Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program in the United States that provides coverage for people aged 65 and older, as well as some younger individuals with certain disabilities or medical conditions. Knowing when someone is eligible for Medicare is crucial for those approaching this milestone age, as well as for their family members and caregivers who may be assisting them.

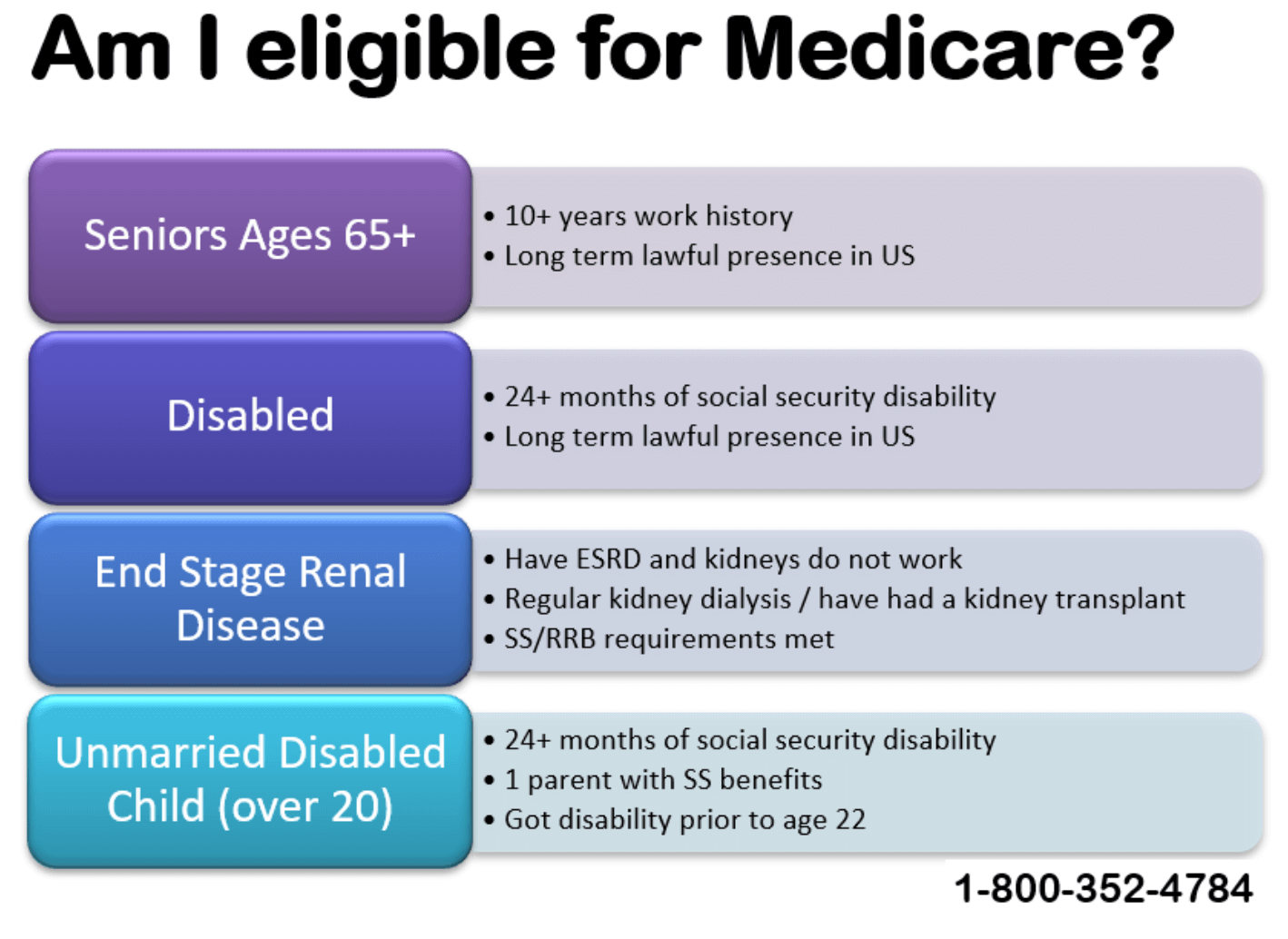

But how exactly does someone become eligible for Medicare? There are several factors to consider, including age, disability status, and work history. In this article, we will explore the various requirements for Medicare eligibility and provide some helpful tips for navigating the enrollment process.

Individuals who are 65 years or older and have lived in the United States for at least five continuous years are eligible for Medicare. People under 65 with certain disabilities or permanent kidney failure requiring dialysis or a transplant may also qualify. To enroll in Medicare, visit Social Security’s website or office three months prior to turning 65, during the seven-month initial enrollment period. After that period, enrollment is available during annual open enrollment periods.

When is Someone Medicare Eligible?

Medicare is a federal health insurance program that is available to those who are 65 years or older, as well as those who have certain disabilities or chronic conditions. However, there are specific requirements that individuals must meet in order to be eligible for Medicare. In this article, we will explore the various factors that determine Medicare eligibility.

Age Requirement

The most common way to become eligible for Medicare is through age. Individuals who are 65 years or older are eligible for Medicare, regardless of their income or health status. If you are turning 65, you can apply for Medicare during the 7-month period that begins 3 months before the month of your 65th birthday and ends 3 months after your birthday month.

Benefits of Medicare at Age 65

At age 65, you become eligible for Medicare Part A, which covers hospitalization, skilled nursing facility care, hospice care, and some home health care services. Medicare Part A is generally premium-free if you or your spouse have paid Medicare taxes for at least 10 years while working.

You can also enroll in Medicare Part B, which covers doctor visits, outpatient care, and some preventive services. However, you may need to pay a monthly premium for Part B.

Medicare Vs. Employer Coverage

If you are still working and have employer-sponsored health insurance, you may be able to delay enrolling in Medicare Part B. However, it is important to understand the rules and potential penalties for delaying enrollment.

Disability Requirements

In addition to age, individuals who have certain disabilities may also be eligible for Medicare. To qualify for Medicare due to disability, you must have received Social Security Disability Insurance (SSDI) for at least 24 months. You will be automatically enrolled in Medicare after you have received SSDI for 24 months.

Benefits of Medicare for People with Disabilities

Medicare coverage for people with disabilities is the same as coverage for those who are 65 or older. However, the eligibility requirements are different.

Medicare Vs. Medicaid for People with Disabilities

If you have a disability and low income, you may also be eligible for Medicaid, a joint federal and state program. Medicaid provides coverage for a wider range of services than Medicare, including long-term care.

Chronic Condition Requirements

Individuals with certain chronic conditions may also be eligible for Medicare. Medicare covers individuals with end-stage renal disease (ESRD), amyotrophic lateral sclerosis (ALS), and those who require a kidney transplant.

Benefits of Medicare for Individuals with Chronic Conditions

Medicare provides coverage for the treatment of chronic conditions, including dialysis for ESRD and home health care for ALS. Medicare can also cover the cost of a kidney transplant and related services.

Medicare Vs. Private Insurance for Chronic Conditions

If you have a chronic condition, you may also have private health insurance. It is important to understand the benefits and limitations of your private insurance, as well as the benefits and limitations of Medicare.

Conclusion

Medicare eligibility is determined by a variety of factors, including age, disability, and chronic conditions. If you meet the eligibility requirements, Medicare can provide coverage for a wide range of health care services. However, it is important to understand the rules and potential penalties for delaying enrollment in Medicare.

Frequently Asked Questions

1. When is someone eligible for Medicare?

To be eligible for Medicare, an individual must meet certain criteria. First and foremost, the person must be 65 years or older. Secondly, the individual must be a United States citizen or a permanent legal resident who has lived in the U.S. for at least 5 years. Additionally, the person must have paid into the Medicare system through payroll taxes for at least 10 years.

It’s important to note that there are some exceptions to these eligibility requirements. For example, individuals with certain disabilities or medical conditions may be eligible for Medicare before they turn 65. People with end-stage renal disease or amyotrophic lateral sclerosis (ALS) are two such examples.

2. When can someone enroll in Medicare?

The initial enrollment period for Medicare begins 3 months before an individual turns 65 and ends 3 months after their 65th birthday. It’s important to enroll during this period to avoid any late enrollment penalties.

However, there are other times when someone can enroll in Medicare outside of their initial enrollment period. For example, the annual enrollment period runs from October 15th to December 7th each year. During this time, individuals can make changes to their coverage or enroll in a new plan. Additionally, special enrollment periods exist for those who have recently lost their health insurance coverage or moved to a new area.

3. What are the different parts of Medicare?

Medicare is divided into several parts, each of which covers different services.

- Part A: This covers hospital stays, skilled nursing facilities, hospice care, and some home health care.

- Part B: This covers doctor visits, outpatient care, preventative services, and medical equipment.

- Part C: This is also known as Medicare Advantage and is offered by private insurance companies. It includes all the benefits of Parts A and B, as well as additional benefits like dental and vision care.

- Part D: This covers prescription drugs.

4. How much does Medicare cost?

The cost of Medicare varies depending on the specific plan and coverage options selected. Part A is typically free for those who have paid into the system through payroll taxes for at least 10 years. Part B comes with a monthly premium, which is determined by income level. Part C and Part D plans also have varying costs depending on the specific plan and coverage options selected.

It’s important to note that there are also additional costs associated with Medicare, such as deductibles, copayments, and coinsurance. However, there are also programs available to help low-income individuals and families with these costs.

5. What if someone has other health insurance?

If an individual has other health insurance, such as through an employer or union, they may still be eligible for Medicare. In some cases, the other insurance may pay first and Medicare will pay second. It’s important to speak with the insurance providers to determine how coverage will work and if any changes need to be made. Additionally, individuals may be able to opt out of certain parts of Medicare if they have other coverage that meets their needs.

Are You Eligible for Medicare? | Medicare Eligibility Requirements

In conclusion, Medicare eligibility is determined by age, disability status, or certain medical conditions. Turning 65 years old is the most common way to become eligible for Medicare. However, individuals with certain disabilities or medical conditions can also qualify for Medicare coverage before age 65.

It is important to note that Medicare is a crucial program that provides health insurance coverage to millions of Americans. Understanding the eligibility requirements and enrollment process is essential to ensure that individuals receive the healthcare coverage they need.

If you are approaching the age of 65 or have a disability or medical condition that may qualify you for Medicare, it is important to explore your options and understand your coverage choices. By doing so, you can take advantage of the many benefits that Medicare has to offer and ensure that you have the healthcare coverage you need to stay healthy and secure.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts