Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage to people aged 65 and over, as well as to those with certain disabilities. But many people are often confused about whether or not they are automatically enrolled in Medicare.

The answer to this question is not straightforward, as it depends on a number of factors. In this article, we will explore the different scenarios under which someone may be automatically enrolled in Medicare, as well as what steps you can take to ensure that you are covered by this important program. So, let’s dive in and clear up the confusion once and for all!

Does Medicare Automatically Enroll You?

Medicare is the government-sponsored health insurance program for Americans aged 65 and over, as well as people with disabilities and those with end-stage renal disease. It’s a valuable resource for millions of Americans, but the enrollment process can be confusing. One of the most common questions people have is whether they will be automatically enrolled in Medicare. In this article, we’ll explore this question in detail.

Automatic Enrollment for Original Medicare

If you’re already receiving Social Security benefits when you turn 65, you’ll be automatically enrolled in Original Medicare (Part A and Part B). This enrollment is automatic, and you’ll receive your Medicare card in the mail around three months before your 65th birthday.

However, if you’re not receiving Social Security benefits, you’ll need to enroll in Medicare yourself. You can do this online, by calling the Social Security Administration, or by visiting your local Social Security office.

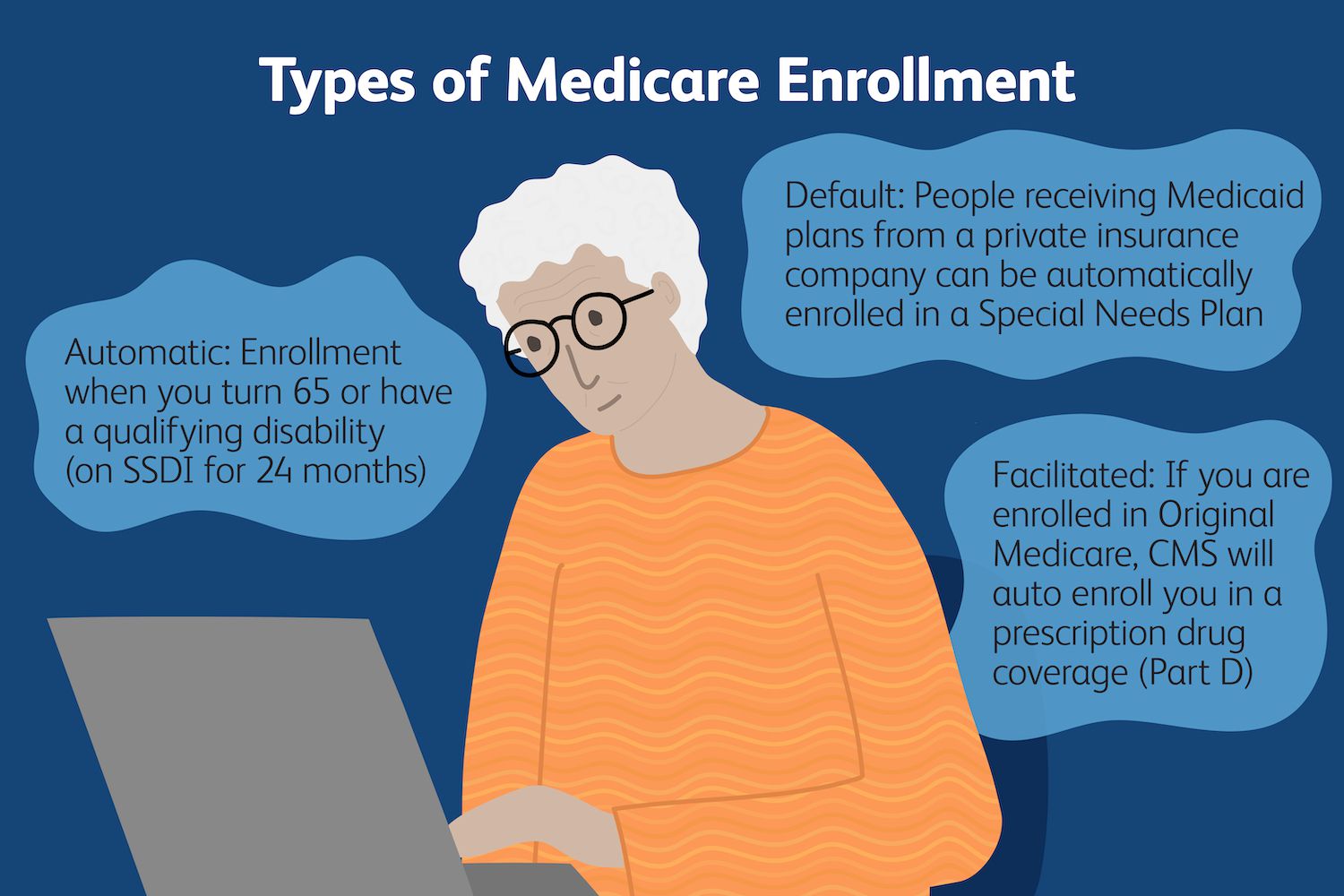

Automatic Enrollment for Medicare Advantage and Part D

Medicare Advantage (Part C) and Medicare Part D (prescription drug coverage) are optional parts of Medicare that are provided by private insurance companies. Unlike Original Medicare, you won’t be automatically enrolled in these plans.

However, if you’re enrolled in Original Medicare, you’ll have the opportunity to enroll in a Medicare Advantage plan or a Part D plan during certain enrollment periods. You’ll receive information about these plans in the mail, and you can also compare plans and enroll online.

The Benefits of Automatic Enrollment

Automatic enrollment in Original Medicare can be a convenient option for those already receiving Social Security benefits. It eliminates the need to enroll in Medicare separately, and it ensures that you’ll have coverage as soon as you turn 65.

However, if you’re not receiving Social Security benefits, you’ll need to take action to enroll in Medicare. This may seem like an inconvenience, but it gives you the opportunity to choose the coverage that’s right for you.

The Drawbacks of Automatic Enrollment

While automatic enrollment in Original Medicare may be convenient, it’s important to remember that it only provides basic health insurance coverage. If you want more comprehensive coverage, you’ll need to consider additional Medicare options, such as Medicare Advantage or Part D.

Additionally, automatic enrollment in Original Medicare can result in higher premiums if you don’t enroll in a timely manner. If you’re not receiving Social Security benefits, you have a seven-month enrollment period that begins three months before your 65th birthday. If you miss this enrollment period, you may be subject to a late enrollment penalty.

Enrolling in Medicare Outside of Automatic Enrollment

If you don’t enroll in Medicare during your initial enrollment period, you still have the opportunity to enroll during a special enrollment period. This period occurs every year from January 1 to March 31, and it allows you to enroll in Medicare Parts A and B if you missed your initial enrollment period.

If you’re interested in Medicare Advantage or Part D, you’ll need to enroll during the annual enrollment period, which occurs from October 15 to December 7 each year.

Choosing the Right Medicare Plan for You

When it comes to choosing a Medicare plan, there are many options to consider. Original Medicare provides basic coverage, but it may not be enough to meet your needs. Medicare Advantage and Part D plans offer additional benefits and coverage, but they may come with higher premiums.

It’s important to evaluate your health care needs and budget when choosing a Medicare plan. Consider factors like your prescription drug needs, health care expenses, and preferred providers.

Medicare vs. Medicaid

It’s important not to confuse Medicare with Medicaid, which is a separate government program that provides health care coverage for low-income individuals and families. While both programs are government-sponsored, they serve different populations and have different eligibility requirements.

The Bottom Line

Medicare does automatically enroll you in Original Medicare (Part A and Part B) if you’re already receiving Social Security benefits when you turn 65. However, if you’re not receiving Social Security benefits, you’ll need to enroll in Medicare yourself. Medicare Advantage and Part D plans are not automatically provided, but you’ll have the opportunity to enroll during certain enrollment periods.

When choosing a Medicare plan, it’s important to evaluate your health care needs and budget. Consider factors like your prescription drug needs, health care expenses, and preferred providers. And don’t confuse Medicare with Medicaid, which is a separate program that serves low-income individuals and families.

Frequently Asked Questions

Does Medicare Automatically Enroll You?

Medicare does not automatically enroll you. However, if you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Parts A and B when you turn 65. If you are not yet receiving Social Security benefits, you will need to sign up for Medicare during your Initial Enrollment Period.

Your Initial Enrollment Period lasts for seven months, starting three months before the month you turn 65 and ending three months after the month you turn 65. If you miss your Initial Enrollment Period, you may face permanent late enrollment penalties, so it is important to sign up on time.

What If You Want to Delay Medicare Enrollment?

If you are still working and have health insurance through your employer, you may be able to delay Medicare enrollment without facing penalties. You can sign up for Medicare Part A, which is usually free and can help cover hospital costs, while delaying enrollment in Part B, which covers doctor visits and other outpatient services.

You can delay Part B enrollment without facing penalties as long as you have creditable coverage through your employer or union. Creditable coverage means that your employer’s insurance is at least as good as Medicare’s. When you are ready to retire or lose your job-based coverage, you can enroll in Part B without penalty during a Special Enrollment Period.

What If You Want to Change Your Medicare Coverage?

If you want to change your Medicare coverage, you can do so during the Annual Enrollment Period, which runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also switch from one Medicare Advantage plan to another, or from one Part D drug plan to another.

Outside of the Annual Enrollment Period, you can make changes to your Medicare coverage only in certain situations, such as if you move to a new area or lose your coverage through your employer.

What Does Medicare Cover?

Medicare Part A covers hospital stays, skilled nursing care, hospice care, and some home health care. Part B covers doctor visits, outpatient services, and preventive care. Part D covers prescription drugs.

Medicare Advantage plans, which are offered by private insurance companies, cover all the same services as Original Medicare, plus additional benefits such as vision, hearing, and dental care. Some plans also include prescription drug coverage.

How Much Does Medicare Cost?

Medicare Part A is usually free if you or your spouse paid Medicare taxes while working. Part B has a monthly premium, which varies depending on your income. In 2021, the standard Part B premium is $148.50 per month. Part D also has a monthly premium, which varies depending on the plan you choose.

Medicare Advantage plans may have a monthly premium in addition to the Part B premium. However, some plans have a $0 premium. You may also face out-of-pocket costs such as deductibles, copayments, and coinsurance, depending on the plan you choose and the services you receive.

Automatic Enrollment into Medicare

In conclusion, Medicare is an essential program that provides health care coverage for millions of Americans. However, it is important to understand that Medicare does not automatically enroll you. You must take action to enroll in Medicare, either by contacting Social Security or by signing up online through the Medicare website.

It is also important to note that there are specific enrollment periods for Medicare, and failure to enroll during these periods can result in penalties and gaps in coverage. It is recommended that you research and understand your Medicare options and enrollment requirements to ensure that you have the coverage you need when you need it.

Overall, Medicare enrollment is an important process that requires attention and action from individuals. By understanding the enrollment requirements and taking the necessary steps to enroll, you can ensure that you have the health care coverage you need to maintain your health and well-being.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts