Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, many of us may require long-term care, and nursing homes are one of the options available. But the cost of such care can be overwhelming. For those who are eligible, Medicare can help cover some of the expenses, including the length of stay in a nursing home.

However, the question remains: how many days will Medicare pay for nursing home care? This is a crucial question that many seniors and their families ask, and understanding the answer can help them plan for the future. In this article, we will explore the details of Medicare coverage for nursing homes and shed some light on this important question.

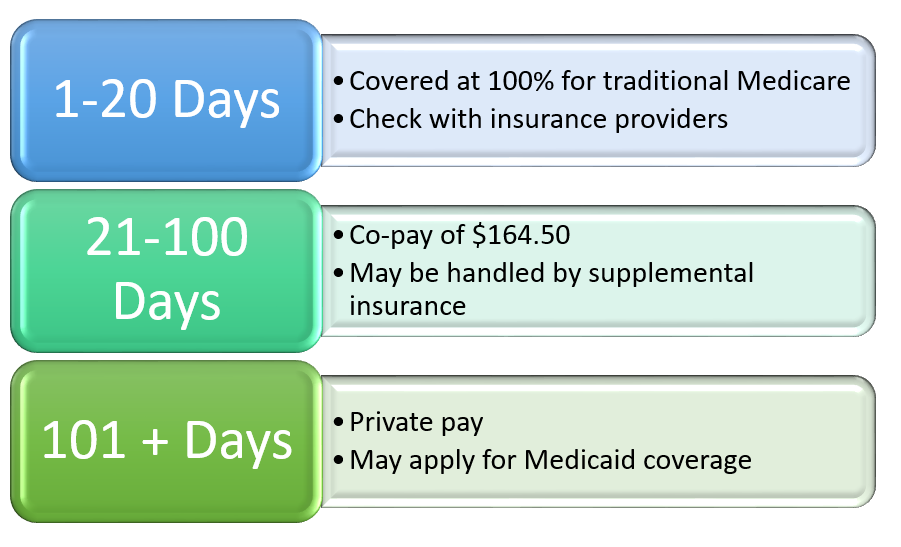

Medicare will pay for up to 100 days of skilled nursing home care under certain conditions. To qualify, you must have a qualifying hospital stay of at least three days and require skilled nursing care. Medicare will cover the full cost of care for the first 20 days, but you must pay a daily co-insurance fee for days 21-100. After 100 days, you will need to pay for the full cost of care.

How Many Days Will Medicare Pay for Nursing Home?

Medicare is a government program that provides health insurance for people aged 65 or older, as well as for younger people with certain disabilities. One of the benefits of Medicare is coverage for nursing home care. However, it’s important to understand how many days of nursing home care Medicare will pay for.

Medicare Coverage for Nursing Home Care

Medicare provides coverage for nursing home care, but only under certain circumstances. To be eligible for Medicare coverage for nursing home care, you must have a qualifying hospital stay. This means that you must have been admitted to the hospital as an inpatient for at least three consecutive days. Additionally, you must need skilled nursing care on a daily basis.

If you meet these requirements, Medicare will cover the cost of skilled nursing care for up to 100 days. However, after the first 20 days, you will be responsible for a daily coinsurance amount. The coinsurance amount for 2021 is $185.50 per day.

What Happens After 100 Days?

After 100 days of skilled nursing care, Medicare will no longer cover the cost of your nursing home care. At this point, you will need to either pay for your care out of pocket or have another form of insurance that will cover the cost.

If you have a Medicare Advantage plan, you may have additional coverage for nursing home care. Some Medicare Advantage plans offer extended nursing home coverage beyond the 100 days provided by original Medicare. However, the terms and conditions of these plans can vary widely, so it’s important to check with your plan to see what is covered.

Benefits of Medicare Coverage for Nursing Home Care

Medicare coverage for nursing home care can be a lifesaver for seniors and their families. Nursing home care can be incredibly expensive, with the average cost of a private room exceeding $100,000 per year. Without Medicare coverage, many seniors would be unable to afford the care they need.

Additionally, nursing home care can be essential for seniors who need skilled nursing care on a daily basis. This type of care can include things like wound care, physical therapy, and medication management. Medicare coverage ensures that seniors have access to the care they need to maintain their health and wellbeing.

Nursing Home Care vs. Assisted Living

It’s important to note that nursing home care is not the same as assisted living. Assisted living facilities provide a lower level of care than nursing homes and are not typically covered by Medicare. Assisted living facilities provide assistance with daily living activities such as bathing, dressing, and meal preparation. However, they do not provide skilled nursing care.

If you or a loved one needs assistance with daily living activities but does not require skilled nursing care, an assisted living facility may be a more appropriate option. However, it’s important to note that assisted living facilities can also be expensive and may not be covered by insurance.

Conclusion

Medicare provides coverage for nursing home care for up to 100 days for those who meet certain eligibility requirements. After 100 days, you will need to find another form of insurance or pay for your care out of pocket. Medicare coverage can be a lifesaver for seniors and their families, ensuring that they have access to the care they need to maintain their health and wellbeing. However, it’s important to understand the difference between nursing home care and assisted living and to choose the option that best meets your needs.

Contents

- Frequently Asked Questions

- 1. How many days will Medicare pay for nursing home care?

- 2. Can I receive Medicare coverage for nursing home care more than once?

- 3. What happens if I leave the nursing home during my Medicare coverage period?

- 4. Can I choose any nursing home and still receive Medicare coverage?

- 5. What if I have long-term care insurance, can I still receive Medicare coverage for nursing home care?

- How Medicare pays for your Nursing Home Care

Frequently Asked Questions

Medicare provides coverage for nursing home care, but many people are unsure about how long this coverage will last. Here are some answers to common questions about Medicare and nursing home coverage.

1. How many days will Medicare pay for nursing home care?

Medicare covers up to 100 days of skilled nursing care per benefit period. To qualify for Medicare coverage, you must have a qualifying hospital stay of at least three days and be admitted to a Medicare-certified skilled nursing facility within 30 days of that stay. During the first 20 days, Medicare pays the full cost of care. For days 21 through 100, you will be responsible for a daily coinsurance amount. After day 100, you are responsible for all nursing home costs.

It is important to note that Medicare does not cover custodial care, which is non-medical care provided to help you with activities of daily living, such as bathing and dressing. If you require custodial care, you will be responsible for the full cost of this care.

2. Can I receive Medicare coverage for nursing home care more than once?

Yes, you can receive Medicare coverage for nursing home care more than once. However, you must meet the qualifying criteria for each benefit period. This means that you must have a qualifying hospital stay of at least three days and be admitted to a Medicare-certified skilled nursing facility within 30 days of that stay. Additionally, there must be a break of at least 60 days between benefit periods.

If you require nursing home care after you have exhausted your Medicare coverage, you may be able to receive coverage from Medicaid, which is a joint federal and state program that provides health coverage to people with low income and limited resources.

3. What happens if I leave the nursing home during my Medicare coverage period?

If you leave the nursing home during your Medicare coverage period, your coverage will not be affected as long as you return within 30 days. If you leave and do not return within 30 days, your Medicare coverage will end, and you will be responsible for all nursing home costs from that point forward.

If you need to leave the nursing home for an extended period of time, it is important to discuss this with your healthcare provider and the nursing home staff to ensure that your coverage will not be affected.

4. Can I choose any nursing home and still receive Medicare coverage?

No, you cannot choose any nursing home and expect to receive Medicare coverage. To receive Medicare coverage for nursing home care, you must be admitted to a Medicare-certified skilled nursing facility. These facilities have met certain standards and are approved by Medicare to provide skilled nursing care.

You can find Medicare-certified nursing homes in your area by using the Nursing Home Compare tool on the Medicare website or by contacting your State Health Insurance Assistance Program (SHIP) for assistance.

5. What if I have long-term care insurance, can I still receive Medicare coverage for nursing home care?

Yes, you can still receive Medicare coverage for nursing home care if you have long-term care insurance. However, your long-term care insurance may cover some or all of the costs that Medicare does not cover, such as custodial care. It is important to review your long-term care insurance policy to understand what is covered and what is not covered.

If you have both Medicare and long-term care insurance, your long-term care insurance may be used to supplement your Medicare coverage and help cover some of the costs that Medicare does not cover.

How Medicare pays for your Nursing Home Care

In conclusion, understanding how many days Medicare will pay for nursing home care is essential for individuals who are planning for their long-term care needs. While Medicare does cover a portion of nursing home costs, it only pays for a limited number of days. Knowing this information can help individuals plan for their financial future and explore other options for long-term care, such as Medicaid or long-term care insurance.

It is important to note that Medicare coverage for nursing home care can vary depending on the individual’s specific circumstances and the services they require. Therefore, it is crucial to consult with a qualified healthcare professional or financial planner to gain a better understanding of the costs and coverage options available.

In summary, while Medicare can be a valuable source of financial support for nursing home care, it is not a comprehensive solution. By understanding the limitations of Medicare coverage and exploring other options for long-term care planning, individuals can ensure that they are prepared for their future healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts