Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, our eyesight may not be as sharp as it once was. For those who rely on contact lenses to see clearly, the cost of replacing them can add up quickly. If you are a Medicare beneficiary, you may be wondering if Medicare covers medically necessary contact lenses.

The short answer is yes, Medicare does cover medically necessary contact lenses. However, there are specific criteria that must be met in order for the lenses to be covered. Let’s take a closer look at what those criteria are and how Medicare can help you maintain your vision.

Does Medicare Cover Medically Necessary Contact Lenses?

If you wear contact lenses for medical reasons, you might be wondering if Medicare covers the cost. Medicare provides health insurance for people who are 65 or older, as well as for people with specific disabilities. While Medicare covers many healthcare services, it does not cover all of them. In this article, we’ll explore whether Medicare covers medically necessary contact lenses.

What Are Medically Necessary Contact Lenses?

Medically necessary contact lenses are contact lenses prescribed by a doctor to treat a medical condition, such as keratoconus, an irregularly shaped cornea, or other vision problems. These lenses are different from cosmetic lenses that are used only to change the appearance or color of the eyes.

If you have a medical condition that requires contact lenses, your doctor will prescribe them as part of your treatment plan. These lenses are typically more expensive than regular contact lenses, so it’s important to know if Medicare covers them.

What Parts of Medicare Cover Medically Necessary Contact Lenses?

Medicare is divided into several parts, each covering different healthcare services. The parts of Medicare that cover medically necessary contact lenses are Part B and Part D.

Part B covers medically necessary contact lenses when they are prescribed by a doctor. This includes the cost of the contact lenses themselves, as well as any associated services, such as fittings or follow-up appointments.

Part D covers prescription drugs, including eye drops or other medications that may be necessary to treat the medical condition that requires contact lenses.

How Much Does Medicare Cover for Medically Necessary Contact Lenses?

The amount that Medicare covers for medically necessary contact lenses varies depending on the specific plan. Part B typically covers 80% of the cost of medically necessary contact lenses, and you are responsible for the remaining 20%. Part D plans vary in their coverage, so it’s important to check with your plan to see what is covered.

It’s also worth noting that Medicare has a yearly deductible, which means you’ll need to pay a certain amount out of pocket before Medicare covers any of the costs. The deductible amount varies by plan.

What Should You Know Before You Get Medically Necessary Contact Lenses?

Before you get medically necessary contact lenses, there are several things you should know. First, you’ll need to have a valid prescription from a doctor. Second, you’ll need to choose a supplier or vendor that accepts Medicare and is enrolled in Medicare’s supplier directory. Finally, you’ll need to make sure that your specific plan covers the cost of the contact lenses.

What Are the Benefits of Medically Necessary Contact Lenses?

Medically necessary contact lenses can provide many benefits for people with certain medical conditions. These lenses can improve vision and quality of life, allowing people to perform daily tasks more easily. They can also prevent further damage to the eyes and reduce the risk of complications.

What Are the Disadvantages of Medically Necessary Contact Lenses?

While medically necessary contact lenses can provide many benefits, there are also some disadvantages to consider. These lenses require more maintenance and care than regular contact lenses, and they may be more expensive. In addition, they may not be covered by all insurance plans, so you may need to pay out of pocket for them.

Medically Necessary Contact Lenses vs. Eyeglasses

If you have a medical condition that affects your vision, you may be wondering if you should get medically necessary contact lenses or eyeglasses. While both options can improve your vision, contact lenses may provide some advantages over eyeglasses. Contact lenses provide a wider field of vision and may be more comfortable to wear for some people. However, they require more maintenance and care than eyeglasses.

How to Find Out if Your Plan Covers Medically Necessary Contact Lenses

To find out if your specific Medicare plan covers medically necessary contact lenses, you can check your plan’s website or call the customer service number on the back of your Medicare card. You can also ask your doctor or eye care professional for more information.

Conclusion

Medicare does cover medically necessary contact lenses when they are prescribed by a doctor. However, the amount that Medicare covers varies depending on the specific plan. Before getting medically necessary contact lenses, it’s important to have a valid prescription, choose a supplier that accepts Medicare, and check your plan’s coverage. Medically necessary contact lenses can provide many benefits for people with certain medical conditions, but there are also some disadvantages to consider.

Contents

- Frequently Asked Questions

- 1. Does Medicare cover medically necessary contact lenses?

- 2. How do I know if I need medically necessary contact lenses?

- 3. What is the process for getting medically necessary contact lenses covered by Medicare?

- 4. What should I do if I have questions or concerns about my Medicare coverage for contact lenses?

- 5. Are there any alternative options for covering the cost of medically necessary contact lenses?

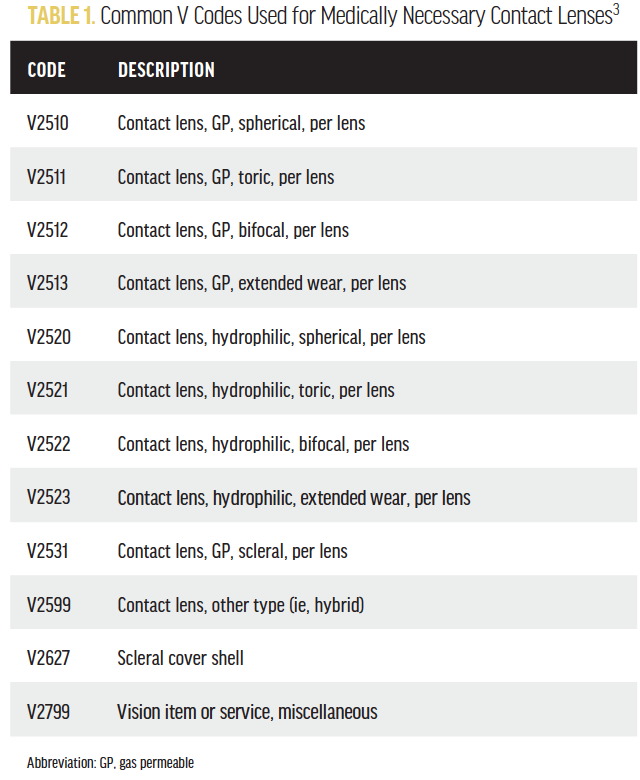

- Billing, Coding and ICD 10 for Medically Necessary Contact Lenses

Frequently Asked Questions

Here are some common questions and answers related to Medicare coverage for medically necessary contact lenses.

1. Does Medicare cover medically necessary contact lenses?

Yes, Medicare Part B provides coverage for medically necessary contact lenses if they are prescribed by a doctor for the treatment of a specific eye condition. This includes conditions such as cataracts, corneal injuries, and certain types of corneal degeneration. However, routine vision care, such as contact lenses for nearsightedness or farsightedness, is typically not covered by Medicare.

It is important to note that there may be certain limitations and restrictions on coverage, such as the type of contact lenses that are covered and the frequency of replacement. It is always best to check with your doctor and your Medicare plan to understand your specific coverage and out-of-pocket costs.

2. How do I know if I need medically necessary contact lenses?

If you have a specific eye condition that requires treatment with contact lenses, your eye doctor will determine if medically necessary contact lenses are appropriate for you. This may involve a comprehensive eye exam and other diagnostic tests to evaluate the health of your eyes and determine the best course of treatment.

If medically necessary contact lenses are prescribed, your eye doctor will typically work with you to ensure that you understand how to properly insert, remove, and care for your lenses. They may also provide guidance on any precautions you should take to minimize the risk of complications or infections.

3. What is the process for getting medically necessary contact lenses covered by Medicare?

If your eye doctor determines that medically necessary contact lenses are the best treatment option for your specific eye condition, they will typically submit a claim to Medicare on your behalf. This claim will include documentation of the medical necessity of the lenses and any other required information.

Once the claim is submitted, Medicare will review it and determine if the contact lenses are covered under your plan. If they are covered, Medicare will pay a portion of the cost, and you will be responsible for any deductibles, coinsurance, or other out-of-pocket expenses.

4. What should I do if I have questions or concerns about my Medicare coverage for contact lenses?

If you have questions or concerns about your Medicare coverage for medically necessary contact lenses, the best place to start is with your eye doctor. They can provide guidance on the types of contact lenses that are covered under your plan and any other details you need to know.

You can also contact Medicare directly if you have general questions about your coverage or need assistance with a claim. The Medicare website provides a wealth of information and resources to help you navigate your coverage options.

5. Are there any alternative options for covering the cost of medically necessary contact lenses?

If you have limited or no coverage for medically necessary contact lenses under your Medicare plan, there may be alternative options available to help you cover the cost. Some eye doctors offer financing options or payment plans to help make the cost more manageable.

You may also be able to use a flexible spending account (FSA) or health savings account (HSA) to pay for medically necessary contact lenses if you have one through your employer or other provider. These accounts allow you to save pre-tax dollars to pay for eligible medical expenses, including contact lenses and other vision care costs.

Billing, Coding and ICD 10 for Medically Necessary Contact Lenses

In conclusion, Medicare coverage for medically necessary contact lenses is a complex issue. While some beneficiaries may be eligible for coverage for specific conditions, such as cataracts or corneal injuries, the majority of individuals will not be able to receive coverage for routine contact lenses. It is important to discuss your specific needs with your eye doctor and Medicare representative to fully understand your coverage options.

It is also worth noting that there may be alternative options available, such as private insurance or discount programs, that can help offset the cost of medically necessary contact lenses. It is always a good idea to explore all options and discuss them with your healthcare provider to make an informed decision about your eye care needs.

Overall, while Medicare coverage for medically necessary contact lenses may be limited, there are still options available for those who require them. With proper research and guidance, individuals can find the support they need to maintain their vision and live a healthy, active life.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts