Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a vital healthcare program that helps millions of Americans access the medical care they need. But how is this program funded? Understanding how Medicare is funded is essential to understanding how it works and how it might change in the future. In this article, we’ll take a closer look at where the money for Medicare comes from and what that means for the program’s future. So let’s dive in and explore the complex world of Medicare funding.

Contents

Understanding How Medicare is Funded

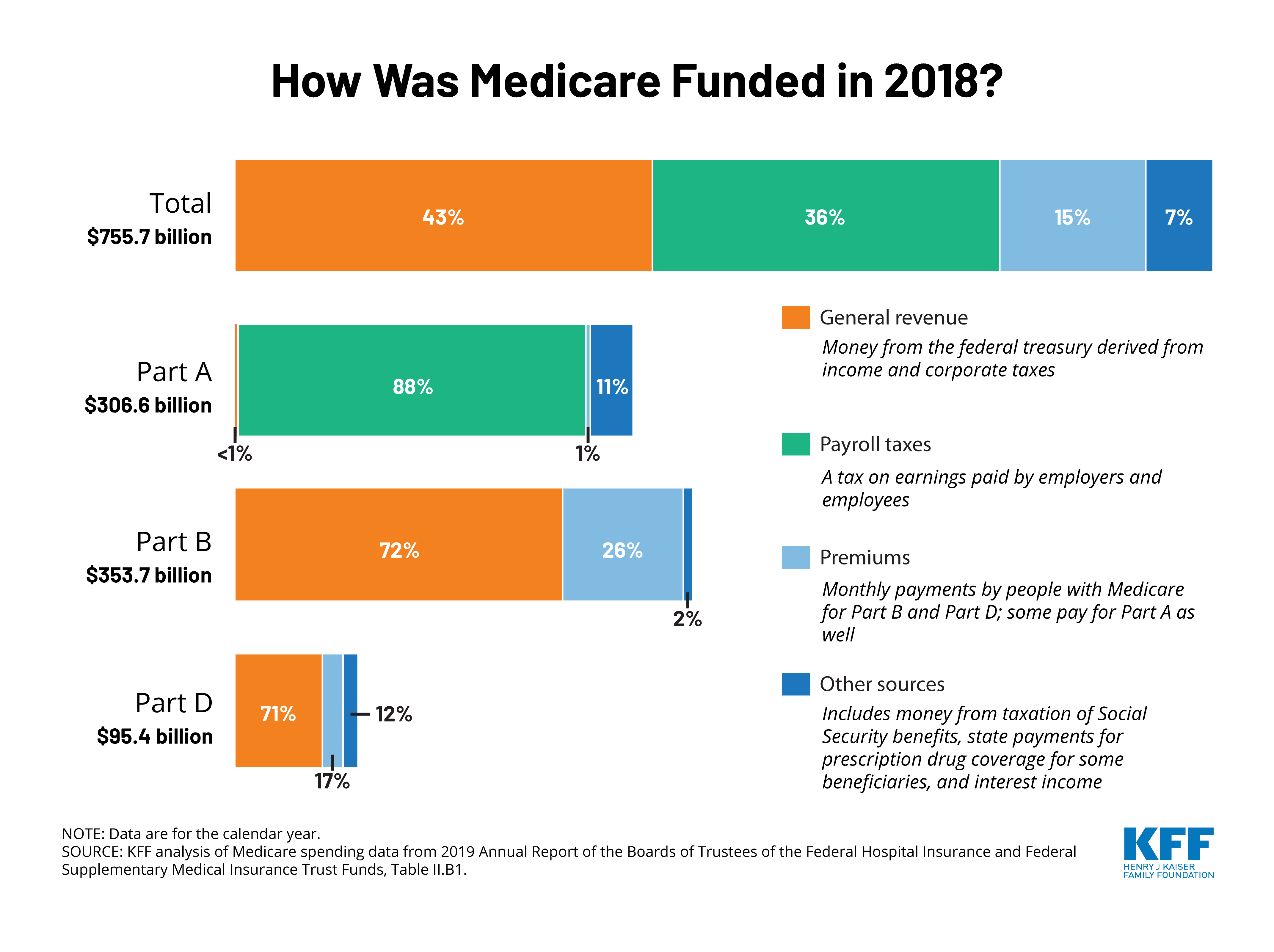

Medicare is a federal health insurance program in the United States that provides coverage to individuals aged 65 and older, as well as those with certain disabilities or chronic conditions. The program is funded through a combination of sources, including payroll taxes, premiums, and general revenue. In this article, we’ll explore the different funding sources for Medicare and how they contribute to the program’s overall budget.

Payroll Taxes

Payroll taxes are the primary source of funding for Medicare’s Part A program, which covers hospital stays, skilled nursing care, and some home health care services. These taxes are automatically deducted from an individual’s paycheck and are split between the employer and employee. In 2021, the payroll tax rate for Medicare is 1.45% for both employers and employees, with a cap on the amount of wages subject to the tax.

How Much Revenue Do Payroll Taxes Generate?

In 2020, payroll taxes generated $319.4 billion in revenue for Medicare’s Part A program. This accounted for approximately 90% of the program’s funding.

Who Pays Payroll Taxes?

Most individuals who work in the United States are subject to payroll taxes. However, certain groups, such as self-employed individuals, may be required to pay a higher tax rate to compensate for the lack of an employer contribution.

Premiums

In addition to payroll taxes, Medicare also collects premiums from beneficiaries to help fund the program. There are four parts to Medicare, and each part has its own premium structure.

Part A Premiums

Most individuals do not have to pay a premium for Part A coverage, as long as they or their spouse paid Medicare taxes while working. However, if an individual does not have enough work credits to qualify for premium-free Part A coverage, they may be required to pay a monthly premium.

Part B Premiums

All individuals who enroll in Part B coverage are required to pay a monthly premium. The premium amount is based on income, with higher earners paying a higher premium.

Part C Premiums

Part C, also known as Medicare Advantage, is an alternative to traditional Medicare that is offered by private insurance companies. These plans often have their own premium structure, which varies depending on the plan and location.

Part D Premiums

Part D is the prescription drug coverage portion of Medicare. Like Part B, all individuals who enroll in Part D coverage are required to pay a monthly premium. The premium amount is based on income.

General Revenue

In addition to payroll taxes and premiums, Medicare is also funded through general revenue from the federal government. This revenue comes from sources such as income taxes, corporate taxes, and excise taxes.

How Much Revenue Does General Revenue Contribute to Medicare?

In 2020, general revenue contributed $92.5 billion to Medicare’s budget. This accounted for approximately 10% of the program’s funding.

Benefits of Medicare

Medicare provides a range of benefits to individuals, including coverage for hospital stays, doctor visits, and prescription drugs. The program also offers preventive services, such as mammograms and colonoscopies, at no cost to beneficiaries.

How Many People Are Enrolled in Medicare?

As of 2021, more than 63 million individuals are enrolled in Medicare. Of these, approximately 52 million are aged 65 and older, while the remaining 11 million are individuals with disabilities or chronic conditions.

How Much Does Medicare Spend on Healthcare?

In 2020, Medicare spent $799.4 billion on healthcare services for beneficiaries. This included spending on hospital stays, physician services, prescription drugs, and other healthcare needs.

Medicare Vs. Private Insurance

While Medicare provides coverage to millions of individuals, some individuals may choose to enroll in private insurance plans instead. There are several key differences between Medicare and private insurance, including:

- Cost: Medicare premiums and deductibles may be lower than those of private insurance plans, but beneficiaries may still be responsible for significant out-of-pocket costs.

- Coverage: Medicare covers a wide range of healthcare services, but some private insurance plans may offer more comprehensive coverage in certain areas.

- Choice: Medicare offers a range of plan options, but beneficiaries may have limited options depending on where they live. Private insurance plans may offer more choice in terms of providers and coverage.

Conclusion

Medicare is a vital program that provides healthcare coverage to millions of individuals in the United States. The program is funded through a combination of payroll taxes, premiums, and general revenue, and provides a range of benefits to beneficiaries. Whether you’re enrolled in Medicare or considering your healthcare options, understanding how the program is funded can help you make informed decisions about your healthcare coverage.

Frequently Asked Questions

How is Medicare Funded?

Medicare is a federal health insurance program that provides coverage for Americans over the age of 65 and those with certain disabilities. The program is funded by several sources, including payroll taxes, premiums, and general revenue.

The majority of Medicare’s funding comes from payroll taxes, which are paid by both employees and employers. In 2021, the payroll tax rate for Medicare is 1.45% for both employees and employers. Self-employed individuals pay a combined rate of 2.9% to cover both the employee and employer portions.

In addition to payroll taxes, Medicare also receives funding from premiums paid by its beneficiaries. Most beneficiaries are required to pay a monthly premium for Medicare Part B, which covers doctor visits and outpatient services. The amount of the premium is based on the beneficiary’s income, with higher-income individuals paying more. Finally, Medicare also receives funding from general revenue, which comes from taxes on income, investments, and other sources.

What is the Medicare Trust Fund?

The Medicare Trust Fund is a financial account that holds the funds collected for the Medicare program. The Trust Fund is divided into two separate accounts: the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund.

The HI Trust Fund is used to pay for Medicare Part A, which covers inpatient hospital stays, skilled nursing care, and hospice care. The SMI Trust Fund is used to pay for Medicare Part B, which covers doctor visits and outpatient services, and Medicare Part D, which provides coverage for prescription drugs.

Both Trust Funds are funded by payroll taxes, premiums, and general revenue. However, the HI Trust Fund is also funded by a special tax on Social Security benefits and interest earned on the Trust Fund’s investments. The SMI Trust Fund is funded entirely by premiums and general revenue.

How is Medicare Funded?

In conclusion, Medicare is funded through a combination of taxes and premiums paid by beneficiaries. The majority of funding comes from payroll taxes imposed on both employers and employees, with additional funding from income taxes and taxes on Social Security benefits.

Despite being a crucial program for millions of Americans, Medicare faces financial challenges in the years to come. As healthcare costs continue to rise and the number of enrollees increases, the program will need to find new sources of funding or make difficult cuts to benefits.

Overall, it is important to understand how Medicare is funded in order to appreciate the program’s value and to advocate for its continued success. By staying informed and engaged, we can help ensure that Medicare remains a vital resource for generations to come.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts