Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program designed to provide coverage for individuals aged 65 and above, as well as those with certain disabilities. While it covers a wide range of medical services, many people wonder whether Medicare covers copays, which are often a significant expense for those on fixed incomes.

The answer is not straightforward, as it depends on the type of Medicare plan you have and the specific situation. In this article, we’ll explore the different types of Medicare plans and what they cover when it comes to copays, so you can better understand your options and make informed decisions about your health care.

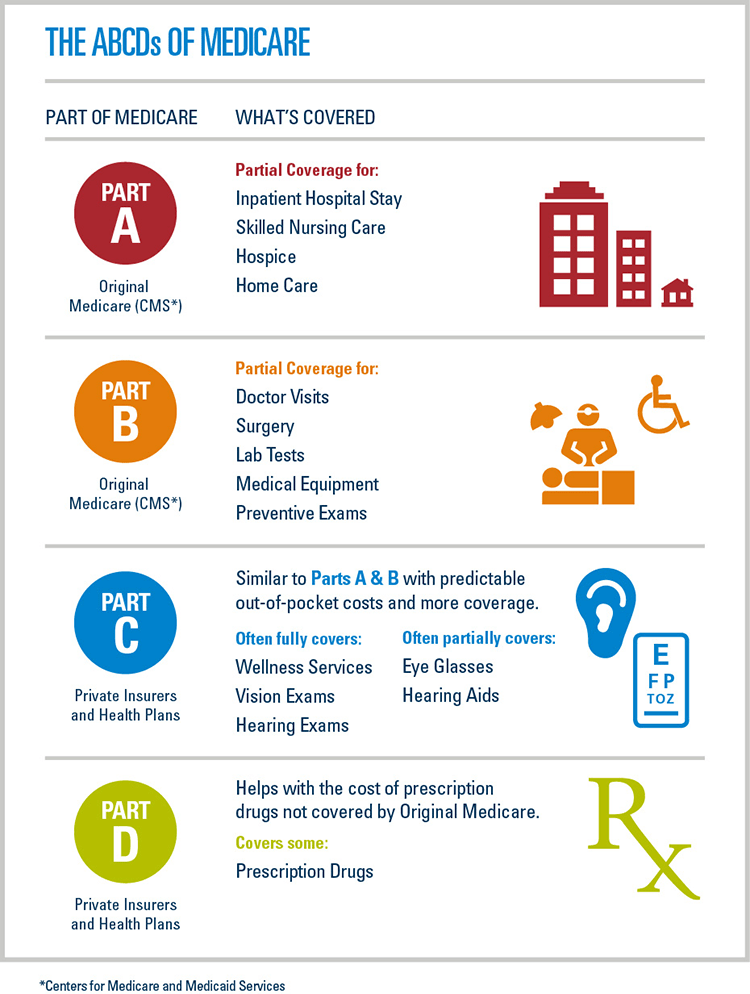

Yes, Medicare covers copays for certain healthcare services. However, the amount of copay coverage varies depending on the type of Medicare plan you have. Original Medicare (Part A and Part B) typically covers 20% of the Medicare-approved amount for most doctor services and outpatient therapy. Medicare Advantage plans may offer different copay amounts depending on the specific plan. It’s important to review your plan’s benefits to understand your copay responsibilities.

Does Medicare Cover Copays?

As you approach retirement age, you may be wondering about the cost of healthcare. Medicare is a federal health insurance program that provides coverage for eligible individuals aged 65 and older, as well as certain younger people with disabilities. However, Medicare coverage can be confusing, especially when it comes to copays. In this article, we’ll explore whether or not Medicare covers copays, and what you need to know.

What are Copays?

A copay, short for copayment, is a fixed amount of money that you pay out-of-pocket for a covered medical service or prescription drug. Copays are typically due at the time of service or purchase, and are often a small percentage of the total cost. For example, you may have a $20 copay for a doctor’s visit, and your insurance will cover the rest of the cost.

Medicare Part A Copays

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and home health care. If you have Original Medicare (Part A and Part B), you may be responsible for paying copays for some of these services. For example, you may have to pay a copay for each day you are in the hospital, or for each home health care visit.

However, if you have a Medicare Supplement (Medigap) policy, it may cover some or all of your copays for Part A services. It’s important to review your policy to understand what copays are covered.

Medicare Part B Copays

Medicare Part B covers doctor visits, outpatient care, preventive services, and medical equipment. Like Part A, you may be responsible for paying copays for some of these services if you have Original Medicare. For example, you may have a copay for each doctor’s visit, or for durable medical equipment like a wheelchair.

Again, if you have a Medigap policy, it may cover some or all of your Part B copays. You should review your policy to understand what copays are covered.

Medicare Advantage Copays

Medicare Advantage plans, also known as Part C, are offered by private insurance companies and provide all the benefits of Original Medicare (Part A and Part B), plus additional benefits like prescription drug coverage and vision or dental care. Medicare Advantage plans may have different copays than Original Medicare, and may also have different rules for when and how much you pay.

If you have a Medicare Advantage plan, you should review your plan’s Summary of Benefits to understand what copays are required for each service or prescription drug.

Medicare Part D Copays

Medicare Part D provides prescription drug coverage, and like other parts of Medicare, you may be responsible for paying copays for your medications. Copays for Part D drugs vary depending on the plan you choose, the specific drug, and whether it’s a brand-name or generic medication.

If you have a Medicare Part D plan, you should review your plan’s formulary to understand what copays are required for each medication.

Benefits of Medicare Copays

While copays may seem like an added expense, they do serve a purpose. Copays are designed to encourage patients to use healthcare services and prescription drugs in a cost-effective manner. By requiring a small out-of-pocket payment, patients are more likely to make informed decisions about their healthcare and avoid unnecessary services or medications.

Copays vs. Coinsurance

It’s important to note that copays are different from coinsurance. While copays are a fixed amount, coinsurance is a percentage of the total cost of a service or medication. For example, you may have a 20% coinsurance for a surgical procedure, meaning you would be responsible for paying 20% of the total cost.

Conclusion

In summary, Medicare does cover copays for certain services and medications. However, the amount and type of copay you may be responsible for will depend on your specific plan. If you have questions about your Medicare coverage or copays, you should contact your plan provider or a licensed insurance agent for assistance. Remember, understanding your healthcare coverage is an important part of making informed decisions about your health and well-being.

Frequently Asked Questions

Does Medicare Cover Copays?

Yes, Medicare does cover copays for some services. However, the amount of copay coverage varies depending on the type of Medicare plan you have. Original Medicare, which includes Part A and Part B, covers some copays for doctor visits, hospital stays, and other medical services. Medicare Advantage plans, which are offered by private insurance companies, also cover copays for medical services, but the amount of coverage may differ from plan to plan.

It’s important to note that Medicare does not cover all copays. Some services, such as dental and vision care, are not covered by Medicare. Additionally, some Medicare Advantage plans may have higher copays for certain services than others. It’s important to review your plan’s benefits and copay requirements before seeking medical care to avoid any unexpected out-of-pocket costs.

What Copays Are Covered by Medicare?

Medicare covers copays for a range of medical services, including doctor visits, hospital stays, and outpatient care. Under Original Medicare, the amount of copay coverage varies depending on the service provided. For example, in 2021, the copay for a doctor’s visit under Part B is $20, while the copay for a hospital stay under Part A can range from $0 to $1,484 per benefit period.

Medicare Advantage plans also cover copays for medical services, but the amount of coverage may differ from plan to plan. Some plans may have lower copays for certain services, while others may have higher copays for the same services. It’s important to review your plan’s benefits to understand what copays are covered and how much you can expect to pay out of pocket.

Are Prescription Copays Covered by Medicare?

Yes, Medicare covers prescription copays under Part D, which is the prescription drug coverage portion of Medicare. The amount of copay coverage varies depending on the specific prescription drug plan you have. Some plans may have low or no copays for certain medications, while others may have higher copays for the same medications.

It’s important to review your plan’s formulary, which is a list of drugs covered by the plan, to understand what medications are covered and what copays you can expect to pay. Additionally, some plans may have a coverage gap, also known as the “donut hole,” which is a temporary limit on what the plan will cover for prescription drugs. Once you reach the coverage gap, you may be responsible for a higher percentage of the cost of your medications until you reach the catastrophic coverage phase.

Do Medicare Supplement Plans Cover Copays?

Medicare Supplement plans, also known as Medigap plans, may cover some copays for medical services. However, the amount of coverage varies depending on the specific plan and the state you live in. Medigap plans are designed to supplement Original Medicare, so they may cover some of the copays and other out-of-pocket costs that Original Medicare does not cover.

It’s important to note that Medigap plans do not cover copays for prescription drugs. If you need prescription drug coverage, you will need to enroll in a separate Part D plan. Additionally, not all Medigap plans may be available in your state, so it’s important to review your options carefully to find the plan that best meets your needs.

Do I Have to Pay Copays for Preventive Services?

Under Original Medicare, you generally do not have to pay copays or coinsurance for most preventive services. These services include things like flu shots, mammograms, and wellness visits. However, if you receive additional services during your preventive visit, such as a blood test or X-ray, you may have to pay a copay or coinsurance for those services.

Medicare Advantage plans also cover preventive services, but the amount of coverage may differ from plan to plan. Some plans may offer additional preventive services beyond what is covered under Original Medicare, while others may have different copay requirements for these services. It’s important to review your plan’s benefits to understand what preventive services are covered and what copays you can expect to pay.

Do I Have To Pay A Copay With Medicare?

In conclusion, Medicare does cover copays for certain services and treatments. However, the amount of coverage may vary depending on the type of Medicare plan you have. It is important to check with your plan provider to understand the copay costs and benefits you are entitled to.

Additionally, copays can be reduced or eliminated through programs such as Medicaid Extra Help or Medicare Savings Programs. These programs provide financial assistance to individuals who cannot afford their Medicare copays and premiums.

Overall, understanding your Medicare plan and the copay costs associated with it is crucial in managing your healthcare expenses. Don’t hesitate to reach out to your plan provider or a Medicare counselor for assistance in navigating the complex world of Medicare copays.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts