Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As you age, your healthcare needs may change, and you could find that your current Medicare Supplement plan no longer meets your needs. Fortunately, you have the option to switch plans and find one that better aligns with your current healthcare requirements. But when exactly can you switch Medicare Supplement plans? Let’s explore the answer to this question and what you need to know before making a change.

The good news is that you can switch your Medicare Supplement plan at any time throughout the year, not just during the annual open enrollment period. However, there are some important factors to consider, such as eligibility requirements, plan availability, and potential costs. So, let’s dive into the details and help you determine the best time to switch your Medicare Supplement plan.

Contents

- When Can I Switch Medicare Supplement Plans?

- Frequently Asked Questions

- When can I switch Medicare supplement plans?

- Can I switch to a different Medicare supplement plan with the same company?

- Can I switch from a Medicare Advantage plan to a Medicare supplement plan?

- Can I switch from a Medicare supplement plan to a Medicare Advantage plan?

- Can I switch Medicare supplement plans if I move to a different state?

- When can I change my Medicare Supplement Plan?

When Can I Switch Medicare Supplement Plans?

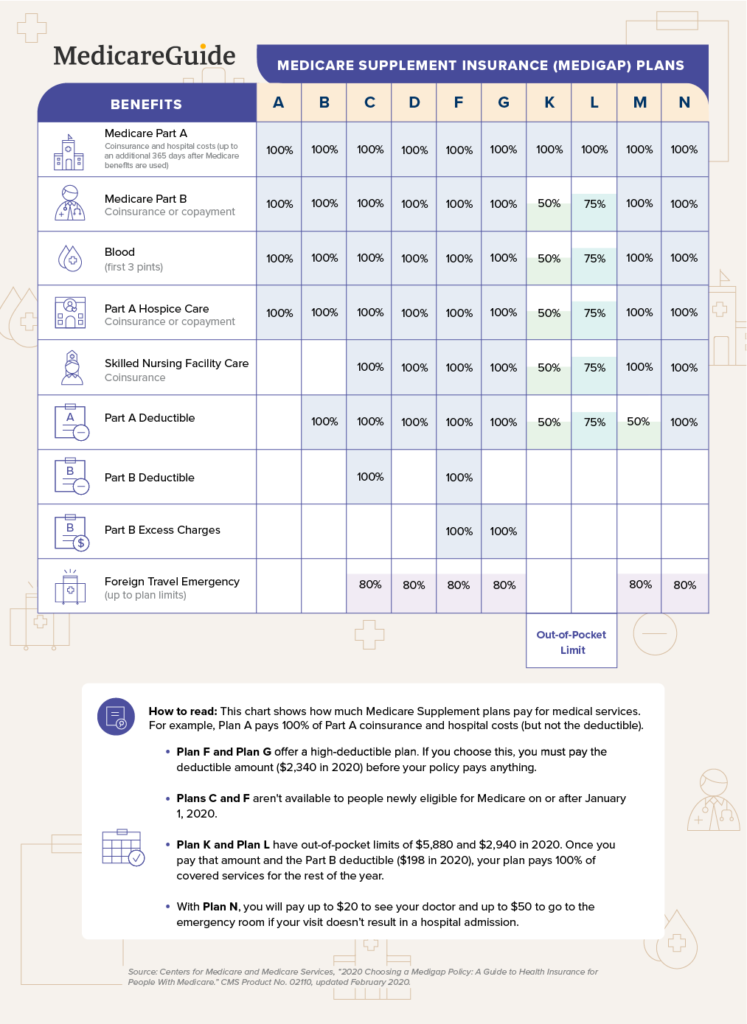

Medicare Supplement Plans, also known as Medigap, are health insurance policies that are designed to help fill in the gaps left by Original Medicare. These plans offer additional coverage for services that are not covered by Medicare, such as deductibles, copayments, and coinsurance. If you are enrolled in a Medicare Supplement Plan and you are wondering if you can switch to a different plan, here is what you need to know.

Open Enrollment Period

One of the best times to switch Medicare Supplement Plans is during the Open Enrollment Period. This period starts on the first day of the month that you turn 65 and are enrolled in Medicare Part B. It lasts for six months and during this time, you have the guaranteed right to enroll in any Medicare Supplement Plan that is available in your state.

If you decide to switch to a different Medicare Supplement Plan during the Open Enrollment Period, the insurance company cannot deny you coverage or charge you a higher premium due to your health status. This is because the Open Enrollment Period is considered a “guaranteed issue” period.

Guaranteed Issue Rights

In addition to the Open Enrollment Period, there are other times when you may have guaranteed issue rights to switch Medicare Supplement Plans. These include:

- If your Medicare Supplement Plan is ending or being terminated

- If you are moving out of your Medicare Supplement Plan’s service area

- If you are enrolled in a Medicare Advantage Plan and want to switch back to Original Medicare

If you have guaranteed issue rights, you can switch to any Medicare Supplement Plan that is available in your state, regardless of your health status.

Underwriting

If you want to switch Medicare Supplement Plans outside of the Open Enrollment Period or without guaranteed issue rights, you will need to go through underwriting. This means that the insurance company will review your health status and medical history to determine if they will offer you coverage and at what premium rate.

If you have pre-existing conditions or health issues, you may be charged a higher premium or denied coverage altogether. It is important to keep this in mind if you are considering switching Medicare Supplement Plans outside of the Open Enrollment Period or without guaranteed issue rights.

Benefits of Switching Medicare Supplement Plans

There are several benefits to switching Medicare Supplement Plans. These include:

- Potentially lower premiums

- Better coverage for your specific needs

- Access to additional benefits, such as fitness programs or vision coverage

Before you switch Medicare Supplement Plans, it is important to review your current plan and compare it to other plans that are available in your state. Make sure you understand the benefits, premiums, and any potential limitations or restrictions before making a decision.

Medicare Supplement Plan Vs. Medicare Advantage Plan

It is also important to note the difference between Medicare Supplement Plans and Medicare Advantage Plans. While both types of plans offer additional coverage beyond Original Medicare, they are different in several ways.

Medicare Supplement Plans work alongside Original Medicare and typically have higher premiums but offer more comprehensive coverage. Medicare Advantage Plans, on the other hand, replace Original Medicare and often have lower premiums but may have more restrictions on doctors and hospitals.

Before choosing between a Medicare Supplement Plan and a Medicare Advantage Plan, it is important to compare the benefits, premiums, and any potential limitations or restrictions of each plan.

Conclusion

Switching Medicare Supplement Plans can be a great way to save money and get better coverage for your specific needs. If you are considering switching plans, make sure to do your research and compare the benefits, premiums, and any potential limitations or restrictions of each plan. If you have guaranteed issue rights, take advantage of them to switch without underwriting. If not, be prepared for the possibility of higher premiums or denied coverage.

Frequently Asked Questions

When can I switch Medicare supplement plans?

If you have a Medicare supplement plan, you may be wondering when you can switch to a different plan. The good news is that you can switch at any time, but there are certain times when it may be more advantageous to do so.

During your initial enrollment period, which is the six-month period following your enrollment in Medicare Part B, you have a “guaranteed issue” right to purchase any Medicare supplement plan available in your area. This means that you cannot be denied coverage or charged a higher premium due to your health status. However, after this period, you may be subject to medical underwriting and may not be able to switch plans as easily.

If you are in good health and can pass medical underwriting, you can switch plans at any time. However, if you have pre-existing conditions or health issues, it may be more difficult to switch plans outside of your initial enrollment period.

Can I switch to a different Medicare supplement plan with the same company?

Yes, you can switch to a different Medicare supplement plan with the same company at any time. This is known as a plan change, and it allows you to switch to a different plan with the same company without having to go through medical underwriting.

However, keep in mind that switching to a different plan with the same company may not always be the best option. You may be able to find a better rate or more comprehensive coverage by switching to a different company altogether.

Can I switch from a Medicare Advantage plan to a Medicare supplement plan?

Yes, you can switch from a Medicare Advantage plan to a Medicare supplement plan. However, you may only do so during certain times of the year.

The Annual Enrollment Period (AEP) is the time of year when you can make changes to your Medicare coverage. During the AEP, which runs from October 15th to December 7th, you can switch from a Medicare Advantage plan to a Medicare supplement plan.

In addition, if you have a Medicare Advantage plan and wish to switch to a Medicare supplement plan outside of the AEP, you may be subject to medical underwriting and may not be able to switch plans as easily.

Can I switch from a Medicare supplement plan to a Medicare Advantage plan?

Yes, you can switch from a Medicare supplement plan to a Medicare Advantage plan. However, you may only do so during certain times of the year.

The Annual Enrollment Period (AEP) is the time of year when you can make changes to your Medicare coverage. During the AEP, which runs from October 15th to December 7th, you can switch from a Medicare supplement plan to a Medicare Advantage plan.

In addition, if you have a Medicare supplement plan and wish to switch to a Medicare Advantage plan outside of the AEP, you may be subject to medical underwriting and may not be able to switch plans as easily.

Can I switch Medicare supplement plans if I move to a different state?

Yes, you can switch Medicare supplement plans if you move to a different state. However, keep in mind that Medicare supplement plans are standardized by the federal government, which means that the benefits of each plan are the same regardless of the state you live in.

If you move to a different state, you may want to consider switching to a different Medicare supplement plan if you can find a plan with better rates or more comprehensive coverage. However, keep in mind that you may be subject to medical underwriting if you switch plans outside of your initial enrollment period.

When can I change my Medicare Supplement Plan?

In conclusion, Medicare Supplement Plans can be changed at any time of the year, but it’s important to understand the restrictions that come with it. Switching plans during your Open Enrollment Period gives you the advantage of guaranteed acceptance, regardless of your health status. However, if you miss this period, you may still be able to switch plans but may be subject to medical underwriting.

When considering switching plans, it’s important to compare the benefits and costs of different Medicare Supplement Plans. By doing so, you can ensure that you’re getting the coverage that best meets your needs and budget. Keep in mind that some plans may offer additional benefits, such as prescription drug coverage or fitness programs, that could save you money in the long run.

Ultimately, the decision to switch Medicare Supplement Plans is a personal one and should be based on your individual needs and circumstances. If you’re unsure about what plan is right for you, consider speaking with a licensed insurance agent or healthcare professional. They can help you navigate the complexities of Medicare and find the plan that best fits your needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts