Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you confused about how federal tax withholding works? Specifically, are you wondering if it includes Social Security and Medicare? You’re not alone – many people are unsure about how these deductions work, and what they cover. In this article, we’ll explore the ins and outs of federal tax withholding and how it relates to Social Security and Medicare, so you can better understand your paycheck and your financial situation. Let’s dive in!

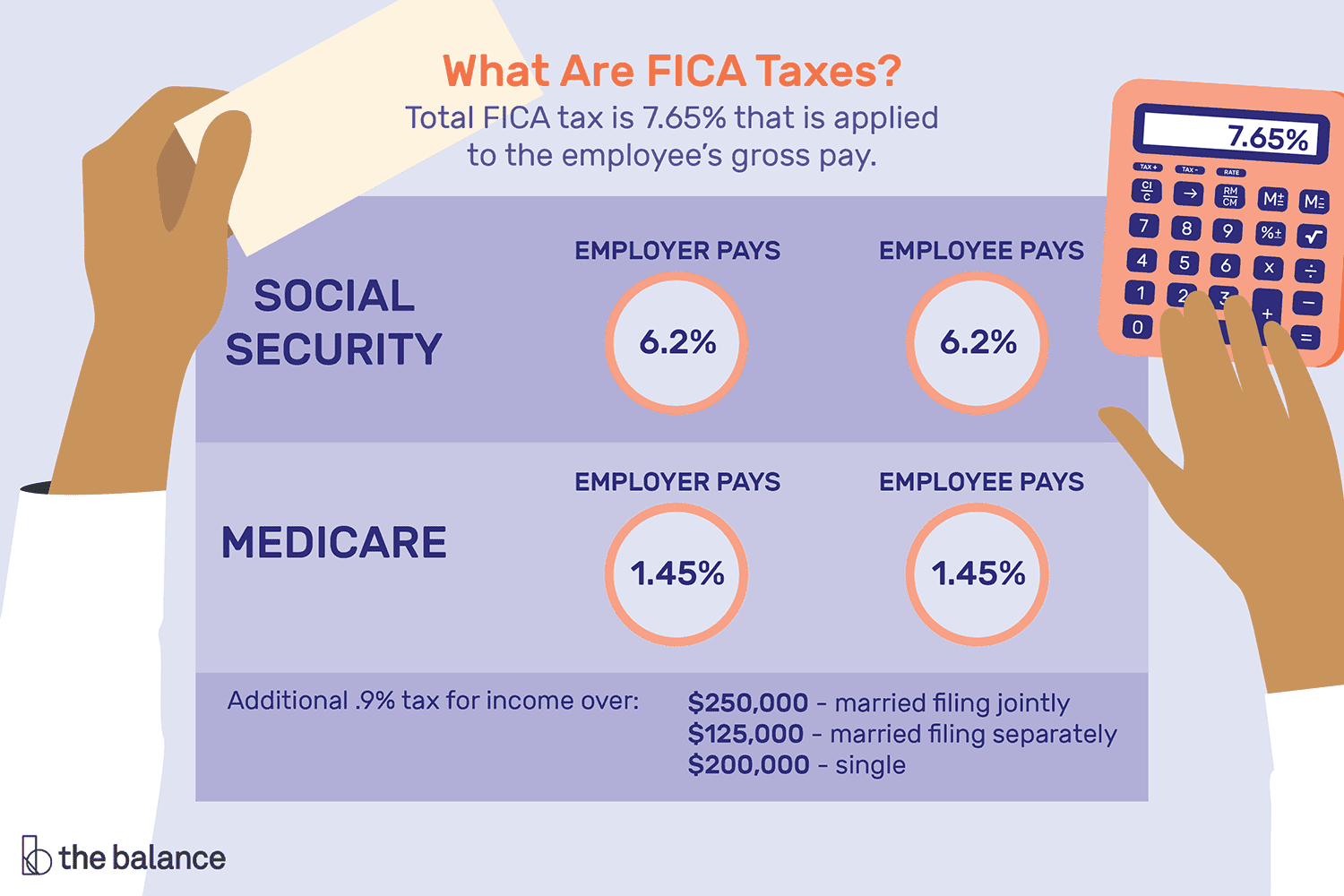

Yes, federal tax withholding includes Social Security and Medicare taxes, also known as FICA taxes. FICA stands for Federal Insurance Contributions Act, and it requires employers to withhold a percentage of an employee’s wages to fund Social Security and Medicare programs. The current FICA tax rate is 7.65%, which includes 6.2% for Social Security and 1.45% for Medicare.

Contents

- Does Federal Tax Withholding Include Social Security and Medicare?

- What is Federal Tax Withholding?

- What is Social Security?

- What is Medicare?

- Does Federal Tax Withholding Include Social Security and Medicare?

- Benefits of Federal Tax Withholding

- How to Adjust Federal Tax Withholding

- Benefits of Social Security

- Benefits of Medicare

- Federal Tax Withholding vs. Estimated Tax Payments

- Conclusion

- Frequently Asked Questions

- Does federal tax withholding include Social Security and Medicare?

- How is federal tax withholding calculated?

- What happens if I don’t have enough federal tax withholding?

- Can I change my federal tax withholding during the year?

- How do I know if my federal tax withholding is correct?

- Social Security and Medicare Deductions

Does Federal Tax Withholding Include Social Security and Medicare?

What is Federal Tax Withholding?

Federal tax withholding is a system where employers withhold a portion of an employee’s paycheck as income tax. This amount is sent to the Internal Revenue Service (IRS) on behalf of the employee. The amount withheld depends on the employee’s income and the number of allowances claimed on the W-4 form.

What is Social Security?

Social Security is a federal program that provides retirement, disability, and survivor benefits to eligible individuals. It is funded through payroll taxes, which are also known as FICA taxes. The Social Security tax rate is 6.2% for employees and 6.2% for employers, for a total of 12.4%.

What is Medicare?

Medicare is a federal health insurance program for elderly and disabled individuals. It is also funded through payroll taxes, with a tax rate of 1.45% for employees and 1.45% for employers, for a total of 2.9%.

Does Federal Tax Withholding Include Social Security and Medicare?

Yes, federal tax withholding includes both Social Security and Medicare taxes. These taxes are withheld from an employee’s paycheck along with federal income tax. The total amount withheld is reported on the employee’s W-2 form at the end of the year.

Benefits of Federal Tax Withholding

Federal tax withholding ensures that employees pay their income taxes throughout the year, rather than having to pay a large sum at tax time. It also helps to fund important federal programs like Social Security and Medicare.

How to Adjust Federal Tax Withholding

Employees can adjust their federal tax withholding by filling out a new W-4 form with their employer. This form allows employees to claim more or fewer allowances, which will affect the amount of tax withheld from their paycheck.

Benefits of Social Security

Social Security provides a safety net for elderly and disabled individuals who may not have enough savings or other sources of income. It also provides survivor benefits for spouses and children of deceased workers.

Benefits of Medicare

Medicare provides access to affordable healthcare for elderly and disabled individuals. It covers a wide range of medical services, including hospital stays, doctor visits, and prescription drugs.

Federal Tax Withholding vs. Estimated Tax Payments

Some self-employed individuals or those with other sources of income may need to make estimated tax payments throughout the year. This is different from federal tax withholding, where taxes are automatically deducted from a paycheck.

Conclusion

Federal tax withholding includes both Social Security and Medicare taxes, which are important federal programs that provide benefits to eligible individuals. Adjusting federal tax withholding can help employees manage their tax liability throughout the year.

Frequently Asked Questions

Does federal tax withholding include Social Security and Medicare?

Yes, federal tax withholding includes Social Security and Medicare. These taxes are collectively known as FICA taxes. FICA stands for Federal Insurance Contributions Act, and it requires employers to withhold a certain percentage of each employee’s paycheck to fund Social Security and Medicare.

Social Security tax is currently set at 6.2% of your gross pay, up to a certain income limit. Medicare tax is set at 1.45% of your gross pay, with no income limit. These taxes are separate from federal income tax, which is also withheld from your paycheck.

How is federal tax withholding calculated?

Federal tax withholding is calculated based on your income, filing status, and the number of allowances you claim on your W-4 form. Your employer uses the IRS tax tables to determine how much to withhold from each paycheck.

If you have additional income or deductions, you may need to adjust your withholding to avoid owing money at tax time. You can use the IRS withholding calculator to estimate your tax liability and determine the appropriate number of allowances to claim.

What happens if I don’t have enough federal tax withholding?

If you don’t have enough federal tax withholding, you may owe money at tax time. You may also be subject to penalties and interest for underpayment of taxes. To avoid this, you should review your withholding periodically and adjust it as needed.

If you are self-employed or have income from sources other than your job, you may need to make estimated tax payments throughout the year. You can use Form 1040-ES to calculate and pay your estimated taxes.

Can I change my federal tax withholding during the year?

Yes, you can change your federal tax withholding during the year by submitting a new W-4 form to your employer. You may want to do this if your financial situation changes, such as if you get married, have a child, or start a new job.

You can also change your withholding if you find that you are owing too much or getting too much of a refund at tax time. To change your withholding, simply submit a new W-4 form with the updated information.

How do I know if my federal tax withholding is correct?

To know if your federal tax withholding is correct, you should review your pay stubs and compare the amount of federal tax withheld to your estimated tax liability. You can use the IRS withholding calculator to estimate your tax liability and determine the appropriate number of allowances to claim on your W-4 form.

If you find that you are owing too much or getting too much of a refund at tax time, you may need to adjust your withholding. You can do this by submitting a new W-4 form to your employer with the updated information.

Social Security and Medicare Deductions

In conclusion, federal tax withholding does not include Social Security and Medicare. These two programs are separate from federal income taxes and have their own separate withholding rates. It’s important to understand the difference between federal income taxes, Social Security, and Medicare taxes to ensure that you are properly withholding the correct amounts from your paycheck.

When it comes to federal income taxes, the amount withheld from your paycheck depends on your income, filing status, and any deductions or credits you may claim. Social Security and Medicare taxes, on the other hand, are calculated as a percentage of your total wages and are used to fund those particular programs.

While federal tax withholding does not include Social Security and Medicare, it’s important to note that you may still be responsible for paying taxes on your Social Security benefits if your income exceeds certain thresholds. It’s always a good idea to consult with a tax professional or use online tax tools to ensure that you are properly withholding and paying all applicable taxes.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts