Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Introduction:

Understanding Medicare coverage can be overwhelming, especially when it comes to hospital stays. One of the most frequently asked questions by seniors is, “how many hospital days does Medicare cover?” The answer is not straightforward, but this article will provide a comprehensive overview to help you understand Medicare coverage for hospital stays.

Medicare covers up to 90 days of hospitalization per benefit period, with an additional 60 “lifetime reserve” days available. However, there are certain criteria that must be met to qualify for these benefits, such as the need for acute care and being admitted as an inpatient. It is crucial to understand the details of Medicare coverage to avoid unexpected expenses and ensure the best possible healthcare outcomes.

Medicare Part A covers up to 90 days of hospitalization per benefit period. If you need to stay in the hospital beyond 90 days, you may be able to use your lifetime reserve days. These are an additional 60 days of coverage that you can use once in your lifetime. After your lifetime reserve days are used, you’ll be responsible for all hospital costs.

How Many Hospital Days Does Medicare Cover?

Medicare is a federal health insurance program for people over 65 and those with certain disabilities. Hospital stays can be expensive, but Medicare covers a portion of the cost. However, it is important to understand how many hospital days Medicare covers to avoid any unexpected costs. In this article, we will discuss the details of how many hospital days Medicare covers.

Medicare Part A Coverage for Hospital Stays

Medicare Part A covers inpatient hospital stays, including semi-private rooms, meals, general nursing, and drugs provided as part of the inpatient treatment. Medicare Part A covers up to 90 days of hospitalization per benefit period. A benefit period begins when you are admitted to the hospital as an inpatient and ends when you have not received any inpatient care for 60 days in a row.

If you need to stay in the hospital for more than 90 days, you may use your Lifetime Reserve Days. You have 60 Lifetime Reserve Days that can be used during your lifetime. These days can be used after you have used your initial 90 days of hospitalization in a benefit period. After you have used your Lifetime Reserve Days, you will be responsible for all hospital costs.

Benefits of Medicare Part A Coverage for Hospital Stays

Medicare Part A covers a significant portion of hospitalization costs, which can be expensive. The coverage includes hospital room charges, nursing care, meals, and other medically necessary services. Additionally, Medicare Part A coverage can help you avoid unexpected hospital bills that can be financially devastating.

Medicare Part A Coverage Vs Medicare Part B Coverage

Medicare Part B covers outpatient medical services, such as doctor visits, lab tests, and diagnostic tests. It does not cover hospital stays or inpatient care. Therefore, if you need hospitalization, you will need to use your Medicare Part A coverage. It is important to note that Medicare Part B has a monthly premium, whereas Medicare Part A does not.

Medicare Advantage Coverage for Hospital Stays

Medicare Advantage plans, or Medicare Part C plans, are offered by private insurance companies that contract with Medicare to provide all of your Part A and Part B benefits. Some Medicare Advantage plans offer additional benefits, such as coverage for prescription drugs, vision, and dental care.

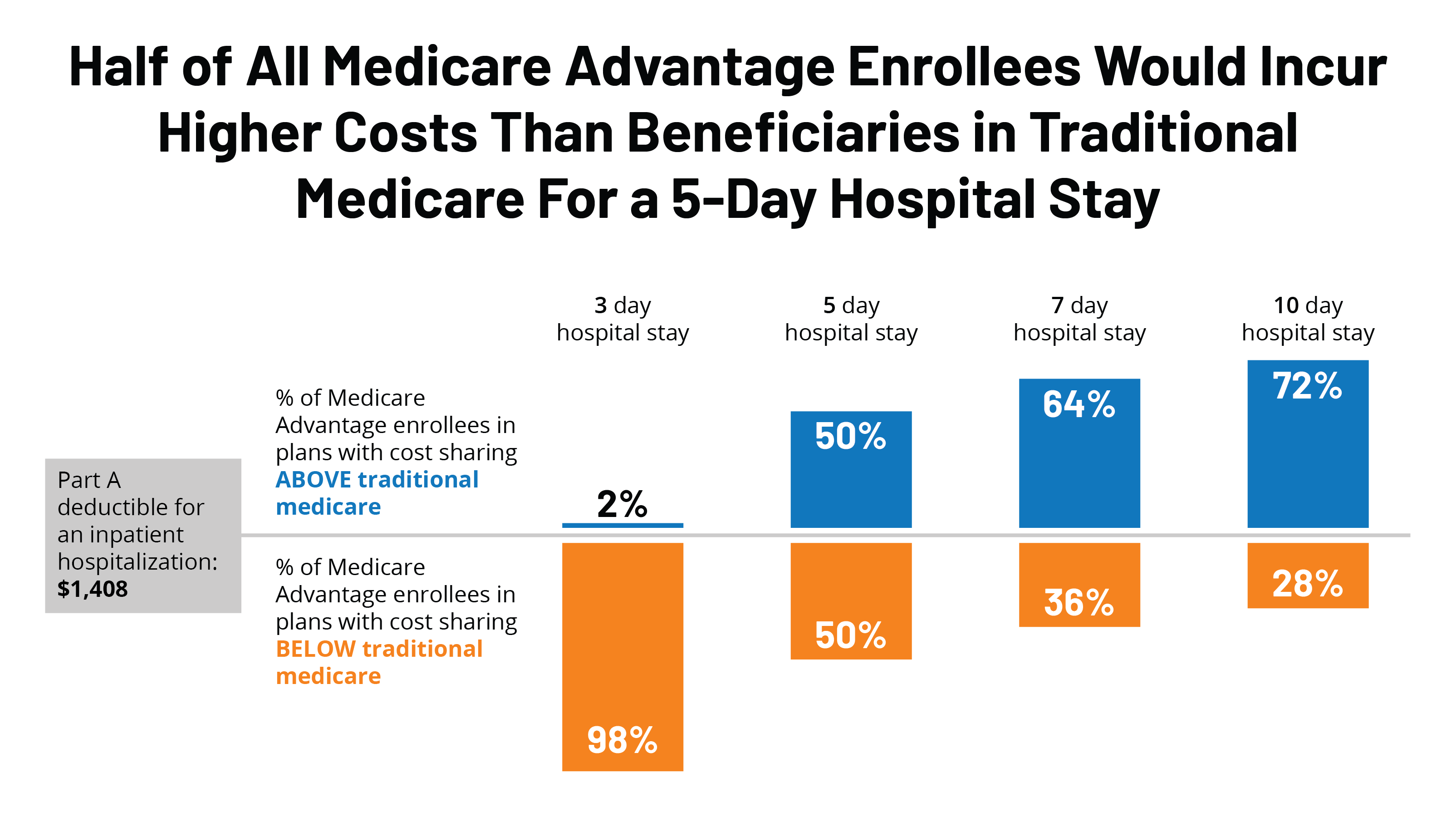

Medicare Advantage plans must cover all of the services that Original Medicare covers, including hospital stays. However, the number of days covered may vary by plan. Some plans may offer additional hospitalization days beyond the 90 days covered by Original Medicare. It is important to review your plan’s coverage details to understand how many hospital days are covered.

Benefits of Medicare Advantage Coverage for Hospital Stays

Medicare Advantage plans can offer additional benefits beyond Original Medicare coverage, such as prescription drug coverage, vision, and dental care. Additionally, some plans may offer additional hospitalization days beyond the 90 days covered by Original Medicare. Medicare Advantage plans may also have lower out-of-pocket costs than Original Medicare.

Medicare Advantage Coverage Vs Original Medicare Coverage

Medicare Advantage plans offer all of the benefits of Original Medicare, but they are offered by private insurance companies. The coverage and costs may vary by plan. Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, but they may also have more restrictions on which doctors and hospitals you can use. It is important to review your plan’s coverage details to understand the costs and limitations.

Conclusion

Medicare provides coverage for hospital stays through Medicare Part A and Medicare Advantage plans. Medicare Part A covers up to 90 days of hospitalization per benefit period, and Medicare Advantage plans may offer additional hospitalization days beyond the 90 days covered by Original Medicare. It is important to review your plan’s coverage details to understand how many hospital days are covered and any out-of-pocket costs associated with hospital stays.

Contents

- Frequently Asked Questions

- What is the Medicare policy regarding hospital stays?

- What is the difference between inpatient and outpatient hospital care?

- What happens if I exceed my Medicare coverage for hospital stays?

- Are there any exceptions to the Medicare policy regarding hospital stays?

- How can I check my Medicare coverage for hospital stays?

- Does Medicare Cover Hospital Stays?

Frequently Asked Questions

Medicare coverage is essential for senior citizens and people with disabilities. One of the most frequently asked questions is how many hospital days does Medicare cover? It’s crucial to understand the Medicare policy regarding hospital stays to make informed decisions about your healthcare.

What is the Medicare policy regarding hospital stays?

Medicare Part A, which covers hospital stays, covers up to 90 days of inpatient hospital care per benefit period. A benefit period begins the day you’re admitted to a hospital and ends when you haven’t received hospital care for 60 consecutive days. If you’re admitted to the hospital again after this period, a new benefit period begins.

If you’re hospitalized for more than 90 days during a benefit period, you may use your lifetime reserve days. You have 60 lifetime reserve days, and you can only use them once. After you’ve used all of your lifetime reserve days, you must pay all hospital costs out of pocket.

What is the difference between inpatient and outpatient hospital care?

Inpatient hospital care requires you to be admitted to the hospital as an overnight patient, and it’s covered under Medicare Part A. Outpatient hospital care involves receiving medical treatment without being admitted to the hospital, and it’s covered under Medicare Part B.

Under Medicare Part B, you’re responsible for a 20% coinsurance for outpatient hospital care. However, if you’re enrolled in a Medicare Advantage plan, your coinsurance may vary depending on your plan’s benefits.

What happens if I exceed my Medicare coverage for hospital stays?

If you exceed your Medicare coverage for hospital stays, you’ll be responsible for paying the additional costs out of pocket. If you have a Medicare Supplement Insurance (Medigap) policy, it may cover the costs that Medicare doesn’t cover. However, if you don’t have a Medigap policy, you’ll be responsible for paying the remaining costs.

It’s essential to discuss your healthcare needs with your healthcare provider and insurance provider to ensure you have adequate coverage for hospital stays.

Are there any exceptions to the Medicare policy regarding hospital stays?

Yes, there are exceptions to the Medicare policy regarding hospital stays. If you require extended hospital care due to a severe medical condition, Medicare may cover additional days. Medicare may also cover additional days if your doctor certifies that you require continued hospital care for a specific medical condition.

It’s important to discuss your medical needs with your healthcare provider to determine if you qualify for additional hospital days under Medicare.

How can I check my Medicare coverage for hospital stays?

You can check your Medicare coverage for hospital stays by reviewing your Medicare Summary Notice (MSN). Your MSN is a summary of your Medicare-covered services and includes information about your hospital stays. You can also contact Medicare directly by calling 1-800-MEDICARE or visiting the Medicare website at www.medicare.gov.

If you have additional questions or concerns about your Medicare coverage for hospital stays, it’s essential to speak with your healthcare provider or insurance provider for more information.

Does Medicare Cover Hospital Stays?

In conclusion, understanding how many hospital days Medicare covers is crucial for anyone who wants to make the most out of their healthcare coverage. With the help of Medicare, you can rest assured that your hospital stay will be covered for a certain amount of time, depending on your plan.

It’s important to note that while Medicare does provide coverage for hospital days, the number of days covered may vary depending on the type of plan you have. This is why it’s essential to do your research and choose a plan that fits your specific needs and budget.

In summary, by taking the time to understand how many hospital days Medicare covers, you can make informed decisions about your healthcare and ensure that you have the coverage you need when you need it most. Don’t hesitate to reach out to a healthcare professional or insurance provider for more information about Medicare coverage and how it can benefit you.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts