Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

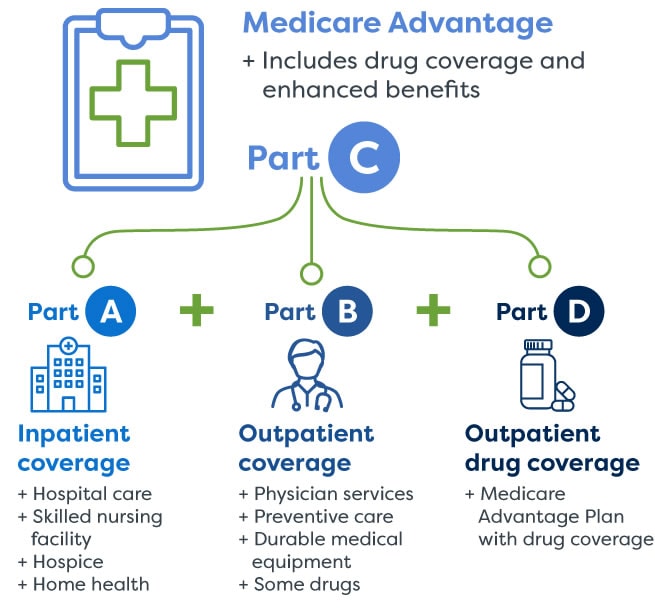

Are you turning 65 soon or planning to enroll in Medicare? If so, you may be wondering what Medicare Advantage plans cover. Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies approved by Medicare. These plans provide all the benefits of Original Medicare (Part A and Part B) and often include additional coverage, such as prescription drugs, dental, vision, and hearing services.

Understanding what Medicare Advantage plans cover can be overwhelming, but it’s important to know your options and make informed decisions. In this article, we will explore the basics of Medicare Advantage plans, what they cover, and how to choose the right plan for your healthcare needs and budget. So, let’s dive in and learn more about Medicare Advantage plans.

What Do Medicare Advantage Plans Cover?

Medicare Advantage Plans, also known as Part C, cover all the services that Original Medicare covers, plus additional benefits such as prescription drug coverage, dental, vision, and hearing benefits. Some Medicare Advantage Plans may also cover fitness programs, transportation to medical appointments, and over-the-counter medications. However, the specific benefits and costs may vary depending on the plan and the insurance provider. It’s important to review the plan details before enrolling.

Contents

- What Do Medicare Advantage Plans Cover?

- Frequently Asked Questions

- 1. What benefits are included in Medicare Advantage plans?

- 2. Do Medicare Advantage plans cover prescription drugs?

- 3. How do Medicare Advantage plans cover out-of-network services?

- 4. Are there any costs associated with Medicare Advantage plans?

- 5. Can I switch Medicare Advantage plans?

- What is Medicare Advantage? Medicare Advantage Plans Explained

What Do Medicare Advantage Plans Cover?

Medicare Advantage plans, also known as Medicare Part C, are a type of health insurance plan offered by private insurance companies. These plans provide coverage for all of the benefits included in Original Medicare (Part A and Part B) and often include additional benefits such as prescription drug coverage, dental, vision, and hearing services. In this article, we will discuss what Medicare Advantage plans cover.

1. Inpatient hospital care

Medicare Advantage plans cover inpatient hospital care, which includes a semi-private room, meals, general nursing, and drugs as part of your inpatient treatment. Medicare Advantage plans help cover the costs of hospital stays, including surgeries, and all other necessary services while you’re in the hospital.

In addition, Medicare Advantage plans also cover inpatient mental health services, including psychiatric hospital stays. This is an important benefit for those who need mental health care and support.

2. Outpatient care

Outpatient care includes services such as doctor visits, lab tests, and diagnostic screenings. Medicare Advantage plans cover these services, which can help you stay healthy and catch any medical issues early on.

Medicare Advantage plans also cover outpatient mental health services, including counseling and therapy sessions. This can be an essential benefit for those who need ongoing mental health support.

3. Prescription drug coverage

Most Medicare Advantage plans include prescription drug coverage, which can help you save money on your medications. This benefit is important for those who need ongoing medication management for chronic conditions.

It’s important to note that not all Medicare Advantage plans offer prescription drug coverage, so it’s important to review your plan’s benefits carefully before enrolling.

4. Preventive services

Medicare Advantage plans cover a variety of preventive services, including annual wellness visits, mammograms, colonoscopies, and flu shots. These services can help you stay healthy and prevent more serious health issues down the line.

5. Vision, hearing, and dental services

Many Medicare Advantage plans offer additional benefits such as vision, hearing, and dental services. These benefits can include routine exams, cleanings, and even things like hearing aids or eyeglasses.

It’s important to note that not all Medicare Advantage plans offer these additional benefits, so it’s important to review your plan’s benefits carefully before enrolling.

6. Transportation services

Some Medicare Advantage plans offer transportation services for non-emergency medical appointments. This can be a helpful benefit for those who have mobility issues or who live in rural areas without easy access to transportation.

7. Fitness and wellness programs

Many Medicare Advantage plans offer fitness and wellness programs, such as gym memberships or discounts on fitness classes. These programs can help you stay active and healthy, which can have numerous health benefits.

8. Home health care

Medicare Advantage plans cover home health care services for those who need care at home. This can include things like skilled nursing care, physical therapy, and occupational therapy.

9. Hospice care

Medicare Advantage plans cover hospice care for those who are terminally ill and need end-of-life care. This benefit can provide comfort and support for both the patient and their family during a difficult time.

10. Medical equipment and supplies

Medicare Advantage plans cover medical equipment and supplies, such as wheelchairs, walkers, and oxygen equipment. This benefit can help you manage your health condition and maintain your independence.

In conclusion, Medicare Advantage plans offer a wide range of benefits that can help you stay healthy and manage your health conditions. It’s important to review your plan’s benefits carefully before enrolling to ensure that you have the coverage you need.

Frequently Asked Questions

Medicare Advantage plans offer an alternative way to receive Medicare Part A and Part B benefits. These plans are offered by private insurance companies and can provide extra benefits beyond what Original Medicare covers. Here are some common questions about what Medicare Advantage plans cover.

1. What benefits are included in Medicare Advantage plans?

Medicare Advantage plans must cover all the same services as Original Medicare, including hospital stays, doctor visits, and preventive care. In addition, many plans offer extra benefits, such as prescription drug coverage, dental and vision care, and fitness programs. Some plans also cover services like hearing aids, transportation, and home health care.

It’s important to review the plan’s summary of benefits to understand what services are covered and any costs or limitations associated with them.

2. Do Medicare Advantage plans cover prescription drugs?

Many Medicare Advantage plans include prescription drug coverage, known as Medicare Part D. These plans have a list of covered prescription drugs called a formulary, which may have different tiers or levels of coverage. It’s important to review the plan’s formulary to see if your medications are covered and at what cost.

If a plan doesn’t include prescription drug coverage, you may be able to enroll in a separate Medicare Part D plan to add this coverage.

3. How do Medicare Advantage plans cover out-of-network services?

Most Medicare Advantage plans have a network of providers that members can use to receive care. If you receive services from a provider outside of the plan’s network, you may have to pay more out-of-pocket or the service may not be covered at all.

However, some plans offer out-of-network coverage for certain services or in certain situations. Review the plan’s summary of benefits to understand how out-of-network services are covered.

4. Are there any costs associated with Medicare Advantage plans?

Yes, Medicare Advantage plans may have monthly premiums, deductibles, copayments, or coinsurance. Some plans have lower out-of-pocket costs than Original Medicare, but it’s important to review the plan’s costs to understand what you’ll be responsible for paying.

If you have a Medicare Advantage plan with prescription drug coverage, you may also be subject to the Medicare Part D coverage gap, also known as the “donut hole.”

5. Can I switch Medicare Advantage plans?

Yes, you can switch Medicare Advantage plans during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. You can also switch plans during the Medicare Advantage Open Enrollment Period (OEP), which runs from January 1 to March 31 each year.

It’s important to review your current plan’s costs and benefits each year and compare them to other plans in your area to ensure you’re enrolled in the plan that best meets your needs.

What is Medicare Advantage? Medicare Advantage Plans Explained

In conclusion, Medicare Advantage plans offer a wide range of benefits that can help seniors and people with disabilities manage their healthcare costs. These plans provide coverage for things like preventative care, prescription drugs, and even dental and vision services. By enrolling in a Medicare Advantage plan, you can take advantage of these benefits and enjoy greater peace of mind when it comes to your healthcare needs.

However, it is important to carefully review the details of each plan before making a decision. Not all plans are created equal, and some may have limitations or restrictions that could impact your coverage. By doing your research and comparing different plans, you can find the one that best fits your unique healthcare needs and budget.

Ultimately, the decision to enroll in a Medicare Advantage plan is a personal one that should be made after careful consideration of all the factors involved. With the right plan in place, you can rest assured that your healthcare needs will be taken care of and that you can live your life to the fullest, without worrying about the cost of medical care.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts