Tax?

- Who pays Medicare Hospital Insurance Tax?

- What is the current rate of Medicare Hospital Insurance Tax?

- What is the maximum amount of wages subject to Medicare Hospital Insurance Tax?

- What happens to the money collected from Medicare Hospital Insurance Tax?

- Additional Medicare Tax

Understanding Medicare Hospital Insurance Tax

Medicare is a federal health insurance program that provides coverage to individuals aged 65 and above, younger people with disabilities, and those with End-Stage Renal Disease. Medicare Hospital Insurance Tax, also known as the Medicare Part A tax, is a payroll tax that funds the hospital insurance portion of Medicare. In this article, we will delve into the details of what Medicare Hospital Insurance Tax is and how it works.

What is Medicare Hospital Insurance Tax?

Medicare Hospital Insurance Tax is a payroll tax that is imposed on both employers and employees to fund the hospital insurance portion of Medicare. The tax is only applicable to wages and self-employment income up to a certain limit. For the year 2021, the wage limit is $142,800, and the self-employment income limit is $285,600. This means that any wages or self-employment income above these limits are not subject to the Medicare Hospital Insurance Tax.

The Medicare Hospital Insurance Tax rate is currently set at 1.45% for both employers and employees. Self-employed individuals are required to pay the full 2.9% rate, which includes both the employer and employee portions of the tax.

How does Medicare Hospital Insurance Tax work?

Medicare Hospital Insurance Tax is withheld from employees’ wages by their employers. The employer is required to match the employee’s contribution and remit the total amount to the Internal Revenue Service (IRS) on a quarterly basis. Self-employed individuals are responsible for paying the entire amount of the Medicare Hospital Insurance Tax with their tax returns.

The funds collected from the Medicare Hospital Insurance Tax are used to fund the hospital insurance portion of Medicare, which covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services.

Benefits of Medicare Hospital Insurance Tax

The Medicare Hospital Insurance Tax provides funding for the hospital insurance portion of Medicare, which ensures that eligible individuals have access to affordable and comprehensive healthcare services. This coverage is crucial for senior citizens, disabled individuals, and those with End-Stage Renal Disease who may require costly medical treatments and hospitalizations.

Furthermore, Medicare Hospital Insurance Tax helps to reduce healthcare costs for individuals and families by providing access to preventative care services, which can help to detect and treat medical conditions before they become more serious and require expensive treatments.

Medicare Hospital Insurance Tax vs. Social Security Tax

Although both Medicare Hospital Insurance Tax and Social Security Tax are payroll taxes that are withheld from employees’ wages, they serve different purposes. The Social Security Tax funds the retirement, disability, and survivor benefits portion of the Social Security program, while the Medicare Hospital Insurance Tax funds the hospital insurance portion of Medicare.

The Social Security Tax rate is currently set at 6.2% for both employers and employees, and the wage limit for the tax is $142,800 for the year 2021. Self-employed individuals are required to pay the full 12.4% rate, which includes both the employer and employee portions of the tax.

Conclusion

Medicare Hospital Insurance Tax is a crucial component of the Medicare program that provides funding for the hospital insurance portion of Medicare. It is a payroll tax that is imposed on both employers and employees to ensure that eligible individuals have access to affordable and comprehensive healthcare services. By understanding the details of Medicare Hospital Insurance Tax, individuals can make informed decisions about their healthcare needs and expenses.

Frequently Asked Questions

What is Medicare Hospital Insurance Tax?

Medicare Hospital Insurance Tax is a tax that helps fund the Medicare program. It is also known as the Medicare payroll tax or the FICA tax. The tax is paid by both employees and employers, with each party contributing an equal amount.

The Medicare Hospital Insurance Tax is used to fund Medicare Part A, which covers hospital stays, skilled nursing facility care, hospice care, and some home health care. The tax is calculated as a percentage of an employee’s wages, with a maximum amount of wages subject to the tax.

Who pays Medicare Hospital Insurance Tax?

Both employees and employers pay the Medicare Hospital Insurance Tax. The tax is automatically deducted from an employee’s paycheck and matched by their employer. Self-employed individuals also pay the tax, with the full amount being calculated based on their net earnings.

Employers are responsible for withholding the tax from their employees’ paychecks and depositing it with the IRS. Failure to withhold and deposit the tax can result in penalties and interest charges.

What is the current rate of Medicare Hospital Insurance Tax?

The current rate of Medicare Hospital Insurance Tax is 1.45% of an employee’s wages. Employers also contribute an additional 1.45% of their employees’ wages, for a total of 2.9%. Self-employed individuals pay the full 2.9% of their net earnings.

There is also an additional Medicare tax of 0.9% on wages and self-employment income above certain thresholds. This additional tax only applies to individuals earning over $200,000 per year or couples earning over $250,000 per year.

What is the maximum amount of wages subject to Medicare Hospital Insurance Tax?

The maximum amount of wages subject to Medicare Hospital Insurance Tax changes each year. In 2021, the maximum amount of wages subject to the tax is $142,800. Any wages earned above this amount are not subject to the tax.

It is important to note that there is no maximum amount of wages subject to the additional Medicare tax of 0.9%. This means that individuals earning over the threshold amount will pay the additional tax on all wages and self-employment income above that amount.

What happens to the money collected from Medicare Hospital Insurance Tax?

The money collected from Medicare Hospital Insurance Tax is used to fund the Medicare Part A program. This program helps cover the cost of hospital stays, skilled nursing facility care, hospice care, and some home health care.

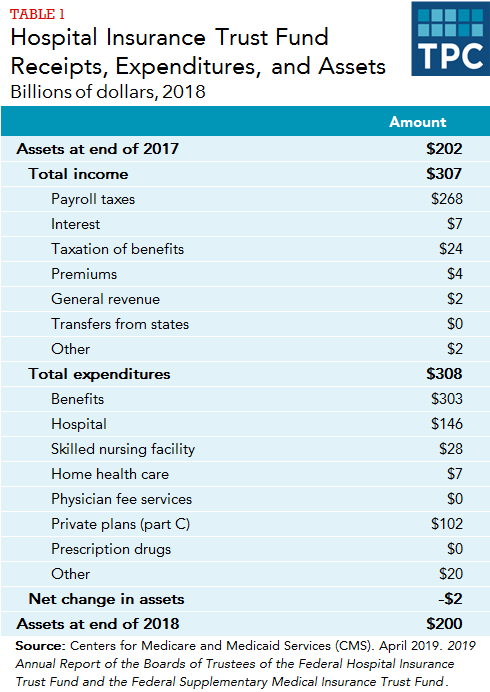

The money collected from the tax is deposited into the Medicare Hospital Insurance Trust Fund. This fund is used to pay for the benefits provided under Medicare Part A. Any excess funds in the trust fund are used to pay down the federal debt.

Additional Medicare Tax

In conclusion, Medicare Hospital Insurance Tax is a payroll tax that helps fund the Medicare program. It is a tax that is automatically deducted from an employee’s paycheck and matched by their employer. This tax helps ensure that Medicare can provide hospital insurance coverage to millions of Americans over the age of 65 and those with certain disabilities.

While the Medicare Hospital Insurance Tax may seem like just another deduction from your paycheck, it is actually a vital part of the Medicare program. Without this tax, it would be much more difficult for Medicare to provide the necessary hospital insurance coverage that many Americans rely on. So the next time you see this deduction on your paycheck, remember that it is helping to provide important healthcare benefits to millions of Americans.

In summary, Medicare Hospital Insurance Tax is a crucial aspect of the Medicare program that ensures that millions of Americans have access to hospital insurance coverage. Whether you are a current or future Medicare beneficiary, this tax plays an important role in your healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts