Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching the age of 65 and wondering when you can apply for Medicare Supplemental Insurance? You’re not alone. Many people have questions about their eligibility and the best time to enroll in this valuable coverage. In this article, we’ll explore the ins and outs of Medicare Supplemental Insurance, including when you can apply, what it covers, and how it can benefit you. So, let’s dive in and get started!

When Can I Apply for Medicare Supplemental Insurance?

If you’re over the age of 65 and enrolled in Medicare, you may be wondering when you can apply for Medicare supplemental insurance. Also known as Medigap, these policies can help cover the out-of-pocket costs that come with Original Medicare, such as deductibles, copayments, and coinsurance. In this article, we’ll explore when you can apply for Medigap coverage and what you should consider before making a decision.

Initial Enrollment Period

When you first enroll in Medicare, you have a seven-month window called the Initial Enrollment Period (IEP) to sign up for a Medigap policy. This period begins three months before your 65th birthday, includes the month you turn 65, and ends three months after your birthday month. During this time, insurance companies cannot deny you coverage or charge you more based on pre-existing conditions.

If you miss your IEP, you may still be able to enroll in Medigap, but you could face medical underwriting, which means the insurance company can review your health history and charge you a higher premium or deny you coverage altogether.

Guaranteed Issue Rights

In some situations, you may be eligible for guaranteed issue rights, which means you can enroll in a Medigap policy without undergoing medical underwriting. These situations include:

- Your Medigap policy is ending, and you’re switching to a new policy

- You’re losing your current coverage (e.g., employer-sponsored insurance)

- You’re enrolled in Medicare Advantage, and your plan is leaving the Medicare program or no longer serving your area

- You’re moving out of your current Medigap policy’s service area

It’s important to note that guaranteed issue rights have specific timeframes, so it’s crucial to act quickly if you’re eligible.

Open Enrollment Period

If you miss your IEP and don’t qualify for guaranteed issue rights, you may still be able to enroll in a Medigap policy during the Open Enrollment Period (OEP). This period begins on the first day of the month that you’re both 65 or older and enrolled in Medicare Part B and lasts for six months.

During this time, insurance companies cannot deny you coverage or charge you more based on pre-existing conditions. However, if you enroll in Medigap outside of the OEP, you may face medical underwriting.

Benefits of Medigap

Medigap policies can offer numerous benefits, including:

- Lower out-of-pocket costs for Medicare-covered services

- Freedom to see any doctor or specialist who accepts Medicare

- Predictable healthcare costs with fixed monthly premiums

- Coverage for healthcare services when traveling overseas

- Guaranteed renewable coverage for life

Medigap vs. Medicare Advantage

While Medigap policies work alongside Original Medicare, Medicare Advantage plans replace Medicare and provide coverage through a private insurance company. Some differences between the two include:

| Medigap | Medicare Advantage | |

|---|---|---|

| Coverage | Supplements Original Medicare | Replaces Original Medicare |

| Costs | Premiums + out-of-pocket costs | Varies by plan; may have lower out-of-pocket costs |

| Choice of doctors | Can see any doctor who accepts Medicare | May be limited to a network of doctors |

| Prescription drug coverage | No coverage; must enroll in a separate Part D plan | Included in many plans |

Ultimately, the decision between Medigap and Medicare Advantage depends on your healthcare needs and budget.

Final Thoughts

Understanding when you can apply for Medigap coverage is essential to ensure you have the protection you need. Whether you’re in your IEP, qualify for guaranteed issue rights, or are within the OEP, it’s crucial to explore your options and choose a policy that meets your needs. Additionally, comparing the benefits and costs of Medigap versus Medicare Advantage can help you make an informed decision about your healthcare coverage.

Contents

Frequently Asked Questions

When can I apply for Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also known as Medigap, is designed to help cover out-of-pocket costs not covered by Original Medicare. The best time to apply for Medigap is during the Medigap Open Enrollment Period, which is the six-month period that begins on the first day of the month in which an individual turns 65 and is enrolled in Medicare Part B. During this time, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions.

However, if an individual misses the Medigap Open Enrollment Period, they may still be able to apply for coverage, but they may be subject to medical underwriting, which means the insurance company can charge higher premiums or even deny coverage based on pre-existing conditions. It’s important to note that some states have additional open enrollment periods or guaranteed issue rights, so it’s important to check with the state insurance department or a licensed insurance agent for more information.

What does Medicare Supplemental Insurance cover?

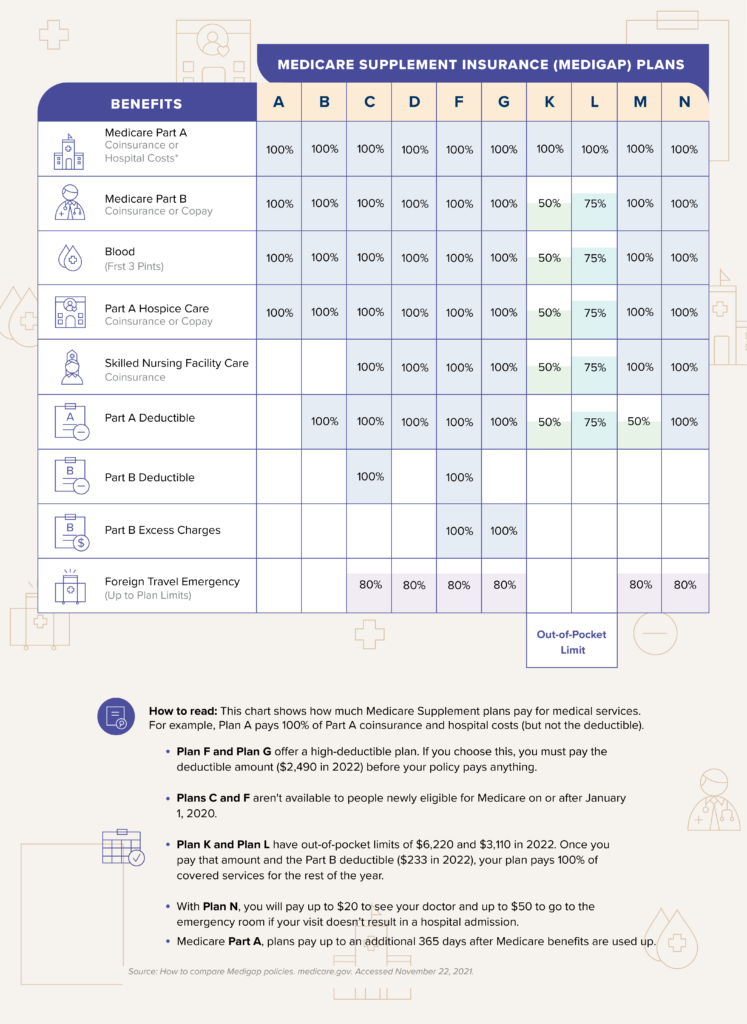

Medicare Supplemental Insurance plans are standardized and labeled A through N, each with different levels of coverage. All plans cover some portion of Medicare Part A and Part B coinsurance, copayments, and deductibles. Some plans also offer coverage for services not covered by Original Medicare, such as foreign travel emergency care or excess charges from providers who don’t accept Medicare assignment.

It’s important to review the different plans and their coverage options to determine which plan best fits an individual’s needs and budget. It’s also important to note that Medigap plans do not cover prescription drugs, so individuals may need to enroll in a separate Medicare Part D plan for prescription drug coverage.

Can I switch Medicare Supplemental Insurance plans?

Yes, individuals can switch Medigap plans at any time, but they may be subject to medical underwriting if they switch outside of their initial enrollment period or a state-specific open enrollment period. It’s important to review the coverage options and costs of different plans before making a switch to ensure it meets their needs and budget.

How much does Medicare Supplemental Insurance cost?

The cost of Medigap plans varies depending on the plan level, location, and insurance company. Premiums can range from a few hundred dollars to over a thousand dollars per month. In addition to the monthly premium, some plans may have out-of-pocket costs such as deductibles or copayments.

It’s important to review different plans and their costs to determine which plan best fits an individual’s needs and budget. It’s also important to note that some insurance companies offer discounts for things like non-smoking or paying premiums annually instead of monthly.

Do I need Medicare Supplemental Insurance?

While Medigap plans are not required, they can be a valuable option for individuals who want to limit their out-of-pocket costs and have more predictable healthcare expenses. Medigap plans can also provide peace of mind for individuals who may be concerned about unexpected medical costs.

It’s important to review an individual’s healthcare needs and budget to determine if a Medigap plan is right for them. Additionally, some individuals may be eligible for other healthcare coverage options, such as Medicare Advantage plans or Medicaid, which may better meet their needs and budget.

When Can I Enroll in Medicare Supplement?

In conclusion, Medicare Supplemental Insurance can provide additional coverage to help you pay for expenses that Original Medicare doesn’t cover. If you’re wondering when you can apply for Medicare Supplemental Insurance, the answer is during your Medigap Open Enrollment Period. This period begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B and lasts for six months.

It’s important to note that if you miss this enrollment period, you may still be able to sign up for a Medicare Supplemental Insurance plan, but you may face higher premiums or even be denied coverage altogether. So, it’s best to enroll during your Medigap Open Enrollment Period to ensure you have the best options available to you.

Overall, Medicare Supplemental Insurance can provide you with peace of mind by helping to cover expenses that Original Medicare doesn’t. By understanding when you can enroll in a plan, you can make the most informed decision about your healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts