Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing retirement age and wondering about Medicare plans? One that may have caught your attention is Keystone 65. But what exactly is Keystone 65 and is it a Medicare plan? Let’s dive in and find out.

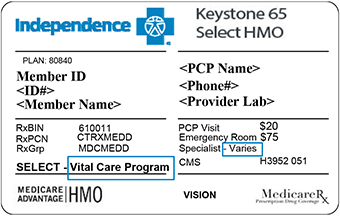

Keystone 65 is a health insurance plan that is offered by Independence Blue Cross. This plan is designed specifically for those who are eligible for Medicare, so it does fall under the umbrella of Medicare plans. However, it is important to note that Keystone 65 is only available in certain areas, so it may not be an option for everyone. Let’s explore this plan in more detail and see if it’s the right fit for you.

Yes, Keystone 65 is a Medicare plan offered by Independence Blue Cross in southeastern Pennsylvania. It is a Medicare Advantage plan that provides additional benefits beyond Original Medicare, such as prescription drug coverage, vision, hearing, and dental benefits. Keystone 65 also offers fitness programs and wellness benefits to help you stay healthy.

Is Keystone 65 a Medicare Plan?

If you are turning 65 and are looking for a Medicare plan, you may have come across Keystone 65. But what exactly is Keystone 65? Is it a Medicare plan? In this article, we will explore what Keystone 65 is, and whether it is a Medicare plan.

What is Keystone 65?

Keystone 65 is a health insurance plan offered by Independence Blue Cross, a health insurance company based in Pennsylvania. It is designed for people who are 65 years or older, or people who have certain disabilities. Keystone 65 offers comprehensive health coverage, including medical, hospitalization, prescription drug, and preventive care services.

Benefits of Keystone 65

One of the main benefits of Keystone 65 is that it provides comprehensive coverage. This means that you can get all the healthcare services you need without worrying about out-of-pocket expenses. Keystone 65 also offers a wide network of healthcare providers, including doctors, hospitals, and pharmacies. This allows you to choose the healthcare providers that best fit your needs.

Another benefit of Keystone 65 is that it offers additional benefits, such as vision, dental, and hearing coverage. These benefits are not covered by Original Medicare, so having them included in your health plan can save you money in the long run.

Keystone 65 vs. Original Medicare

While Keystone 65 is not a Medicare plan, it is a Medicare Advantage plan. This means that it is an alternative to Original Medicare, which is the federal health insurance program for people over 65. Keystone 65 offers all the benefits of Original Medicare, as well as additional benefits that are not covered by Original Medicare, such as prescription drug coverage, vision, dental, and hearing benefits.

One of the main differences between Keystone 65 and Original Medicare is that Keystone 65 has a network of healthcare providers. This means that you may need to choose healthcare providers within the network to get the most coverage. With Original Medicare, you can see any healthcare provider that accepts Medicare.

Enrolling in Keystone 65

To enroll in Keystone 65, you must first be enrolled in Medicare Part A and Part B. You can then choose a Keystone 65 plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 every year.

To compare Keystone 65 plans and choose the one that best fits your needs, you can use the Medicare Plan Finder tool on the Medicare website. You can also contact an independent insurance agent or a Keystone 65 representative for assistance.

Conclusion

In summary, Keystone 65 is a Medicare Advantage plan offered by Independence Blue Cross. It provides comprehensive health coverage, including medical, hospitalization, prescription drug, and preventive care services. Keystone 65 also offers additional benefits, such as vision, dental, and hearing coverage, which are not covered by Original Medicare. While Keystone 65 is not a Medicare plan, it is an alternative to Original Medicare that can provide you with more benefits and coverage options.

Contents

- Frequently Asked Questions

- 1. Is Keystone 65 a Medicare Plan?

- 2. What are the benefits of enrolling in Keystone 65?

- 3. How do I enroll in Keystone 65?

- 4. Are there any out-of-pocket costs with Keystone 65?

- 5. Can I switch from my current Medicare plan to Keystone 65?

- Your Independence Blue Cross Medicare Advantage Keystone 65 Focus Rx HMO-POS Health Plan

Frequently Asked Questions

1. Is Keystone 65 a Medicare Plan?

Yes, Keystone 65 is a Medicare plan that is offered by Independence Blue Cross to eligible individuals who are 65 years or older, or who have certain qualifying disabilities. Keystone 65 is a type of Medicare Advantage plan, also known as Medicare Part C, which provides all of the benefits of Original Medicare (Part A and Part B) along with additional benefits such as prescription drug coverage, vision, hearing, and dental services.

Keystone 65 is a popular choice among Medicare beneficiaries in Pennsylvania because it offers comprehensive coverage at a predictable cost. With Keystone 65, you can choose from a variety of plan options that best meet your individual needs and budget.

2. What are the benefits of enrolling in Keystone 65?

Enrolling in Keystone 65 can offer many benefits to Medicare beneficiaries, including:

- Comprehensive coverage for all of your healthcare needs, including prescription drugs, routine care, and preventive services

- Predictable costs, with many plans offering $0 or low monthly premiums

- Access to a network of healthcare providers, including doctors, hospitals, and pharmacies

- Additional benefits such as vision, hearing, and dental services that are not covered by Original Medicare

By enrolling in Keystone 65, you can enjoy the peace of mind that comes with knowing that you have comprehensive health coverage that meets your individual needs.

3. How do I enroll in Keystone 65?

To enroll in Keystone 65, you must first be eligible for Medicare. Once you are eligible, you can enroll in Keystone 65 during the Annual Enrollment Period (AEP) which runs from October 15 to December 7 each year. You can also enroll in Keystone 65 during the Special Enrollment Period (SEP) if you have a qualifying life event such as moving to a new area or losing your current coverage.

When enrolling in Keystone 65, it is important to carefully review the available plan options and choose the one that best meets your individual needs and budget. You can compare plans and enroll online, by phone, or by meeting with a licensed insurance agent who can help guide you through the enrollment process.

4. Are there any out-of-pocket costs with Keystone 65?

Yes, there may be some out-of-pocket costs associated with Keystone 65, depending on the plan you choose. These may include deductibles, copayments, and coinsurance for medical services, as well as copayments for prescription drugs. However, many Keystone 65 plans offer $0 or low monthly premiums, and some plans may offer additional benefits that can help offset these costs.

It is important to carefully review the costs associated with each Keystone 65 plan and choose the one that best meets your individual needs and budget.

5. Can I switch from my current Medicare plan to Keystone 65?

Yes, if you are currently enrolled in Original Medicare (Part A and Part B) or another Medicare Advantage plan, you can switch to Keystone 65 during the Annual Enrollment Period (AEP) or the Special Enrollment Period (SEP) if you have a qualifying life event. When switching to Keystone 65, it is important to carefully review the available plan options and choose the one that best meets your individual needs and budget.

Before switching to Keystone 65, it is also important to consider any potential costs associated with changing plans, such as deductibles, copayments, and coinsurance. You should also ensure that any healthcare providers you currently see are in the Keystone 65 network to avoid any unexpected out-of-pocket costs.

Your Independence Blue Cross Medicare Advantage Keystone 65 Focus Rx HMO-POS Health Plan

In conclusion, Keystone 65 is indeed a Medicare plan that is available to eligible individuals. Through this plan, beneficiaries can access a variety of healthcare services, including hospital stays, doctor visits, and prescription drugs. With its comprehensive coverage and affordable pricing, Keystone 65 is a popular choice for those seeking reliable healthcare coverage.

It’s important to note that while Keystone 65 is a Medicare plan, it is not the only option available. Beneficiaries can also consider other plans, such as Medicare Advantage or Medigap, to find coverage that best meets their individual needs. However, for those who choose Keystone 65, they can rest assured that they are receiving quality healthcare coverage through a trusted provider.

In summary, if you are eligible for Medicare and looking for reliable healthcare coverage, Keystone 65 may be a great option for you. With its comprehensive coverage and affordable pricing, this plan can help you access the care you need without breaking the bank. So, if you’re in the market for Medicare coverage, be sure to consider Keystone 65 as one of your top choices.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts