Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching your golden years and wondering if you’ll be able to afford dental coverage? Or maybe you’re already on Medicare and are looking to add dental benefits to your plan? The good news is that dental insurance is available through some Medicare plans, but the options can be confusing. In this article, we’ll explore your options for dental coverage under Medicare and what to consider when choosing a plan.

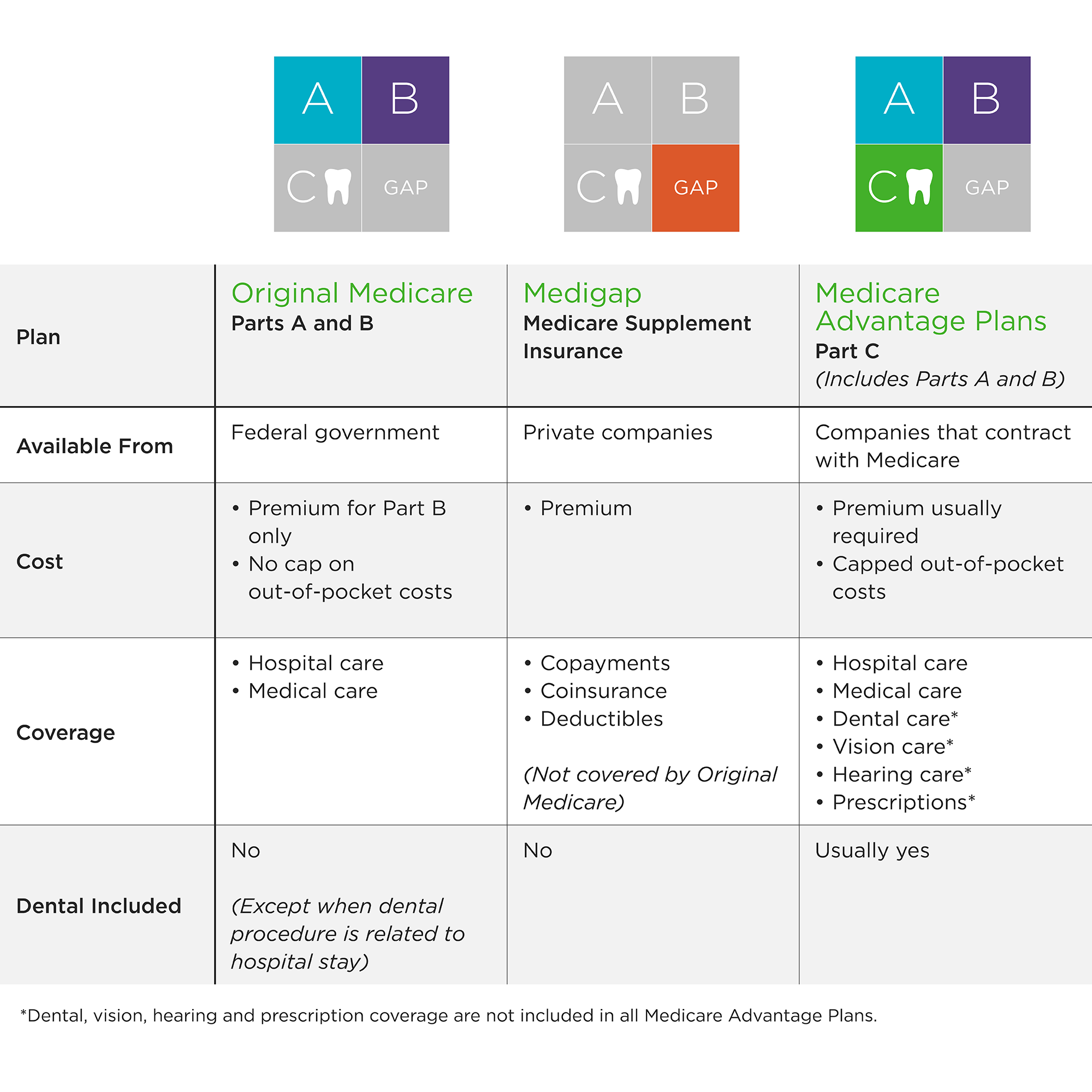

Unfortunately, original Medicare (Part A and Part B) does not cover routine dental care, including checkups, cleanings, fillings, and dentures. However, some Medicare Advantage plans offer dental coverage as an added benefit. You can also consider purchasing a standalone dental insurance policy or enrolling in a dental discount plan to help cover the costs of dental care.

Can I Get Dental Insurance Through Medicare?

If you’re a senior citizen or someone with a disability, you may be wondering if you can get dental insurance through Medicare. Unfortunately, Medicare does not cover most dental services, including routine exams, fillings, and extractions. However, there are a few options available to help you get the dental care you need.

Option #1: Medicare Advantage Plans

One way to get dental coverage through Medicare is to enroll in a Medicare Advantage plan. These plans are offered by private insurance companies and provide all the benefits of Original Medicare, plus additional coverage for things like dental, vision, and hearing care. Some Medicare Advantage plans offer comprehensive dental coverage, while others may only cover basic services like cleanings and X-rays. Before enrolling in a Medicare Advantage plan, be sure to review the plan’s benefits and network of providers to ensure it meets your needs.

Option #2: Standalone Dental Insurance Plans

Another option is to purchase standalone dental insurance from a private insurance company. These plans are designed specifically to cover dental services and may offer more comprehensive coverage than Medicare Advantage plans. Standalone dental insurance plans typically have a monthly premium, deductible, and coinsurance, so be sure to compare costs and benefits before enrolling.

Option #3: Discount Dental Plans

Finally, you may be able to save money on dental care by enrolling in a discount dental plan. These plans are not insurance, but rather offer discounts on dental services from participating providers. Discount dental plans typically have a low monthly fee and may be a good option if you only need basic dental services.

Benefits of Dental Insurance

Having dental insurance can provide many benefits, including:

- Financial protection from unexpected dental expenses

- Access to preventive care, which can help you avoid costly dental procedures in the future

- The ability to choose from a network of participating providers

- Peace of mind knowing that you have coverage for dental emergencies

Dental Insurance vs. Discount Dental Plans

While both dental insurance and discount dental plans can help you save money on dental care, there are some key differences to consider. Dental insurance typically has a higher monthly premium, deductible, and coinsurance, but offers more comprehensive coverage for a wider range of services. Discount dental plans, on the other hand, have a lower monthly fee and offer discounts on dental services from participating providers, but may only cover basic services.

Conclusion

While Medicare does not cover most dental services, there are still options available to help you get the dental care you need. Whether you choose a Medicare Advantage plan, standalone dental insurance plan, or discount dental plan, be sure to review the plan’s benefits and costs before enrolling. With the right coverage, you can enjoy the benefits of good oral health and a bright, healthy smile.

Frequently Asked Questions

Many people wonder if they can get dental insurance through Medicare. Here are some of the most common questions and answers regarding dental insurance and Medicare.

Can I get dental insurance through Medicare?

Unfortunately, Original Medicare (Part A and Part B) does not cover most dental services. This means that if you have Medicare coverage, you will likely need to purchase a separate dental insurance plan or pay for dental services out of pocket.

However, some Medicare Advantage plans (Part C) may offer dental benefits. These plans are offered by private insurance companies and can provide additional benefits beyond what is covered by Original Medicare. If you are interested in getting dental coverage through Medicare, you may want to consider enrolling in a Medicare Advantage plan that includes dental benefits.

What dental services are covered by Medicare?

Original Medicare (Part A and Part B) only covers dental services that are deemed medically necessary. This means that if you need dental services because of an injury or illness, Medicare may cover the costs. However, routine dental care, such as cleanings, fillings, and extractions, are generally not covered.

Some Medicare Advantage plans (Part C) may offer additional dental benefits beyond what is covered by Original Medicare. These benefits may include routine dental care, such as cleanings and fillings, as well as more extensive procedures like root canals and dentures. It’s important to review the benefits offered by each plan carefully to determine which plan is right for you.

How much does dental insurance through Medicare cost?

The cost of dental insurance through Medicare will vary depending on the plan you choose and your location. If you enroll in a Medicare Advantage plan that includes dental benefits, you will likely pay an additional premium for the dental coverage. The cost of this premium will vary depending on the plan and your location.

If you choose to purchase a separate dental insurance plan, the cost will depend on the type of plan you choose and the coverage it provides. Some plans have low monthly premiums but high deductibles and copays, while others have higher premiums but lower out-of-pocket costs. It’s important to compare plans carefully to determine which plan offers the best value for your needs and budget.

Can I purchase dental insurance through the Health Insurance Marketplace?

Yes, you can purchase dental insurance through the Health Insurance Marketplace. However, dental coverage is not included in the standard health insurance plans offered through the Marketplace. Instead, you will need to select a separate dental plan and pay an additional premium for the coverage. It’s important to review the available plans carefully to determine which plan offers the best value for your dental care needs and budget.

If you are enrolled in a Medicare Advantage plan that includes dental benefits, you will not be eligible to purchase a separate dental plan through the Marketplace. Instead, you will need to use the dental benefits provided by your Medicare Advantage plan.

What should I consider when choosing a dental insurance plan?

When choosing a dental insurance plan, there are several factors to consider. First, you will want to review the coverage offered by the plan to ensure that it meets your dental care needs. You should also consider the cost of the plan, including the monthly premium, deductible, and copays.

In addition, you should review the network of dentists and specialists included in the plan to ensure that you can receive care from a provider you trust. Finally, you may want to consider the reputation of the insurance company and their customer service record to ensure that you will receive high-quality care and support when you need it.

In conclusion, while Medicare does not offer dental coverage as part of its basic plan, there are options available for those seeking dental insurance. One option is to enroll in a Medicare Advantage plan that includes dental coverage. Another option is to purchase a stand-alone dental insurance plan from a private insurance provider. It’s important to consider your specific dental needs and budget when choosing a plan that works best for you. Don’t let the lack of dental coverage in Medicare deter you from finding the right dental insurance plan to meet your needs and maintain your oral health.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts