Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, as well as those with certain disabilities or chronic conditions. With over 60 million Americans currently enrolled in Medicare, it’s no wonder that there are many questions and concerns about the program.

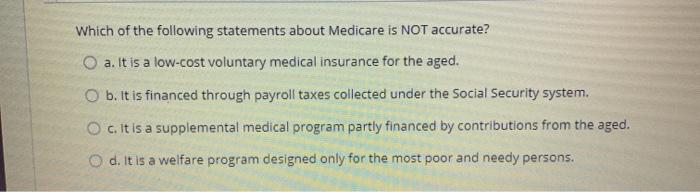

One common question is, “Which statement about Medicare is most accurate?” With so much information and misinformation out there, it can be hard to know what to believe. In this article, we’ll explore the different statements about Medicare and help you understand which one is truly accurate. So, let’s dive in and discover the truth about Medicare!

Medicare is a U.S. federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). The most accurate statement about Medicare is that it provides health insurance coverage for many necessary medical services, such as hospital stays, doctor visits, and preventive care. However, Medicare doesn’t cover all medical expenses, and beneficiaries may need to pay deductibles, copayments, and coinsurance for certain services.

Contents

- Which Statement About Medicare is Most Accurate?

- Statement 1: Medicare is Free for Everyone

- Statement 2: Medicare Covers Everything You Need

- Statement 3: Medicare Advantage Plans are Better than Original Medicare

- Statement 4: Medicare is Going Bankrupt

- Statement 5: Medicare is the Same Everywhere

- Statement 6: Medicare is Only for the Elderly

- Statement 7: Medicare Covers Prescription Drugs

- Statement 8: Medicare is Easy to Understand

- Statement 9: Medicare Provides the Same Benefits as Medicaid

- Statement 10: Medicare is a Comprehensive Health Insurance Program

- Frequently Asked Questions

Which Statement About Medicare is Most Accurate?

Medicare is a federal health insurance program that provides coverage to Americans aged 65 and older, as well as to younger individuals with certain disabilities. With so many different aspects to the program, it can be difficult to determine which statement about Medicare is most accurate. In this article, we’ll take a closer look at some of the most common statements about Medicare and provide the information you need to make an informed decision.

Statement 1: Medicare is Free for Everyone

One of the most common misconceptions about Medicare is that it is free for everyone. While Medicare Part A (hospital insurance) is free for most people, Part B (medical insurance) requires a monthly premium. Additionally, there are other costs associated with Medicare, such as deductibles, coinsurance, and copayments. These costs can add up quickly, so it’s important to understand what you’ll be responsible for paying.

If you’re eligible for Medicare, it’s important to enroll during your initial enrollment period to avoid late enrollment penalties. You can also save money on Medicare costs by choosing the right plan for your needs.

Statement 2: Medicare Covers Everything You Need

Another common misconception about Medicare is that it covers everything you need. While Medicare does provide coverage for many medical services and procedures, there are some things that are not covered. For example, Medicare does not cover dental or vision care, hearing aids, or long-term care. If you need these services, you’ll need to pay for them out of pocket or purchase additional insurance coverage.

It’s important to review your Medicare coverage each year during the open enrollment period to ensure you have the coverage you need. You can also consider purchasing a Medicare Supplement plan to help cover the costs of services that are not covered by Medicare.

Statement 3: Medicare Advantage Plans are Better than Original Medicare

Medicare Advantage plans are a type of Medicare plan offered by private insurance companies. These plans provide all the benefits of Original Medicare (Parts A and B), as well as additional benefits such as prescription drug coverage, dental and vision care, and fitness programs. While Medicare Advantage plans can be a good option for some people, they are not necessarily better than Original Medicare.

One downside of Medicare Advantage plans is that they often have network restrictions, meaning you may not be able to see the doctor or specialist you want. Additionally, Medicare Advantage plans can change their coverage and costs each year, so it’s important to review your plan each year during the open enrollment period.

Statement 4: Medicare is Going Bankrupt

One of the most concerning statements about Medicare is that it is going bankrupt. While it is true that the Medicare Trust Fund is projected to run out of money in the coming years, this does not mean that Medicare itself is going bankrupt. The program will continue to exist, but changes may need to be made to ensure its long-term sustainability.

To address the financial challenges facing Medicare, lawmakers may need to consider increasing taxes, reducing benefits, or implementing other changes. However, any changes to the program will likely be gradual and phased in over time.

Statement 5: Medicare is the Same Everywhere

Another common misconception about Medicare is that it is the same everywhere. In reality, Medicare coverage can vary depending on where you live. For example, some states offer additional benefits or have lower costs than others. Additionally, Medicare Advantage plans may be available in some areas but not in others.

Before enrolling in Medicare, it’s important to research your options and compare plans to find the best coverage for your needs. You can also work with a licensed insurance agent who can help you navigate the enrollment process and find the right plan for you.

Statement 6: Medicare is Only for the Elderly

While Medicare is primarily associated with older adults, it is not only for the elderly. Individuals with certain disabilities, such as end-stage renal disease or amyotrophic lateral sclerosis (ALS), are also eligible for Medicare. Additionally, some individuals may be eligible for Medicare before age 65 if they have a qualifying medical condition.

If you’re unsure whether you’re eligible for Medicare, you can check with the Social Security Administration or visit the Medicare website for more information.

Statement 7: Medicare Covers Prescription Drugs

While Medicare does provide some coverage for prescription drugs, this coverage is limited. Medicare Part D is a prescription drug plan that is offered by private insurance companies. If you need prescription drug coverage, you’ll need to enroll in a Part D plan or a Medicare Advantage plan that includes drug coverage.

It’s important to review your prescription drug coverage each year during the open enrollment period to ensure you have the coverage you need. You can also consider purchasing a Medicare Supplement plan that includes prescription drug coverage.

Statement 8: Medicare is Easy to Understand

One of the biggest challenges facing Medicare beneficiaries is understanding the program’s rules and regulations. With so many different parts and plans, it can be difficult to know what’s covered and what’s not. Additionally, Medicare rules and regulations can change from year to year.

To help you better understand Medicare, you can work with a licensed insurance agent who can provide personalized guidance and support. You can also visit the Medicare website for more information and resources.

Statement 9: Medicare Provides the Same Benefits as Medicaid

While Medicare and Medicaid are both government-run health insurance programs, they are not the same. Medicaid is a program that provides health coverage to individuals with low incomes, while Medicare provides coverage to individuals aged 65 and older and to individuals with certain disabilities.

If you’re eligible for both Medicare and Medicaid, you may be able to receive additional benefits and cost savings. It’s important to review your eligibility and options to determine what coverage you qualify for.

Statement 10: Medicare is a Comprehensive Health Insurance Program

Overall, Medicare is a comprehensive health insurance program that provides coverage for a wide range of medical services and procedures. While there are some limitations and restrictions, Medicare can be a valuable resource for individuals who need affordable health coverage.

If you’re approaching age 65 or have a qualifying medical condition, it’s important to explore your Medicare options and enroll in a plan that provides the coverage you need. With the right plan and support, you can enjoy the peace of mind that comes with having comprehensive health coverage.

Frequently Asked Questions

Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD). Here are some commonly asked questions about Medicare.

Which Statement About Medicare is Most Accurate?

Medicare is a federal health insurance program that provides coverage for eligible individuals. The most accurate statement about Medicare is that it is a complex program that offers a range of benefits to its beneficiaries. Medicare is divided into several parts, each of which covers different services.

Part A covers hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers doctor visits, outpatient care, and preventive services. Part C, also known as Medicare Advantage, offers an alternative way to receive your Medicare benefits through private insurance plans. Part D covers prescription drugs.

Who Is Eligible for Medicare?

People who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (ESRD) are eligible for Medicare. To be eligible for Medicare, you must be a U.S. citizen or a permanent legal resident who has lived in the U.S. for at least five years. You must also have worked and paid Medicare taxes for at least ten years.

If you are eligible for Medicare, you can enroll during the Initial Enrollment Period (IEP), which starts three months before your 65th birthday and ends three months after your birthday. If you miss your IEP, you can enroll during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year.

What Does Medicare Cover?

Medicare covers a wide range of services, including hospital stays, doctor visits, preventive care, and prescription drugs. Medicare Part A covers hospital stays, skilled nursing facility care, hospice care, and some home health care. Medicare Part B covers doctor visits, outpatient care, and preventive services. Medicare Part C, also known as Medicare Advantage, offers additional benefits and services through private insurance plans. Medicare Part D covers prescription drugs.

While Medicare covers many services, it does not cover all medical expenses. Some services, such as dental, vision, and hearing care, are not covered by Medicare. It is important to review your Medicare coverage and understand what is and is not covered.

How Much Does Medicare Cost?

The cost of Medicare varies depending on the type of coverage you have. Medicare Part A is usually free if you or your spouse has worked and paid Medicare taxes for at least ten years. Medicare Part B, Part C, and Part D have premiums and other costs that vary depending on your income and the plan you choose.

There are also out-of-pocket costs associated with Medicare, such as deductibles, copayments, and coinsurance. It is important to review your Medicare coverage and understand the costs associated with each part of the program.

Can I Change My Medicare Coverage?

Yes, you can change your Medicare coverage during certain times of the year. The Annual Enrollment Period (AEP), also known as the Open Enrollment Period, runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also change your Medicare Advantage plan or your Part D prescription drug plan.

There are also other times when you can make changes to your Medicare coverage, such as the Medicare Advantage Open Enrollment Period, which runs from January 1 to March 31 each year. It is important to review your Medicare coverage and make changes as needed to ensure you have the best coverage for your needs.

How to get the Most Accurate Medicare Part D Prescription Drug Plan Quotes

In conclusion, it is clear that Medicare is a vital program that provides healthcare coverage to millions of Americans. However, there are several inaccuracies about Medicare that have been circulating for years. After analyzing the statements made about Medicare, it is evident that the most accurate statement is that Medicare is a federally funded health insurance program for people who are 65 or older, have certain disabilities, or have End-Stage Renal Disease.

Furthermore, it is essential to understand the various components of Medicare, including Parts A, B, C, and D, to ensure that you are getting the coverage you need. While there may be confusion and misinformation about Medicare, it is crucial to do your research and consult with professionals to ensure that you are making informed decisions about your healthcare coverage.

Overall, Medicare is a crucial program that provides healthcare coverage to millions of Americans, and it is essential to understand the facts and dispel any inaccuracies about the program. With the right information and support, you can make the most of your Medicare coverage and ensure that you have access to the healthcare services you need.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts