Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that covers millions of Americans aged 65 and over, as well as those with certain disabilities. It’s a vital program that ensures seniors have access to affordable medical care. However, navigating the intricacies of Medicare can be daunting, especially when it comes to deductibles. So, what is the yearly deductible for Medicare?

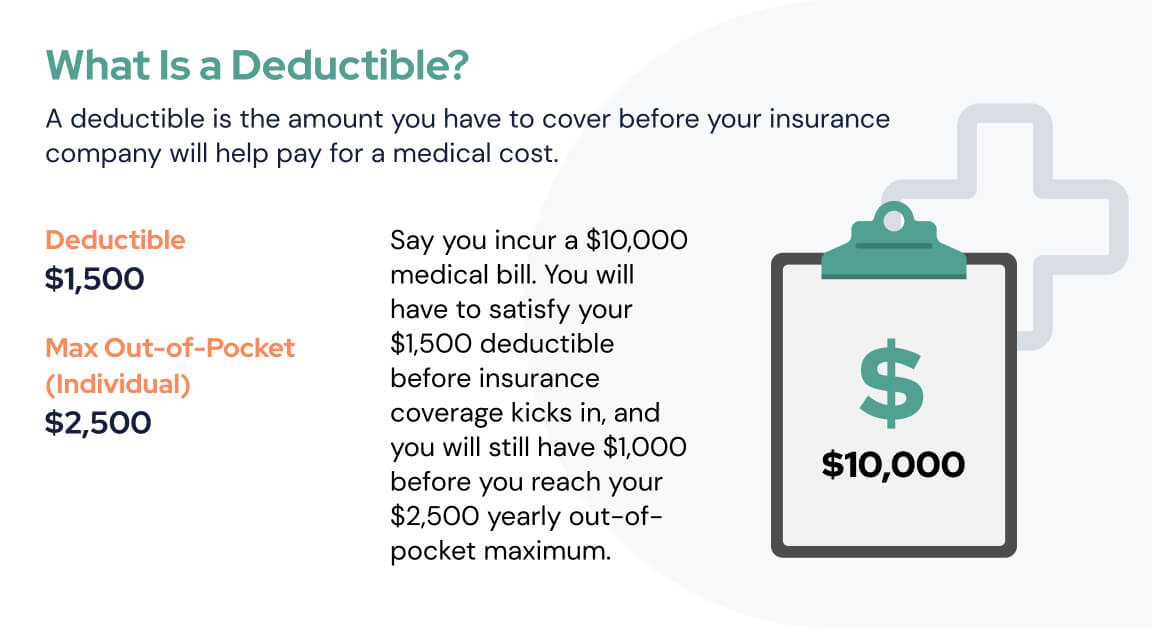

To put it simply, the yearly deductible for Medicare is the amount of money you must pay out of pocket each year before your Medicare coverage begins. It’s an important aspect of Medicare, as it can have a significant impact on your overall healthcare costs. In this article, we’ll dive deeper into what the yearly deductible is, how it works, and what you can expect to pay.

The Medicare Part A deductible for 2021 is $1,484 per benefit period. The benefit period begins the day you’re admitted to a hospital as an inpatient and ends when you haven’t received any inpatient hospital care for 60 days in a row. The Part B deductible for 2021 is $203 per year. Once you meet your Part B deductible, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you’re a hospital inpatient), outpatient therapy, and durable medical equipment (DME).

Contents

- Understanding the Medicare Yearly Deductible

- Frequently Asked Questions

- What is the yearly deductible for Medicare?

- Do I have to pay the yearly deductible every year?

- Is the yearly deductible different for different beneficiaries?

- Can I change my Medicare plan to avoid paying the yearly deductible?

- What happens if I can’t afford to pay the yearly deductible?

- What is the Medicare Deductible 2021

Understanding the Medicare Yearly Deductible

When it comes to healthcare expenses, Medicare plays a significant role in the lives of many seniors and disabled individuals. The Medicare program is designed to provide health insurance for individuals over 65 years of age or those with certain disabilities. However, it’s important to understand the different costs associated with Medicare coverage, including the yearly deductible. In this article, we’ll explore what the yearly deductible for Medicare is and how it impacts your healthcare expenses.

What is a Medicare Yearly Deductible?

A Medicare deductible is the amount that you must pay out of pocket before Medicare coverage kicks in. This means that you’ll be responsible for paying a certain amount before your Medicare benefits start to cover the remaining costs. The yearly deductible for Medicare is the amount you must pay each year before Medicare will cover your healthcare expenses.

In 2021, the yearly deductible for Medicare Part A is $1,484. This means that you’ll be responsible for paying the first $1,484 of your healthcare expenses each year before Medicare coverage begins. The deductible for Medicare Part B is $203 per year. You’ll need to pay this amount before Medicare coverage starts paying for your doctor visits and other outpatient services.

How Does the Medicare Deductible Work?

The Medicare deductible works differently for each part of Medicare. For Medicare Part A, the deductible applies to each benefit period. A benefit period begins when you are admitted to the hospital and ends when you haven’t received any hospital care for 60 consecutive days. If you are admitted to the hospital more than once during the same benefit period, you won’t have to pay the deductible again.

For Medicare Part B, the deductible applies to all services covered under Part B, such as doctor visits, lab tests, and outpatient services. Once you’ve met your Part B deductible for the year, you’ll typically pay 20% of the Medicare-approved amount for these services.

Benefits of the Medicare Deductible

While paying a yearly deductible may seem like an added expense, it’s important to remember that the Medicare program provides significant benefits to seniors and disabled individuals. The yearly deductible helps to keep healthcare costs down for everyone by encouraging individuals to be more mindful of their healthcare expenses.

Additionally, once you’ve met your Medicare deductible for the year, you’ll typically pay less for healthcare services since Medicare will cover a portion of the cost. This can be especially beneficial for individuals who require ongoing medical care or have chronic conditions that require frequent visits to the doctor.

Medicare Deductible Vs. Premiums

It’s important to understand the difference between Medicare deductibles and premiums. While the deductible is the amount you must pay out of pocket before Medicare coverage begins, premiums are the monthly payments you make to maintain your Medicare coverage.

In general, the higher your premium, the lower your deductible will be. However, it’s important to weigh the costs and benefits of each plan option before making a decision. Choosing a plan with a lower premium may seem more affordable in the short term, but a higher deductible could end up costing you more in the long run.

Conclusion

Understanding the Medicare yearly deductible is an important part of managing your healthcare expenses. While it may seem like an added expense, the yearly deductible helps to keep healthcare costs down for everyone. By taking the time to understand how the deductible works and comparing plan options, you can make informed decisions about your healthcare coverage and minimize your out-of-pocket expenses.

Frequently Asked Questions

Medicare is a federal health insurance program that provides coverage to individuals who are 65 years or older, those with certain disabilities, and those with end-stage renal disease. One of the key features of Medicare is the yearly deductible that beneficiaries must pay before their coverage begins. Here are some frequently asked questions about the yearly deductible for Medicare:

What is the yearly deductible for Medicare?

The yearly deductible for Medicare varies depending on the type of Medicare plan you have. For Medicare Part A, which covers hospital stays, the yearly deductible is $1,484 in 2021. This means that beneficiaries must pay $1,484 out of pocket before their coverage kicks in. For Medicare Part B, which covers doctor visits and other outpatient services, the yearly deductible is $203 in 2021. This means that beneficiaries must pay $203 out of pocket before their coverage begins.

It’s important to note that some Medicare Advantage plans may have different deductibles and cost-sharing requirements than traditional Medicare. If you’re enrolled in a Medicare Advantage plan, you should review your plan documents to understand your specific costs.

Do I have to pay the yearly deductible every year?

Yes, beneficiaries must pay the yearly deductible for each year they are enrolled in Medicare. The deductible resets each year on January 1st. This means that even if you met your deductible in the previous year, you will need to pay it again in the new year. However, beneficiaries who have a Medigap policy may have some or all of their deductible covered by their policy.

It’s also important to note that some services, such as preventive care, may be covered by Medicare without being subject to the deductible. Beneficiaries should review their plan documents to understand what services are covered and what costs they may be responsible for.

Is the yearly deductible different for different beneficiaries?

No, the yearly deductible is the same for all beneficiaries enrolled in Medicare. However, the deductible may be adjusted each year based on inflation and other factors. Additionally, beneficiaries with higher incomes may be subject to higher premiums and cost-sharing requirements under Medicare.

If you have questions about your specific costs under Medicare, you should contact Medicare or your plan administrator for more information.

Can I change my Medicare plan to avoid paying the yearly deductible?

It’s possible to change your Medicare plan during certain enrollment periods, but you may not be able to completely avoid paying the yearly deductible. Medicare Advantage plans may have different deductibles and cost-sharing requirements than traditional Medicare, but they may also have other costs, such as additional premiums or copays.

If you’re considering changing your Medicare plan, it’s important to review your current coverage and any potential new plans to understand the costs and benefits of each option.

What happens if I can’t afford to pay the yearly deductible?

If you’re having trouble affording the yearly deductible, there may be options available to help. Some beneficiaries may qualify for financial assistance programs, such as Medicaid or the Medicare Savings Programs, which can help cover some or all of their Medicare costs.

You can also contact Medicare or your plan administrator to discuss payment options or to request a payment plan. It’s important to keep up with your Medicare payments to avoid losing coverage or incurring additional costs.

What is the Medicare Deductible 2021

In conclusion, the yearly deductible for Medicare varies depending on the type of plan you have. For Part A, the deductible is $1,484 for each benefit period in 2021. For Part B, the deductible is $203 per year. However, some Medicare Advantage plans may have different deductibles and out-of-pocket costs. It’s important to review your plan’s details and understand your coverage to make informed healthcare decisions.

Overall, understanding the yearly deductible for Medicare is an important aspect of managing your healthcare costs. By knowing the deductible for your plan and how it applies to your care, you can better plan for medical expenses and make informed decisions about your health. Don’t hesitate to reach out to your plan’s provider or Medicare for more information on deductibles and other costs. With the right knowledge, you can take control of your healthcare and ensure you’re getting the best possible care at a reasonable cost.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts