Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing the age of 65 and wondering how to get Medicare insurance? Or maybe you have a disability and need to know how to qualify for Medicare coverage? Whatever your situation may be, navigating the Medicare system can be overwhelming. But don’t worry, we’re here to guide you through the process and help you understand your options.

Medicare is a federal health insurance program that provides coverage to millions of Americans. Whether you’re looking for hospital insurance, medical insurance, or prescription drug coverage, there are different plans and options available to meet your needs. In this article, we’ll break down the basics of Medicare and help you understand how to enroll and get the coverage you need.

To get Medicare Insurance, you must meet certain eligibility requirements. If you are 65 or older, you are likely eligible for Medicare, although younger people with certain disabilities may also qualify. You can apply for Medicare online, by phone, or in person at a Social Security office. It’s important to enroll during your initial enrollment period, which begins three months before your 65th birthday and ends three months after.

How Can I Get Medicare Insurance?

Medicare is a federal health insurance program that provides coverage to people who are 65 years of age or older, as well as those with certain disabilities and chronic conditions. It can be a confusing process to navigate, but with the right information, you can enroll in Medicare and get the coverage you need. Here is a guide to help you understand how to get Medicare insurance.

1. Eligibility Requirements for Medicare

To be eligible for Medicare, you must be a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years, and you must meet one of the following criteria:

– You are 65 years old or older

– You have End-Stage Renal Disease (ESRD)

– You have Amyotrophic Lateral Sclerosis (ALS)

If you are receiving Social Security or Railroad Retirement Board (RRB) benefits at least 4 months before turning 65, you will be automatically enrolled in Medicare Part A and Part B. If you are not receiving Social Security or RRB benefits, you will need to enroll in Medicare yourself.

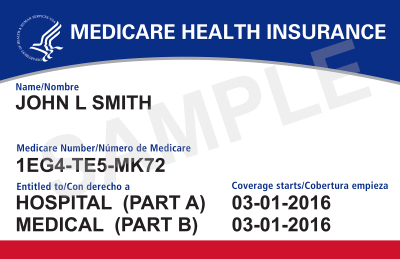

2. Understanding the Different Parts of Medicare

Medicare is divided into four parts: Part A, Part B, Part C, and Part D. Here is a brief overview of each part:

– Part A: Hospital insurance that covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care.

– Part B: Medical insurance that covers doctor visits, outpatient care, preventive services, and medical equipment.

– Part C: Medicare Advantage plans that are offered by private insurance companies and include all the benefits of Part A and Part B, plus additional benefits like prescription drug coverage.

– Part D: Prescription drug coverage that helps pay for the cost of prescription drugs.

3. Enrolling in Medicare Part A and Part B

To enroll in Medicare Part A and Part B, you can do the following:

– Visit the Social Security website and complete the online application.

– Call Social Security at 1-800-772-1213 and apply over the phone.

– Visit your local Social Security office and apply in person.

It is important to enroll in Medicare Part A and Part B during your Initial Enrollment Period (IEP), which is a 7-month period that begins 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

4. Enrolling in Medicare Part C and Part D

To enroll in Medicare Part C and Part D, you can do the following:

– Visit the Medicare website and use the plan finder tool to compare plans and enroll online.

– Contact the plan directly and enroll over the phone.

– Complete a paper application and mail it to the plan.

It is important to enroll in Medicare Part C and Part D during the Annual Enrollment Period (AEP), which is a 7-week period that begins on October 15 and ends on December 7 each year.

5. Understanding the Costs of Medicare

Medicare Part A is generally free for most people, but there are costs associated with Medicare Part B, Part C, and Part D. Here is a breakdown of the costs:

– Part B: The standard premium for Medicare Part B in 2021 is $148.50 per month. However, if your income is above a certain threshold, you may pay a higher premium.

– Part C: The costs for Medicare Advantage plans vary depending on the plan you choose. Some plans have low or no monthly premiums, while others have higher monthly premiums but offer more benefits.

– Part D: The costs for Medicare Part D vary depending on the plan you choose. You will pay a monthly premium, and you may also have to pay a deductible and copayments for your medications.

6. Understanding the Benefits of Medicare

One of the biggest benefits of Medicare is that it provides access to quality healthcare for older Americans and those with disabilities. With Medicare, you can receive coverage for hospital stays, doctor visits, preventive services, prescription drugs, and more. Additionally, Medicare provides financial protection against high healthcare costs, which can be especially important for those with chronic conditions.

7. Medicare Advantage vs. Original Medicare

Medicare Advantage plans (Part C) are offered by private insurance companies and provide all the benefits of Original Medicare (Part A and Part B), plus additional benefits like vision, dental, and hearing coverage. Some Medicare Advantage plans also include prescription drug coverage. However, Medicare Advantage plans may have limited provider networks, and you may need to get a referral from your primary care physician to see a specialist.

Original Medicare allows you to choose your own doctors and hospitals and has no restrictions on provider networks. However, it does not cover all healthcare services, and you may need to purchase additional coverage (like a Medigap policy) to fill in the gaps.

8. Tips for Choosing a Medicare Plan

When choosing a Medicare plan, here are some tips to keep in mind:

– Consider your healthcare needs and budget.

– Compare plans based on cost, benefits, and provider networks.

– Check if your doctors and hospitals are in the plan’s network.

– Look for plans with high ratings and good customer reviews.

9. Common Medicare Mistakes to Avoid

Here are some common mistakes to avoid when enrolling in Medicare:

– Failing to enroll in Medicare Part B during your IEP if you are not receiving Social Security or RRB benefits.

– Choosing a Medicare Advantage plan without checking if your doctors and hospitals are in the plan’s network.

– Failing to review your Medicare coverage each year during the AEP and potentially missing out on new benefits or cost savings.

10. Getting Help with Medicare

If you need help with Medicare, there are resources available to you. Here are some options:

– Contact your State Health Insurance Assistance Program (SHIP) for free, unbiased counseling and assistance.

– Call Medicare at 1-800-MEDICARE (1-800-633-4227) for general questions and enrollment assistance.

– Work with a licensed insurance agent who specializes in Medicare to help you compare plans and enroll.

In conclusion, getting Medicare insurance can be a complicated process, but with the right information and resources, you can enroll in the coverage you need. By understanding the different parts of Medicare, enrolling in the right plans at the right time, and avoiding common mistakes, you can ensure that you have access to quality healthcare and financial protection against high healthcare costs.

Contents

Frequently Asked Questions

Medicare is a health insurance program offered by the federal government of the United States. It is designed to cover the healthcare needs of people over 65 years old and those with certain disabilities. Here are some frequently asked questions about how to get Medicare insurance.

What are the eligibility requirements to get Medicare insurance?

To be eligible for Medicare insurance, you must be a U.S. citizen or a legal resident for at least five years and be 65 years or older. You may also be eligible if you have a disability or end-stage renal disease. If you or your spouse paid Medicare taxes for at least ten years, you may also be eligible for premium-free Medicare Part A.

You can apply for Medicare insurance three months before you turn 65, and the enrollment period lasts for seven months. If you don’t enroll during this period, you may have to pay a late enrollment penalty.

What are the different parts of Medicare insurance?

Medicare insurance has different parts that cover different healthcare services. Medicare Part A covers hospital stays, nursing care, hospice care, and some home healthcare services. Medicare Part B covers doctor’s visits, outpatient care, preventive services, and medical equipment. Medicare Part C, also known as Medicare Advantage, is a combination of Part A, Part B, and sometimes Part D (prescription drug coverage) offered by private insurance companies. Medicare Part D covers prescription drugs.

You can choose which parts of Medicare insurance you want to enroll in, depending on your healthcare needs and budget. You may also choose to enroll in a Medicare Supplement plan (Medigap), which helps cover the out-of-pocket costs of Original Medicare.

How much does Medicare insurance cost?

The cost of Medicare insurance depends on the parts you enroll in and your income. Medicare Part A is usually premium-free if you or your spouse paid Medicare taxes for at least ten years. Medicare Part B has a monthly premium, which varies depending on your income. For 2021, the standard premium is $148.50 per month. Medicare Part C and Part D also have monthly premiums, which vary depending on the plan you choose.

If you have a low income, you may be eligible for extra help with Medicare costs, such as premiums, deductibles, and copayments. You can apply for this assistance through the Social Security Administration.

How do I enroll in Medicare insurance?

You can enroll in Medicare insurance online through the Social Security Administration website, by phone, or in person at your local Social Security office. If you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Parts A and B when you turn 65. However, if you are not receiving Social Security benefits, you will need to enroll during the enrollment period.

It is essential to enroll in Medicare insurance during the enrollment period to avoid late enrollment penalties. You can also change your Medicare coverage during the annual enrollment period, which runs from October 15 to December 7 each year.

Can I get Medicare insurance if I am still working?

Yes, you can get Medicare insurance even if you are still working. If you are 65 years or older and have employer-sponsored health insurance, you can choose to delay enrolling in Medicare Part B without paying a late enrollment penalty. However, you must enroll in Medicare Part A, even if you have employer-sponsored health insurance. If you have a disability and are working, you may also be eligible for Medicare insurance.

If you are still working and have employer-sponsored health insurance, you may choose to enroll in a Medicare Advantage plan (Part C) or a Medicare Supplement plan (Medigap) to supplement your employer-sponsored health insurance. It is essential to compare the costs and benefits of your options to make an informed decision.

Medicare Basics: Parts A, B, C & D

In conclusion, getting Medicare insurance can seem like a daunting task, but it doesn’t have to be. By understanding the different parts of Medicare, you can choose the coverage that best fits your needs. Whether you’re enrolling for the first time or making changes to your existing coverage, it’s important to do your research and compare plans to ensure you’re getting the most comprehensive coverage at the best price.

Remember, Medicare insurance is an investment in your health and well-being. It provides coverage for a wide range of medical services and can help you manage your healthcare costs. So, if you’re eligible for Medicare, don’t hesitate to explore your options and find the coverage that’s right for you. With the right plan in place, you can enjoy peace of mind knowing that your healthcare needs are covered.

In conclusion, the best way to get Medicare insurance is to be informed. Take the time to learn about the different parts of Medicare, the benefits they offer, and the costs associated with each. Consider your healthcare needs and budget when choosing a plan, and don’t be afraid to ask questions or seek help from a Medicare specialist if you need it. By doing your research and making an informed decision, you can get the coverage you need to stay healthy and happy in your golden years.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts