Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching the age of 65 and wondering how you will cover your medical expenses? You’re not alone. Many seniors rely on Medicare to cover their healthcare costs, but Medicare alone may not be enough. That’s where Medicare Supplement plans come in, and Plan C is an option worth exploring.

Medicare Supplement Plan C offers comprehensive coverage that can give you peace of mind. But what exactly does it cover? In this article, we’ll break down the specifics of Plan C so you can make an informed decision about your healthcare coverage. Let’s dive in!

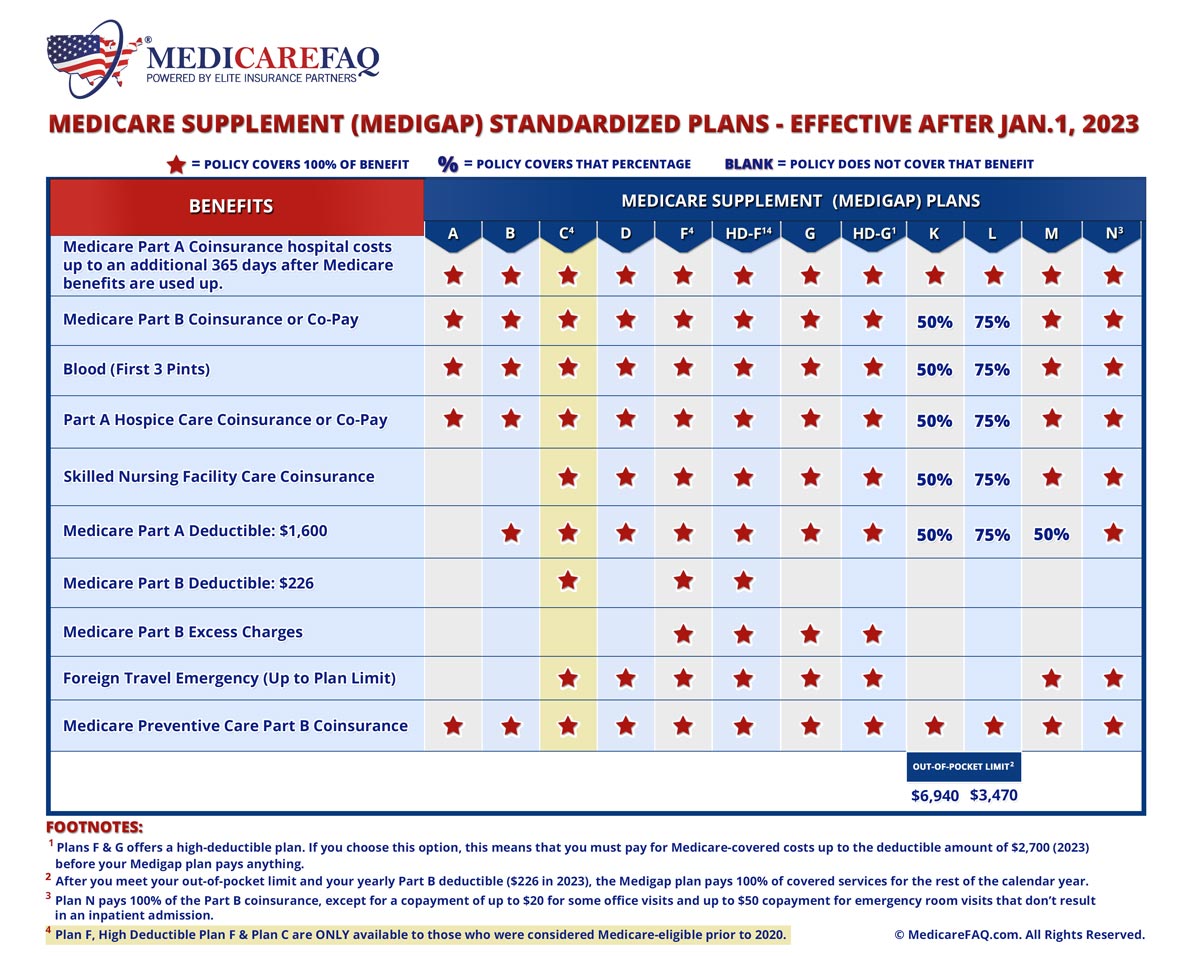

Medicare Supplement Plan C covers the same benefits as Plan B, including hospital and medical expenses. In addition, Plan C covers skilled nursing facility care, Medicare deductibles, and emergency medical care while traveling abroad. However, Plan C doesn’t cover Medicare Part B excess charges. It’s important to note that Plan C is no longer available to new Medicare enrollees as of January 1, 2020.

Contents

- What Does Medicare Supplement Plan C Cover?

- Frequently Asked Questions

- What is Medicare Supplement Plan C?

- What does Medicare Supplement Plan C cover that other plans do not?

- What is not covered by Medicare Supplement Plan C?

- How much does Medicare Supplement Plan C cost?

- Is Medicare Supplement Plan C the right choice for me?

- What Does Medicare Supplement Plan C Cover? Medigap Plan C

What Does Medicare Supplement Plan C Cover?

Medicare Supplement Plan C is one of the ten standardized Medicare Supplement insurance plans available in the United States. It is designed to help cover some of the out-of-pocket costs associated with Original Medicare, including deductibles, copayments, and coinsurance. In this article, we’ll take a closer look at what Medicare Supplement Plan C covers and how it compares to other Medicare Supplement plans.

Coverage

Medicare Supplement Plan C covers a wide range of healthcare expenses, including:

Part A coinsurance and hospital costs: Plan C covers the coinsurance and hospital costs associated with Medicare Part A, including extended hospital stays and hospice care.

Part B coinsurance and copayments: Plan C covers the coinsurance and copayments associated with Medicare Part B, including doctor visits, diagnostic tests, and medical equipment.

Blood transfusions: Plan C covers the cost of the first three pints of blood per year.

Skilled nursing facility care coinsurance: Plan C covers the coinsurance associated with skilled nursing facility care.

Part A hospice care coinsurance: Plan C covers the coinsurance associated with hospice care.

Part A deductible: Plan C covers the deductible associated with Medicare Part A, which is $1,484 in 2021.

Foreign travel emergency: Plan C covers emergency medical care received outside of the United States.

Benefits

Medicare Supplement Plan C offers several benefits to those who enroll. One of the biggest benefits is that it helps protect against unexpected healthcare costs. With Plan C, you’ll have predictable out-of-pocket expenses, which can help you budget for healthcare expenses more effectively.

Another benefit of Plan C is that it gives you more control over your healthcare. You’ll have the freedom to choose any doctor or hospital that accepts Medicare, without worrying about network restrictions or referrals.

Vs

While Medicare Supplement Plan C offers comprehensive coverage, it may not be the best choice for everyone. Here are some key differences between Plan C and other Medicare Supplement plans:

Plan F: Plan F offers the same coverage as Plan C, with the addition of coverage for the Medicare Part B deductible. However, Plan F is no longer available to new Medicare beneficiaries.

Plan G: Plan G offers the same coverage as Plan C, with the exception of the Medicare Part B deductible. However, Plan G may have lower premiums than Plan C.

Plan N: Plan N offers similar coverage to Plan C, with the exception of some of the Part B coinsurance and copayments. However, Plan N may have lower premiums than Plan C.

Conclusion

Medicare Supplement Plan C is a comprehensive insurance plan that can help cover many of the out-of-pocket costs associated with Original Medicare. While it may not be the best choice for everyone, it offers predictable healthcare expenses and the freedom to choose any doctor or hospital that accepts Medicare. If you’re interested in enrolling in Medicare Supplement Plan C, be sure to compare plans and shop around for the best coverage and rates.

Frequently Asked Questions

Medicare Supplement Plan C is one of the standardized Medicare supplement plans offered by private insurance companies. It covers certain out-of-pocket costs that Original Medicare does not cover. Here are some common questions and answers about what Medicare Supplement Plan C covers:

What is Medicare Supplement Plan C?

Medicare Supplement Plan C is a standardized Medicare supplement plan that covers certain out-of-pocket costs that Original Medicare does not cover. This plan is offered by private insurance companies and is designed to work alongside Original Medicare.

Medicare Supplement Plan C covers several costs, including Medicare Part A and Part B coinsurance, hospice care coinsurance, and the first three pints of blood used in a medical procedure. It also covers skilled nursing facility care coinsurance and foreign travel emergency coverage up to plan limits.

What does Medicare Supplement Plan C cover that other plans do not?

Medicare Supplement Plan C covers several out-of-pocket costs that other plans do not cover. Specifically, it covers Medicare Part B excess charges, which are charges that a doctor or provider may bill beyond the amount that Medicare approves. This plan also covers the first three pints of blood used in a medical procedure, which some other plans do not cover.

It is important to note that Medicare Supplement Plan C is no longer available to new enrollees as of January 1, 2020. However, if you were enrolled in this plan prior to that date, you can keep it and continue to receive the same benefits.

What is not covered by Medicare Supplement Plan C?

While Medicare Supplement Plan C covers many out-of-pocket costs, there are some things that it does not cover. For example, this plan does not cover prescription drugs, so you may need to enroll in a separate Medicare Part D plan if you need prescription drug coverage. Additionally, this plan does not cover dental, vision, or hearing services, so you may need to seek out additional insurance coverage if you need these services.

It is also important to note that Medicare Supplement Plan C is no longer available to new enrollees as of January 1, 2020. However, if you were enrolled in this plan prior to that date, you can keep it and continue to receive the same benefits.

How much does Medicare Supplement Plan C cost?

The cost of Medicare Supplement Plan C varies depending on several factors, including your age, location, and the insurance company you choose. In general, this plan may be more expensive than other Medicare supplement plans because it covers more out-of-pocket costs.

It is important to shop around and compare prices from different insurance companies to find the best deal. Additionally, some insurance companies may offer discounts or other incentives that can help lower your monthly premium.

Is Medicare Supplement Plan C the right choice for me?

Whether or not Medicare Supplement Plan C is the right choice for you depends on your individual healthcare needs and budget. This plan may be a good choice if you want comprehensive coverage for out-of-pocket costs and are willing to pay a higher monthly premium.

However, it is important to note that Medicare Supplement Plan C is no longer available to new enrollees as of January 1, 2020. If you are a new Medicare beneficiary, you may want to consider other Medicare supplement plans that are still available, such as Plan F or Plan G.

What Does Medicare Supplement Plan C Cover? Medigap Plan C

In conclusion, Medicare Supplement Plan C is a comprehensive plan that provides coverage for a wide range of healthcare services. With Plan C, you can rest assured that you will be covered for the majority of your healthcare expenses, including deductibles, copayments, and coinsurance.

If you are someone who is concerned about the high cost of healthcare, then Medicare Supplement Plan C may be the right choice for you. This plan can help you save money on your medical bills and ensure that you have access to the care you need when you need it.

Overall, Medicare Supplement Plan C can provide you with peace of mind and financial security. By choosing this plan, you can focus on your health and well-being without worrying about the cost of healthcare. So, if you are eligible for Medicare, be sure to consider Medicare Supplement Plan C as a way to protect your health and your finances.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts