Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching the age of 65 and wondering if you have to re-enroll in Medicare? Or perhaps you’re already enrolled and want to know if there are any additional steps you need to take. With all the information available, it can be overwhelming to navigate the Medicare system. But don’t worry, we’re here to help.

In this article, we’ll break down the rules and regulations surrounding Medicare enrollment and explain who needs to re-enroll and when. Whether you’re a first-time enrollee or a long-time Medicare recipient, this guide will provide you with the information you need to make informed decisions about your healthcare coverage. So, let’s dive in!

Most people are automatically enrolled in Medicare when they turn 65. However, if you delayed enrollment or opted out of Part B, you may need to re-enroll during the General Enrollment Period (January 1 – March 31) or the Special Enrollment Period (if you qualify). If you receive Social Security benefits, you will be automatically enrolled in Medicare Parts A and B. It’s important to keep track of your enrollment status and deadlines to avoid any gaps in coverage.

Do You Have to Re Enroll in Medicare?

If you are enrolled in Medicare, the question “Do I have to re-enroll in Medicare?” may have crossed your mind at some point. The answer to this question depends on your situation and the type of Medicare coverage you have.

Medicare Part A and Part B

If you have Medicare Part A and Part B, also known as Original Medicare, you do not need to re-enroll every year. Once you are enrolled in Medicare, your coverage will continue as long as you pay your premiums and your plan is still in effect.

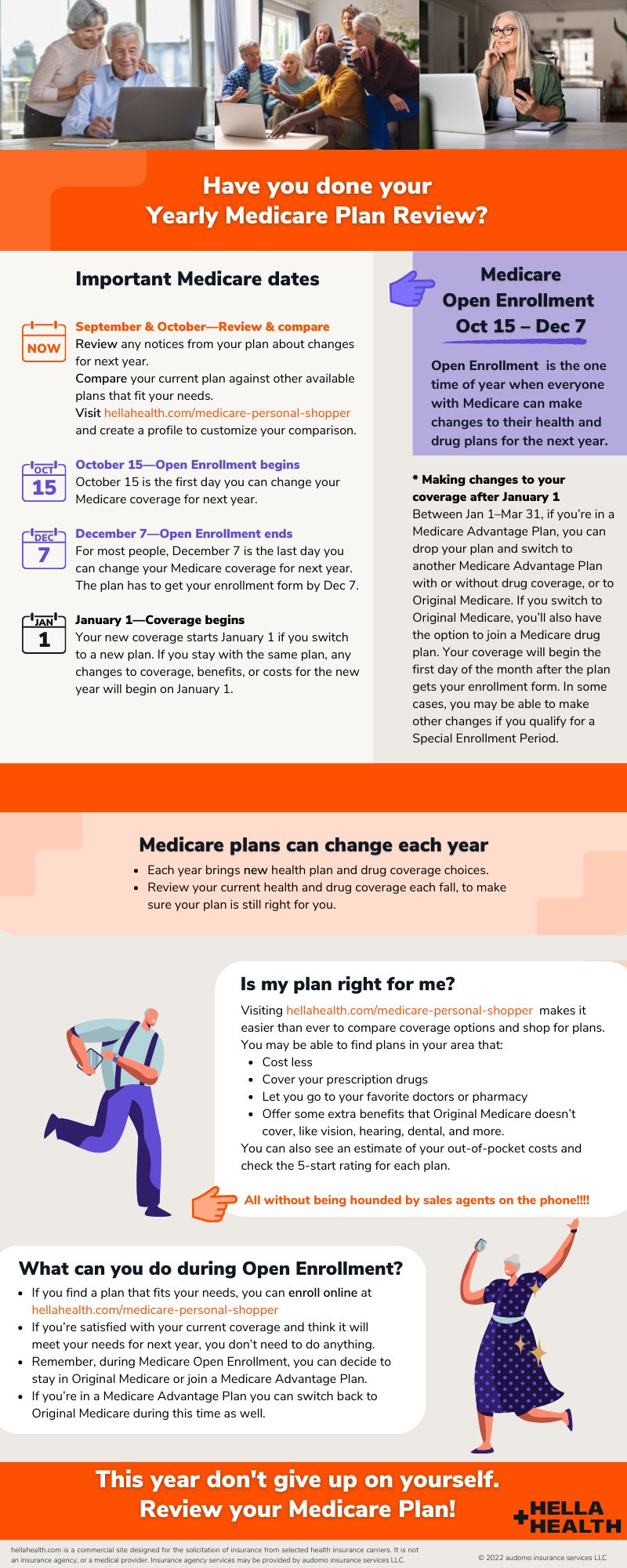

However, it is important to review your coverage each year during the Annual Enrollment Period (AEP) from October 15th to December 7th. During this time, you can make changes to your coverage, switch to a different plan, or add or drop coverage.

To make the most of the AEP, it is recommended that you review your current coverage, consider your healthcare needs for the upcoming year, and compare plans to find the best fit for you.

Medicare Advantage

If you have a Medicare Advantage plan, also known as Part C, you do not need to re-enroll in Original Medicare. However, you may need to re-enroll in your Medicare Advantage plan each year during the AEP.

During the AEP, you can switch to a different Medicare Advantage plan or switch back to Original Medicare. If you do not make any changes during the AEP, your coverage will automatically renew for the following year.

It is important to review your plan each year during the AEP to ensure that it still meets your healthcare needs and budget. You should also check to see if there are any changes to your plan’s premiums, deductibles, or benefits.

Medicare Part D

If you have Medicare Part D, which covers prescription drugs, you will need to re-enroll each year during the AEP. This is because prescription drug plans can change their premiums, deductibles, and coverage each year.

During the AEP, you can switch to a different Medicare Part D plan or keep your current plan. If you do not enroll in a new plan during the AEP, you will be automatically enrolled in your current plan for the following year.

To make the most of your Medicare Part D coverage, it is important to review your plan’s formulary, which is a list of the prescription drugs it covers. You should also compare plans to find the one that offers the best coverage and cost for your specific prescription drug needs.

Benefits of Re-Enrolling

Re-enrolling in Medicare each year can offer many benefits. It gives you the opportunity to review your coverage and make changes that better meet your healthcare needs and budget.

For example, if you have experienced changes in your health or have new healthcare needs, you may need to switch to a plan that offers more coverage. Or, if you are on a tight budget, you may need to find a plan with lower premiums and deductibles.

Re-enrolling also ensures that you are getting the most up-to-date coverage and benefits. Medicare plans can change their coverage and benefits each year, so it is important to review your plan to ensure that it still meets your needs.

Re-Enrolling vs. Automatic Renewal

If you do not make any changes to your Medicare coverage during the AEP, your coverage will automatically renew for the following year. While this may seem convenient, it may not be the best option for everyone.

Automatic renewal means that you will keep the same coverage and benefits for another year, even if they no longer meet your healthcare needs or budget. By re-enrolling each year, you have the opportunity to review your coverage and make changes as needed.

Conclusion

In conclusion, whether or not you need to re-enroll in Medicare depends on the type of coverage you have. If you have Original Medicare, you do not need to re-enroll each year, but should review your coverage during the AEP. If you have a Medicare Advantage or Part D plan, you will need to re-enroll each year during the AEP.

Re-enrolling in Medicare each year can offer many benefits, including the opportunity to review your coverage, make changes as needed, and ensure that you are getting the most up-to-date coverage and benefits.

Frequently Asked Questions

Do You Have to Re Enroll in Medicare?

If you are already enrolled in Medicare, you do not have to re-enroll every year. Once you are enrolled, you will be automatically re-enrolled each year. However, it is important to review your coverage and make changes if necessary during the annual open enrollment period.

During the open enrollment period, you can switch from Original Medicare to a Medicare Advantage plan or vice versa. You can also change your prescription drug coverage or make changes to your existing plan. It is important to review your coverage annually to ensure that you have the best coverage for your needs.

When Do You Need to Enroll in Medicare?

If you are eligible for Medicare, you should enroll during your initial enrollment period. This period begins three months before your 65th birthday and ends three months after your 65th birthday. If you miss your initial enrollment period, you can enroll during the general enrollment period, which runs from January 1 to March 31 each year.

If you do not enroll in Medicare when you are first eligible, you may face a penalty when you do enroll. The penalty is based on how long you went without coverage and can add up to a significant amount over time.

Can You Drop Medicare Coverage?

Yes, you can drop your Medicare coverage at any time. However, if you drop your coverage and then want to enroll again later, you may face a penalty. It is important to consider your options carefully before dropping your coverage.

If you are switching from Original Medicare to a Medicare Advantage plan or vice versa, you can do so during the annual open enrollment period. This period runs from October 15 to December 7 each year. If you are dropping your coverage altogether, you should contact Medicare to discuss your options.

What Happens if You Move Out of State?

If you move out of state, your Medicare coverage will still be in effect. However, you may need to change your Medicare Advantage plan or prescription drug coverage if your plan is not available in your new location.

If you are enrolled in a Medicare Advantage plan, you should contact your plan provider to discuss your options. If you are enrolled in Original Medicare with a separate prescription drug plan, you can continue to use your plan as long as it is available in your new location.

What if You Have Other Insurance?

If you have other insurance in addition to Medicare, such as an employer-sponsored plan, you should coordinate your coverage carefully. In most cases, Medicare will be the primary payer and your other insurance will be secondary.

It is important to review your coverage and understand how your plans work together. You should also inform your healthcare providers of all of your coverage to ensure that your claims are processed correctly.

When to Enroll In Medicare | Tips to Avoid Penalties

In conclusion, re-enrolling in Medicare depends on your individual circumstances. If you’ve been automatically enrolled in Medicare, you won’t need to re-enroll unless you’ve opted out of Part B coverage. However, if you’ve voluntarily disenrolled from Part B or cancelled your Medicare coverage altogether, you’ll have to re-enroll during the designated enrollment periods.

It’s important to keep in mind that failing to re-enroll in Medicare when required can result in penalties and gaps in coverage. So, if you’re unsure about your Medicare enrollment status, it’s best to consult with a licensed Medicare advisor who can guide you through the process and ensure that you have the coverage you need.

Ultimately, whether or not you need to re-enroll in Medicare will depend on your specific situation. Therefore, it’s essential to stay informed about enrollment periods, deadlines, and coverage options to make the best decisions for your health and well-being.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts