Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage for people who are 65 years and older, as well as those with certain disabilities or medical conditions. Applying for Medicare can be a confusing and overwhelming process, but it is essential to ensure that you have access to the healthcare services you need.

In this guide, we will break down the steps you need to follow to apply for Medicare insurance, including what documents you will need, when to apply, and how to choose the right plan for your needs. Whether you are just turning 65 or are looking to enroll in Medicare for the first time, this guide will provide you with all the information you need to make the process as easy and stress-free as possible.

- Visit the official website of the Social Security Administration.

- Click on the ‘Apply for Medicare’ button and fill out the online application form.

- If you’re not comfortable applying online, you can call the Social Security Administration and apply over the phone or schedule an in-person appointment.

- After submitting your application, you will receive a confirmation letter in the mail.

How to Apply for Medicare Insurance?

If you are turning 65 soon, or have a disability, you may be wondering how to apply for Medicare insurance. Medicare is a federal health insurance program that provides coverage for millions of Americans. It is important to understand the different parts of Medicare and how to apply for them in order to get the coverage you need.

Understanding the Different Parts of Medicare

Medicare is divided into several parts, each of which covers different services. It is important to understand these parts so that you know what you are eligible for and what you need to sign up for.

Part A: Hospital Insurance

Part A provides coverage for hospital stays, hospice care, and skilled nursing facility care. Most people do not have to pay a premium for Part A.

Part B: Medical Insurance

Part B provides coverage for doctor visits, outpatient care, and preventive services. You will have to pay a monthly premium for Part B.

Part C: Medicare Advantage

Part C is an alternative to Original Medicare (Parts A and B) that is offered by private insurance companies. These plans often offer additional benefits, but may have different costs and restrictions.

Part D: Prescription Drug Coverage

Part D provides coverage for prescription drugs. You will have to pay a monthly premium for Part D.

When to Apply for Medicare

You can apply for Medicare during your Initial Enrollment Period (IEP), which is the seven-month period that begins three months before the month you turn 65 and ends three months after the month you turn 65. If you have a disability, you can apply for Medicare after receiving Social Security Disability Insurance (SSDI) for 24 months.

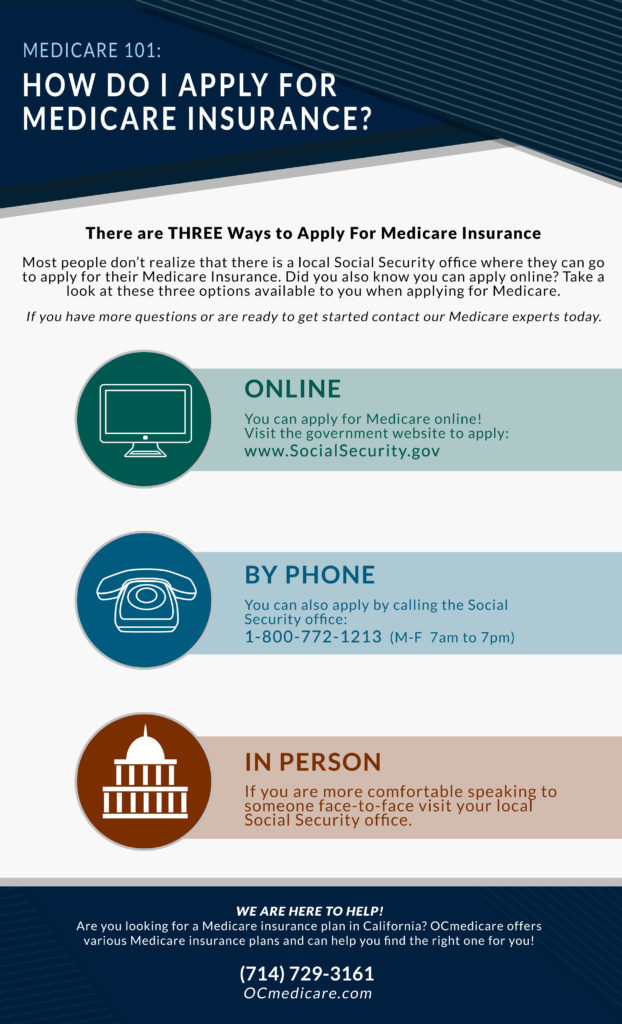

Applying for Medicare Online

One of the easiest ways to apply for Medicare is to do so online. You can apply online through the Social Security Administration (SSA) website.

Applying for Medicare in Person

You can also apply for Medicare in person at your local Social Security office. You will need to bring your Social Security card and other documentation.

Applying for Medicare by Phone

If you prefer, you can apply for Medicare by phone by calling the Social Security Administration at 1-800-772-1213.

Medicare Benefits vs. Medicare Advantage

While Original Medicare (Parts A and B) provides coverage for hospital stays and doctor visits, it does not cover all medical expenses. Medicare Advantage plans often offer additional benefits, such as dental and vision coverage, but may have different costs and restrictions.

Benefits of Original Medicare

Original Medicare provides flexibility in choosing doctors and healthcare providers. It also covers a wide range of medical services and treatments.

Benefits of Medicare Advantage

Medicare Advantage plans often offer additional benefits, such as dental and vision coverage, and may have lower out-of-pocket costs for certain services.

Choosing the Right Plan for You

When choosing between Original Medicare and Medicare Advantage, it is important to consider your individual healthcare needs and budget. Consider the costs and coverage of each plan before making a decision.

Conclusion

Applying for Medicare can seem overwhelming, but it is an important step in securing your healthcare coverage. Understanding the different parts of Medicare and when to apply can help make the process smoother. Whether you choose Original Medicare or Medicare Advantage, make sure to choose the plan that best fits your individual needs.

Frequently Asked Questions

Medicare insurance is a federal health insurance program for people aged 65 or older, those under 65 with certain disabilities, and people with End-Stage Renal Disease (ESRD). Applying for Medicare can be a complicated process, so here are some frequently asked questions to help you get started.

What is Medicare Insurance?

Medicare is a federal health insurance program that covers people aged 65 or older, those under 65 with certain disabilities, and people with End-Stage Renal Disease (ESRD). The program helps pay for medical expenses, including hospital stays, doctor visits, and prescription drugs.

To apply for Medicare, you must be a U.S. citizen or permanent legal resident who has lived in the country for at least five years. You can apply for Medicare online, by phone, or in person at your local Social Security office.

What are the different parts of Medicare?

Medicare is divided into four parts: A, B, C, and D. Part A covers hospital stays, skilled nursing, hospice care, and some home health care. Part B covers doctor visits, outpatient care, and preventive services. Part C, also called Medicare Advantage, is a combination of Parts A and B, and is offered by private insurance companies. Part D covers prescription drugs.

To enroll in Medicare Parts A and B, you can apply online, by phone, or in person at your local Social Security office. To enroll in Part C or Part D, you must choose a plan offered by a private insurance company that contracts with Medicare.

When can I apply for Medicare?

You can apply for Medicare during the Initial Enrollment Period (IEP), which is a seven-month period that starts three months before your 65th birthday and ends three months after your birthday month. If you have a disability, you can apply for Medicare during the seven-month period that starts three months before your 25th month of receiving disability benefits.

If you miss your IEP, you can enroll during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. However, you may face a late enrollment penalty if you don’t enroll during your IEP or qualify for a Special Enrollment Period (SEP).

How much does Medicare cost?

The cost of Medicare varies depending on the part you enroll in. Part A is generally free if you or your spouse paid Medicare taxes while working. Part B has a monthly premium, which is based on your income. If you choose to enroll in Part C or Part D, you may also have to pay a premium, depending on the plan you choose.

It’s important to note that Medicare does not cover all medical expenses. You may still have to pay deductibles, coinsurance, and copayments depending on the services you receive.

Can I change my Medicare coverage?

Yes, you can change your Medicare coverage during the Annual Enrollment Period (AEP), which runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also change your Part D plan or enroll in a Part D plan if you didn’t enroll during your IEP.

If you experience a qualifying life event, such as moving to a new state or losing your employer-sponsored coverage, you may also be eligible for a Special Enrollment Period (SEP) to change your Medicare coverage outside of the AEP.

How to Apply for Medicare Step by Step 😉

In conclusion, applying for Medicare insurance can be a daunting task, but it is a necessary step for those who are eligible. To ensure a smooth and stress-free process, it is important to gather all necessary documents, research different plans, and consult with a trusted healthcare provider. By taking these steps, individuals can rest assured that they have made informed decisions and have access to the healthcare coverage they need.

Remember, Medicare is an essential program that helps millions of Americans receive affordable healthcare coverage. Whether you are applying for the first time or making changes to your existing coverage, it is important to approach the process with patience and diligence. With the right information and resources, you can make the best decisions for your healthcare needs and enjoy the peace of mind that comes with having reliable insurance coverage.

In conclusion, applying for Medicare can be an overwhelming process, but it doesn’t have to be. By taking the time to educate yourself on your options and gathering the necessary information, you can make informed decisions that will benefit your health and financial well-being. Don’t hesitate to reach out to trusted healthcare professionals or Medicare representatives for guidance and support throughout the process. With the right resources and mindset, you can successfully navigate the Medicare application process and enjoy the security and peace of mind that comes with quality healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts