Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Introduction:

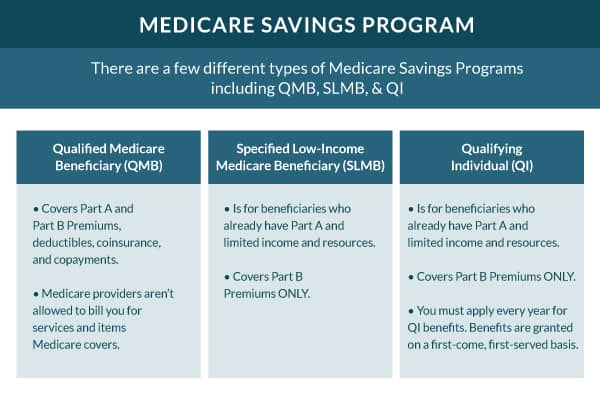

As we age, healthcare costs can become a significant burden on our finances. Fortunately, there are programs available to help alleviate some of that burden, such as the Medicare Savings Program. But what exactly does this program cover? Let’s take a closer look.

Paragraph 1:

The Medicare Savings Program is designed to help low-income seniors and individuals with disabilities afford healthcare costs that are not covered by traditional Medicare. This program provides financial assistance for premiums, deductibles, coinsurance, and copayments associated with Medicare Part A and Part B, as well as Medicare prescription drug coverage.

Paragraph 2:

In addition to financial assistance, the Medicare Savings Program may also cover other healthcare expenses, such as vision, dental, and hearing services. However, the specific coverage and eligibility requirements can vary depending on the state in which you live. It’s important to research and understand the program’s guidelines in your state to take advantage of the benefits it offers.

The Medicare Savings Program (MSP) is a state-run program that provides financial assistance to eligible Medicare beneficiaries. MSP pays for Medicare Part A and Part B premiums, deductibles, copayments, and coinsurance. It may also cover Medicare Advantage premiums and prescription drug costs. The program aims to help low-income individuals and families afford their healthcare expenses, ensuring they have access to necessary medical services. Eligibility for MSP varies by state and is based on income and other factors.

Understanding Medicare Savings Program and What It Pays For

Medicare Savings Program (MSP) is a state-administered program that provides financial assistance to eligible individuals who have limited income and assets to pay for their Medicare premiums, deductibles, coinsurance and other healthcare costs. This program is designed to help seniors and people with disabilities who struggle to afford their healthcare expenses and live on a fixed income. In this article, we will discuss what MSP pays for and how it works.

Medicare Premiums

Medicare Part A and Part B are the two main components of Original Medicare. Part A covers hospital and inpatient care, while Part B covers doctor visits, preventive services, and outpatient care. Most people don’t have to pay a premium for Part A because they or their spouse paid Medicare taxes while working. However, Part B requires a monthly premium, which can be a burden for some beneficiaries.

If you qualify for MSP, your state Medicaid program will pay for some or all of your Part B premium, depending on your income and assets. This means you will have more money in your pocket to cover other expenses, such as prescription drugs, copayments, or medical equipment.

Medicare Deductibles and Coinsurance

Medicare also requires beneficiaries to pay deductibles and coinsurance for certain services. For example, in 2021, the Part A deductible for hospital stays is $1,484 per benefit period, and the Part B deductible is $203 per year. In addition, beneficiaries may have to pay coinsurance for hospital stays that exceed a certain length or for outpatient services.

If you have MSP, your state Medicaid program may cover some or all of these costs. For instance, some states may pay for the Part A deductible or the Part B deductible and coinsurance. This can save you hundreds or thousands of dollars in out-of-pocket expenses.

Medicare Extra Help

Medicare Part D is the prescription drug coverage that helps beneficiaries pay for their medications. Part D plans are offered by private insurance companies, and their costs vary depending on the plan you choose, your income, and the drugs you take. However, if you have limited income and assets, you may qualify for Medicare Extra Help, which is a federal program that offers additional assistance with your Part D costs.

If you have MSP, you may be automatically enrolled in Medicare Extra Help, which can lower your Part D premiums, deductibles, and copayments. This can make your medications more affordable and easier to manage.

Benefits of Medicare Savings Program

There are several benefits of enrolling in Medicare Savings Program:

- You can save money on your Medicare premiums, deductibles, coinsurance, and prescription drugs.

- You can have peace of mind knowing that you have financial assistance to cover your healthcare expenses.

- You can access more healthcare services without worrying about the costs.

- You can improve your health outcomes by getting the care you need on a regular basis.

MSP vs. Medicare Advantage

Medicare Advantage is an alternative to Original Medicare that offers additional benefits, such as dental, vision, hearing, and fitness programs, in addition to the services covered by Part A and Part B. Medicare Advantage plans are offered by private insurance companies, and they may have different costs, networks, and coverage rules.

While Medicare Advantage can be a good option for some beneficiaries, it’s important to compare the costs and benefits of each plan and to choose the one that best meets your needs. MSP is a separate program that can help you pay for your Medicare expenses, regardless of whether you have Original Medicare or a Medicare Advantage plan.

How to Apply for Medicare Savings Program

To apply for MSP, you need to contact your state Medicaid agency and fill out an application form. You may need to provide proof of your income, assets, and citizenship or residency status. The eligibility criteria and benefits may vary by state, so it’s important to check the requirements and rules in your area.

In conclusion, Medicare Savings Program is a valuable resource for eligible beneficiaries who need financial assistance to pay for their Medicare expenses. Whether you need help with your premiums, deductibles, coinsurance, or prescription drugs, MSP may be able to offer you the support you need. If you think you qualify for MSP, contact your state Medicaid agency today and explore your options.

Frequently Asked Questions

Medicare Savings Program helps low-income Medicare beneficiaries pay for their healthcare costs. Here are some common questions about what the program pays for:

What is Medicare Savings Program?

Medicare Savings Program is a program that helps low-income Medicare beneficiaries pay for their healthcare costs. The program is designed to help people who have limited income and resources to pay for their healthcare expenses. The program is administered by the state and is funded by the federal government.

The program helps pay for some of the costs that are typically not covered by Medicare, such as deductibles, copayments, and coinsurance. The amount of assistance you can receive will depend on your income and the state you live in.

What healthcare costs does the program cover?

The Medicare Savings Program can help pay for some of the out-of-pocket costs associated with Medicare, such as deductibles, copays, and coinsurance. The program can also help pay for your Medicare Part B premium, which is the monthly fee you pay for Medicare coverage.

However, it’s important to note that the program does not cover everything. For example, it does not cover the cost of prescription drugs, and it does not cover the cost of long-term care.

Who is eligible for Medicare Savings Program?

To be eligible for Medicare Savings Program, you must be enrolled in Medicare Part A and have limited income and resources. The eligibility requirements vary by state, but generally, your income must be below a certain level to qualify for the program.

In addition, some states have asset limits, which means that your total assets must be below a certain amount to qualify for the program. To find out if you’re eligible for Medicare Savings Program in your state, you can contact your local Medicaid office or visit the Medicare website.

How do I apply for Medicare Savings Program?

To apply for Medicare Savings Program, you will need to contact your local Medicaid office. You can find the contact information for your local office on the Medicaid website or by calling the Medicare hotline.

When you apply, you will need to provide information about your income, assets, and healthcare expenses. The application process can vary by state, but generally, you will need to provide proof of your income and assets, such as tax returns and bank statements.

Can I still see my own doctor if I enroll in Medicare Savings Program?

Yes, you can still see your own doctor if you enroll in Medicare Savings Program. The program does not restrict your choice of healthcare providers, so you can continue to see the doctors and specialists you trust.

However, it’s important to note that the program may only cover certain services or treatments, so you may need to check with your doctor to make sure that the services you need are covered by the program.

✅ Medicare Savings Program – How Much Can You Save?

In conclusion, the Medicare Savings Program is a valuable resource for seniors and individuals with disabilities who struggle with the high costs of healthcare. This program helps pay for Medicare premiums, deductibles, and co-payments, which can provide significant financial relief. As a result, beneficiaries can access necessary medical services without worrying about out-of-pocket expenses.

It is important to note that eligibility for the program depends on income and asset levels, and the amount of assistance provided varies based on individual circumstances. However, for those who qualify, the Medicare Savings Program can make a big difference in their ability to afford healthcare.

Overall, the Medicare Savings Program is a crucial aspect of the Medicare system that supports the health and well-being of vulnerable populations. By providing financial assistance for necessary medical expenses, this program helps ensure that seniors and individuals with disabilities can access the care they need to live healthy and fulfilling lives.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts